Education

Our goal at Shouldice Wealth is to create better financial outcomes for Canadians. One way to do this is by offering a better service for less, the other way is through education. Financially informed individuals make better financial decisions which leads to better outcomes. All our educational resources and programs are offered for free and are split out below according to life stages.

Children

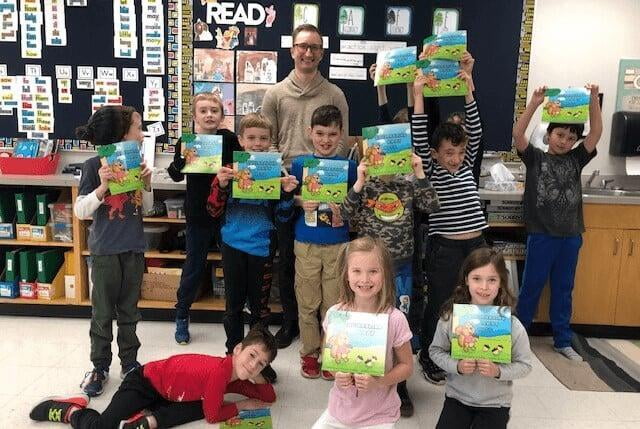

Good financial habits, like saving and investing, are often imprinted on us at a young age and have a huge impact on our lives. We wrote and published a children's book to help parents and teachers instill these positive financial habits on their kids, which sets them up for long-term success.

This book is available for free electronic download below. We also arrange to come into schools and other groups to read the book, then lead a discussion about money and give out free copies of the book at the end. If you're interested in having us come in, or you know a group looking for a financial educator, please reach out at info@shouldicewealth.com.

Squirreling Away Nuts

Three young squirrels head off on their own, but are they prepared for winter? Follow along as they learn the value of saving and investing while making some friends along the way.

Adults

While basic financial topics can be taught at a young age, adults benefit from more advanced topics. That's why we wrote our wealth guide that teaches you how to manage your finances effectively. By signing up for our newsletter below you'll receive a free copy of our ongoing quarterly commentaries to keep you informed on what's happening in the markets. If you want to see our past market commentaries, check out our blog.

Financial Education Workshops

46% of Canadian employees say financial stress impacts their workplace performance. We help boost productivity and retention by solving financial problems for employees, so they can focus on their work. We do this through free educational workshops at companies and other groups interested in financial literacy.

All-Ages

Follow us on social media where we post weekly financial tips to keep you on top of your finances. We keep these tips short and simple to benefit individuals of all ages and knowledge levels. You can find links to our social media profiles on the right of your screen for desktop and in the menu bar on mobile.

Employers

To truly improve the financial outcomes of everyday Canadians, we must also support small and medium-sized enterprises (SMEs) who employ ~85% of the workforce. We've written a free educational guide to help SMEs create a modern suite of workplace benefits their employees will love, helping attract and retain talent, boost productivity and save money.

Financial Tools

We are in the process of building free web-based financial tools. In the meantime, we have scoured the internet to find the best online tools from a variety of sources.