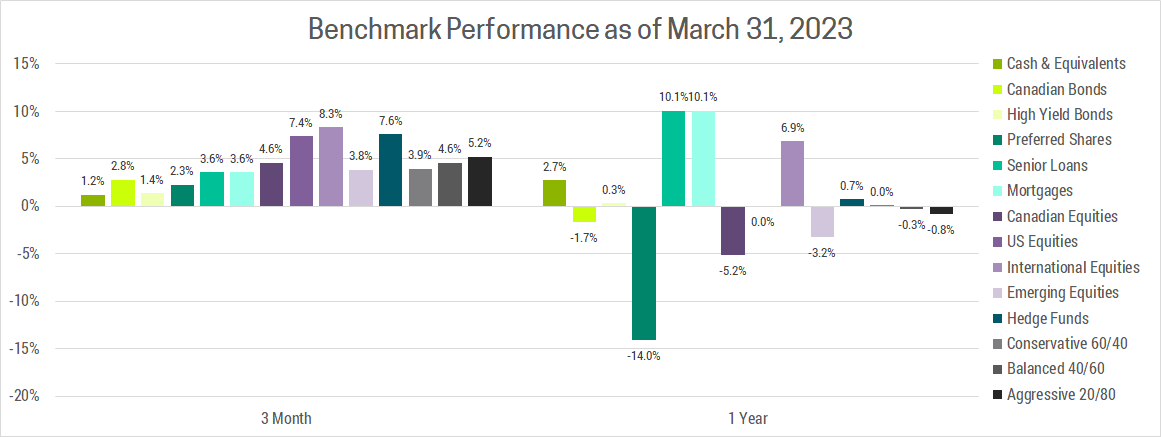

Markets continued their ascent in Q4 to cap off another great year. Every major asset class was up, with equities leading the way. Our client portfolios outperformed significantly as nearly every one of our overweight/underweight calls proved correct. Most impactful was our equity overweight and cor...

January 13, 2026 07:28 PM - Comment(s)