The Fed adds Fuel to the Fire

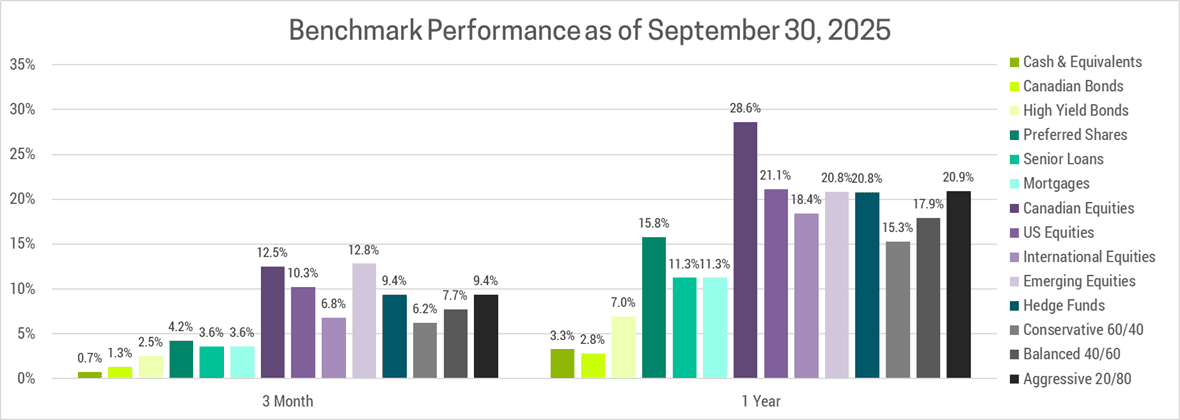

The third quarter of 2025 delivered solid returns for equity investors. Markets pushed to new highs as investors looked past earlier concerns about tariffs and trade policy uncertainty, choosing instead to focus on expectations of Fed rate cuts and resilient corporate earnings. Even a U.S. government shutdown hasn’t deterred investors from buying up stocks and pushing prices ever higher. This exuberance has benefited our portfolios, which continue to outperform the benchmark.

Under the surface, problems are brewing that will eventually derail the market. Last quarter, we focused on how the U.S. government’s fiscal trajectory was unsustainable. They are running larger and larger deficits at a time when the economy is growing at a healthy pace and doesn’t require stimulus. In this newsletter, we’ll focus on how the Fed seems to be making a similar mistake by cutting rates to stimulate an economy that doesn’t need support.

IS THE FED MAKING A MISTAKE?

