The U.S. Won’t Win a Trade War

After a strong start in January, markets gave back most of their gains by the end of Q1 as Trump began his trade war. Last newsletter we cautioned that, “2025 is likely to exhibit more volatility and less upside”. Unfortunately, this has turned out to be true. Much is this is normal, markets go through rough patches all the time, particularly after the outsized gains we experienced last year. What isn’t normal is that this sell-off is entirely self-inflected.

I try to keep politics out of investing. After all, markets don’t care how you feel or what view you hold. Unlike individuals or countries, they cannot be threatened, coerced, bullied, intimidated or invaded. That’s why the U.S. markets dramatic underperformance this year is the clearest signal that tariffs will have profound, negative impact corporate profits. The question is, will Trump listen to the markets and de-escalate, as he did in 2018 when his trade war with China risked sending the global economy into a recession? That is still our base case assumption, but given how unpredictable his actions have been we’ll focus this newsletter on what might happen if Trump continues down this path. This aligns with our overarching investment strategy of planning for the worst while hoping for the best.

TRADE WAR RISKS ARE RISING

The risk of a global trade war escalated materially these last few months, and history has shown there will be no winner. The assumption many market prognosticators had heading into this was that the U.S. stood to come out as a relative winner, given its stronger economy and the fact it runs a trade deficit with most of its partners (i.e. It imports more than it exports). We cautioned against this view in our last newsletter, and the consensus has shifted in our favour.

To forecast what happens next, we first need to determine what Trump’s objectives are. He referenced border security and fentanyl for Canada and Mexico, but this was to create a legal pretext for "emergency" action that would normally require congressional approval. Yesterday’s broad based tariffs point to his true objective of reducing the trade deficit by reshoring manufacturing from abroad. Unfortunately, tariffs alone will not achieve this goal and to understand why, we first need to understand how we got here.

GLOBALIZATION

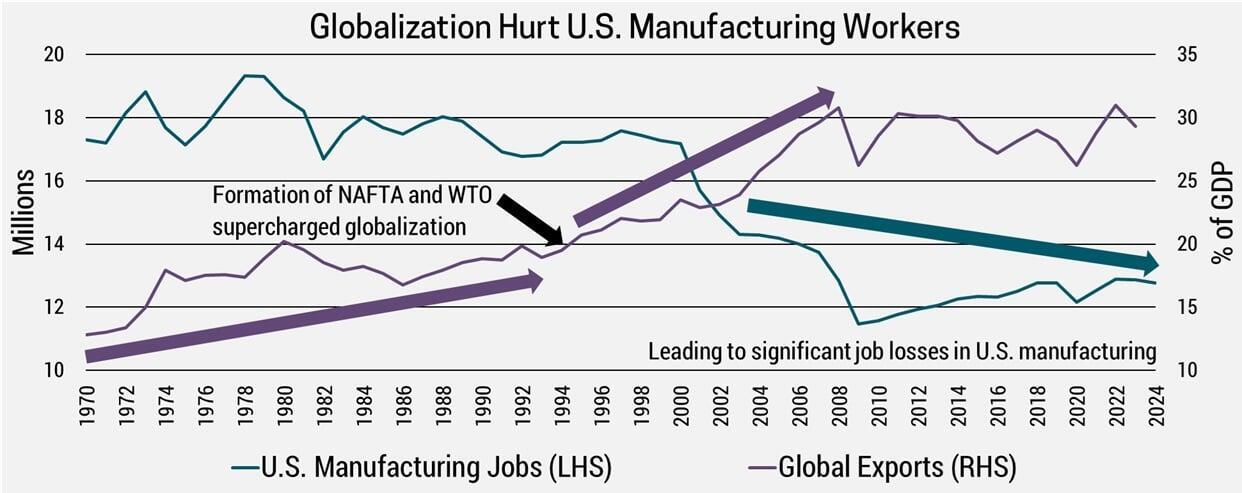

Globalization has led to a concentration of high-skilled, knowledge-based work in western democracies while offshoring manufacturing to emerging markets with abundant low-cost labour. While this benefits highly skilled workers in developed countries, providing them with better job prospects and cheaper goods, it has severely hurt and angered manufacturing workers. Arguably this is what led to Trump’s election win and his subsequent tariffs. While this will benefit domestic producers who will find it easier to compete, it comes at the cost of higher prices for consumers. In addition, retaliation from trading partners can escalate into a trade war, further harming both countries.