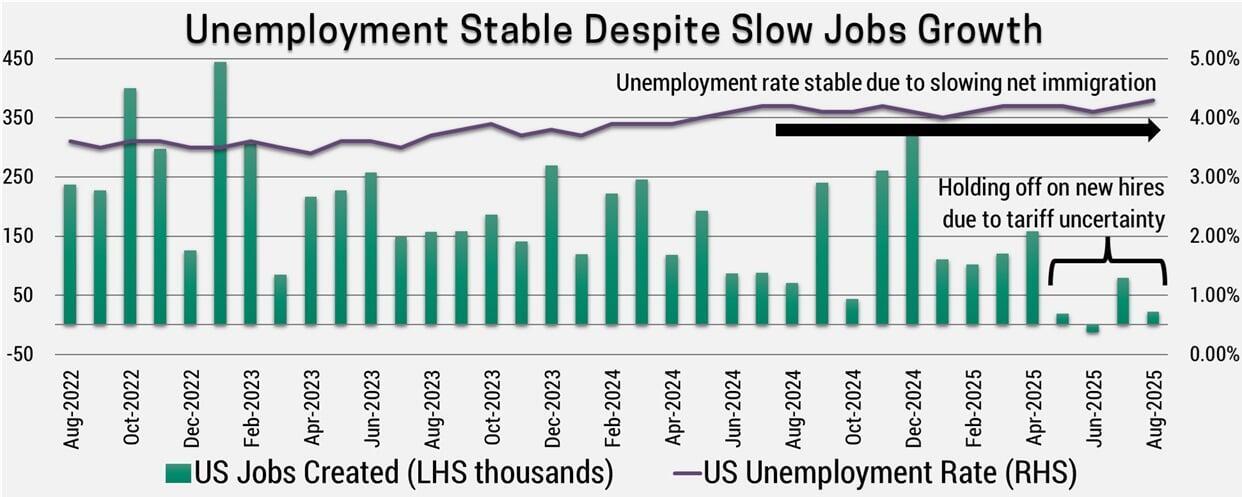

The dominant narrative throughout Q3 centered on the Federal Reserve's pivot toward rate cuts, with markets pricing in substantial easing through year-end. Trump has been openly pressuring the Fed to cut rates, and a weaker-than-expected payroll report in the summer provided the justification the Fed was waiting for. However, the case for meaningful monetary easing remains questionable at best, leading us to wonder whether the Fed has lost its independence or lost its way.

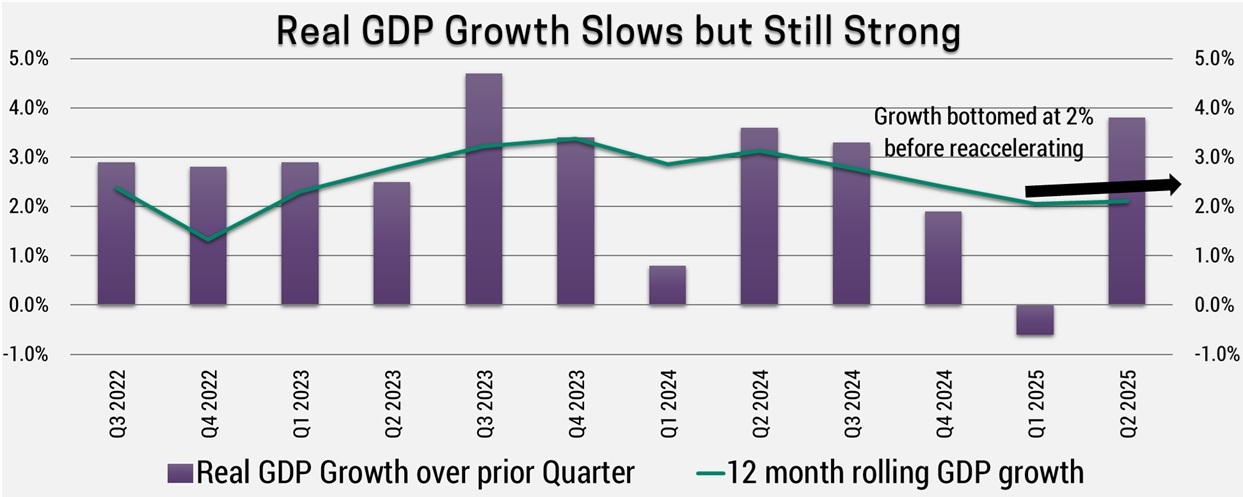

Monetary policy is not restrictive at current levels. Over the long-term, interest rates should align with nominal GDP growth-potential, which is a combination of real growth and inflation. Over the past 3 years the U.S. economy has sustained strong 2%+ real growth despite supposedly "tight" monetary conditions. While Q1 2025 did show negative GDP growth this was due to a significant increase in imports, which is a subtraction in the GDP calculation, as businesses rushed to bulk up inventories before tariffs were announced. Furthermore, GDP seems to be reaccelerating again which suggests rate cuts are not needed to support the economy.

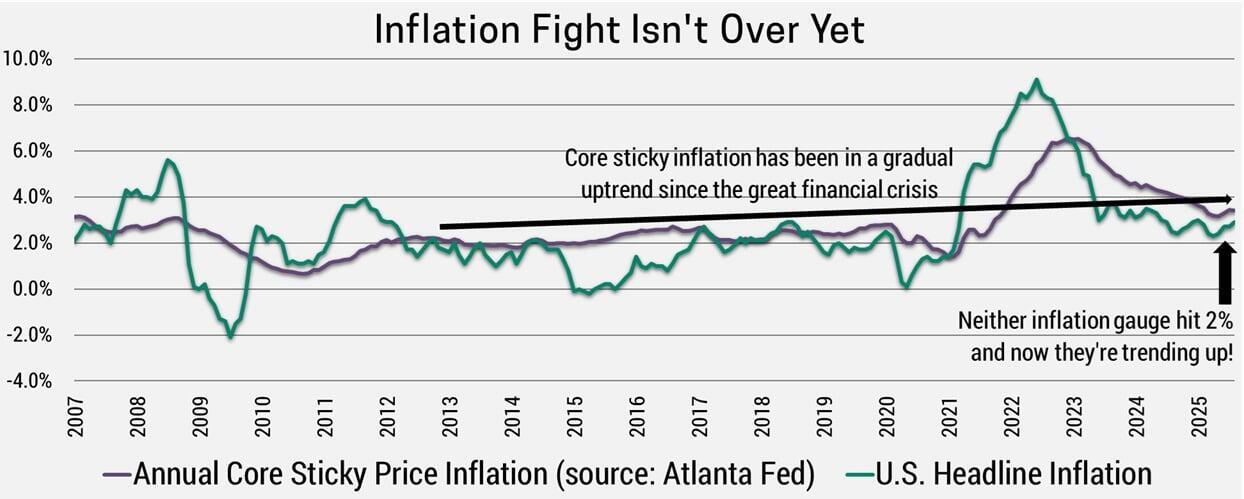

Financial conditions paint a similar picture as equity markets and nearly all major asset classes are trading at, or near, all-time highs. These are not the characteristics of an economy crying out for stimulus. Meanwhile, inflation has recently crept up after bottoming well above the Fed’s 2% target. With inflation close to 3% this suggests a 5% equilibrium Fed policy rate, making the current 4.25% already stimulative and further cuts that the market expects wildly unnecessary.

Moreover, the Fed doesn't operate in a vacuum. The U.S. government continues to provide massive fiscal stimulus—the kind typically reserved for reflating economies out of deep recessions. The U.S. dollar has declined more than 10% this year, adding its own form of stimulus as U.S. exports now look cheaper to international buyers. Layering aggressive monetary easing on top of these tailwinds risks throwing fuel on a fire that's already burning quite hot.

SLOW TO HIRE, SLOW TO FIRE

Employment growth slowed through the summer months, driven primarily by low hiring due to tariff/trade policy uncertainty, rather than widespread layoffs. Employers are understandably cautious about adding headcount given policy uncertainty, but elevated profit margins and solid cash flow generation have kept them from cutting staff.

Job openings have stabilized after declining from record highs, and initial unemployment claims remain low by historical standards. The unemployment rate has stabilized near cyclical lows and well below any reasonable estimate of the level that would prevent wages from rising. Indeed, wage growth in service industries continues running well above pre-pandemic rates, a clear signal that the labor market is still tight.

The immigration reversal has important implications for assessing labor market health. With the Trump administration pursuing lower immigration rates and actively deporting residents, the labour force isn’t growing nearly as fast and therefore requires fewer jobs to maintain full employment. This means the labor market will continue exerting upward pressure on prices rather than providing justification for additional Fed rate cuts.

INFLATION IS STILL A PROBLEM

Perhaps the most concerning development in Q3 was the confirmation that underlying inflation has not only stopped declining but may be edging higher. Core inflation measures have plateaued well above the Fed's 2% target, with a broad basket of CPI components showing annual increases above target levels.

Even goods prices, which typically pull inflation down are showing mild price increases as tariffs and a weaker USD work their way through the system. Once retailers work through the inventory they amassed prior to tariffs being implemented, prices could rise further. Multiple channels point toward higher inflation ahead:

- Years of above-potential economic growth have eliminated economic slack

- Wage pressures remain elevated

- A weaker USD is adding to import costs

- Tariffs are only beginning to show up in consumer prices

Under moderate scenarios, core inflation could exceed 3.5% by year-end and remain above 3% through mid-2026. The pipeline for future price increases looks concerning, with intermediate producer prices firming and manufacturing surveys showing elevated input and output price expectations. Yet bond markets remain remarkably complacent, pricing in material Fed easing and showing little concern about inflation reacceleration.

LOOKING AHEAD

The fourth quarter sets up as a potential inflection point. Markets have priced in a benign scenario of sufficient Fed easing to support asset prices, continued earnings growth and subdued inflation. The foundations of this narrative look shaky. Inflation is more likely to surprise to the upside than down, leading the Fed to choose between its mandate and market expectations. Valuations offer little cushion if the growth-inflation mix deteriorates or if yields resume their upward march.

The 2020s have been a roller coaster unlike anything we've seen before, and Q3 2025 may be remembered as the calm before the storm. Unfortunately, determining when the storm arrives will be extremely difficult and getting out too soon could result in missing out on substantial further upside.

The key for investors is maintaining flexibility, avoid concentration in expensive segments of the market, and position for higher inflation and interest rates.

As always, diversification across asset classes and geographies will be critical for navigating what appears to be the later stages of this economic cycle.

IMPLICATIONS OF AN AI BUBBLE

In prior newsletters we’ve discussed the three key elements you need to create a bubble. We appear to be entering the later stages of an AI bubble, so thought we’d revisit it from that perspective:

- Story: The foundation of all bubbles is a strong narrative. A story that is rooted in truth and captures the imagination of investors. In the case of AI, this began with the release of ChatGPT in late 2022 and has continued to evolve sense. As prices rise, it attracts attention from outside investors and acts as confirmation the story is true.

- Liquidity: To inflate the bubble, we need a large supply of cheap money. This is typically a result of artificially low interest rates, and as discussed in this newsletter history appears to be repeating itself. The lower rates are and longer they stay there, the bigger the resulting bubble. This is why we’re watching inflation and long-term interest rates so closely, as it’s the most likely catalyst to burst the AI bubble.

- FOMO: At this point investors throw caution to the wind, eschew traditional valuation metrics and convince themselves it’s rational because “this time is different”. Best epitomized by fear-of-missing-out (FOMO), investors are willing to pay any price to get in on the action. This leads to the final stage of a bubble, when prices go exponential and completely detach from reality. Perhaps the clearest indication we have entered this phase is that tech CEO’s themselves have fallen victim to this mentality. Mark Zuckerberg has acknowledged the risk of an AI bubble, but said he’d rather risk “misspending a couple of hundred billion” than miss superintelligence.

Not only are valuations high for U.S. tech, but risks are elevated due to the following:

- Overconcentration: The top 10 companies now make up over 40% of the U.S. market value. This is a record high, far exceeding the 26% share reached during the dot com bubble.

- Correlation: All 10 companies are directly or indirectly exposed to AI and to each other. Spending from one (eg. A data center build-out) is revenue to another (eg. Nvidia or broadcom chips). This can lead to contagion, where a problem for one snowballs into a problem for all.

- No Longer Defensive: Tech companies have historically traded at a premium, which was justified by the high margins, stable revenues and the lower capital intensity of their business. This narrative will be challenged by the hundreds of billions being spent on data centers (semiconductor sales are highly cyclical), which will put downward pressure on profit margins if demand for AI doesn’t materialize as fast as expected (or if users are not willing to pay as much as providers expect).

PORTFOLIO STRATEGY

We prefer to focus on identifying bubbles so we can avoid them entirely. Bubbles inevitably attract attention from the masses, causing them to miss opportunities elsewhere. While this could lead us to miss out on some upside should the bubble inflate further, it has not hurt our performance yet. We are comfortable giving up some potential upside to protect against the inevitable downside.

The case for diversifying into non-U.S. equities has strengthened. International markets offer better valuation support and greater potential for positive earnings surprises. In particular, the euro area has room for upside economic surprises as they benefit from earlier rate cuts, the €500 billion infrastructure fund and open-ended defense spending. Emerging markets are expanding faster than the U.S. while trading at far lower valuations. They also stand to benefit from continued USD weakness as the Fed cuts rates while most other central banks see limited need for further easing.