It's naïve to believe tariffs alone will reverse this trend and bring Manufacturing jobs back to the U.S. The real issue is that outside of technology, most U.S. industries are struggling to compete on the global stage. Adding a tariff will simply force U.S. consumers to pay a cost for the lack of competitiveness, rather than addressing its root causes. It would be different if the U.S. had manufacturing capabilities in place already. Then Trump’s tariffs would simply shift demand towards domestic producers.

The reality is that U.S. manufacturing is often more than 50% more expensive, if it even has the capability to begin with. Even with yesterday’s unexpectedly high tariff announcements, most goods will still make economic sense to import into the U.S. When costs are similar, companies will hold off on investing in U.S. manufacturing given all the uncertainty. To accelerate investment in U.S. manufacturing, cost parity is not enough, there would need to be a significant cost advantage. Tariffs might need to rise further, or they could try to devalue the USD, but either way it would lead to a significant inflationary shock. This exacerbates their existing inflation problem which continues to run above target and comes on the back of a ~20% cumulative increase since the pandemic.

How long will U.S. consumers tolerate the pain of higher prices before they pressure their leaders to change course? How long will investors continue to buy U.S. debt without being compensated for the risks of higher inflation or a falling USD? It's also important to recognize that much of their trade deficit is a result of U.S. companies setting up manufacturing in countries with cheaper labour to boost profits. Tariffs will shrink profits before even considering the impact of retaliatory measures.

In short, U.S. consumers, markets and corporate lobbyists are likely to put pressure on the Trump administration to pivot long before there is any material reshoring of manufacturing.

ISOLATIONISM

The process of reshoring manufacturing will cost trillions, take decades and be a painful transition. Applying different tariffs to individual countries is more likely to shift manufacturing to other low-cost producers instead of bringing them into the U.S. Trump may be trying to circumvent this game of whack-a-mole with his 10% minimum on all countries, but this brings up a whole new set of problems.

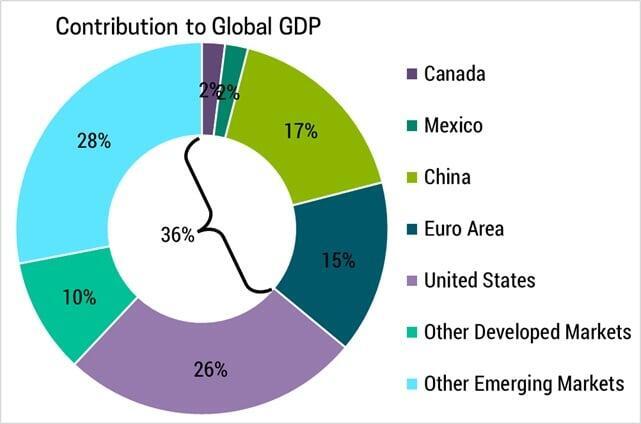

Universal tariffs put the U.S. at a long-term disadvantage against their peers who would likely continue trading freely amongst themselves. Manufacturers setting up shop in the U.S. would have an advantage selling to domestic customers, but higher costs and retaliatory tariffs would make their products uncompetitive in global markets. As such, companies would be putting all their eggs in the U.S. basket which makes up 26% of global GDP while forgoing global markets.

WIN THE BATTLE, LOSE THE WAR

Perhaps this is why Trump started his trade war with Canada and Mexico. We make up a mere 2% of global GDP each which makes us easier targets. The U.S. can inflict far more pain upon us than we can in return. Trump made an example of us so that yesterday’s tariff announcement is taken seriously. How would you feel if someone threatened you, especially when they’ve already hurt their closest ally, friend and neighbour? Instilling fear may get you leverage in short-term negotiations, but it will have significant long-term consequences.

A better approach would have been for the U.S. to work with its allies to lead a unified trade war against key strategic targets. This would give them far greater leverage to target Russia, or perhaps China and Mexico who jointly account for 46% of the total U.S. trade deficit. Instead, the U.S. has turned on its allies. History if riddled with examples of great military and economic superpowers overextending themselves, attacking on too many fronts and eventually being overrun. If yesterday’s tariffs stand, then suddenly the U.S. will find itself surrounded by enemies. Perhaps Trump should look in the mirror the next time he says, “You don’t have the cards”.

Trump might understand these issues, and this is all posturing to get a better deal. It’s also possible the scope of tariffs will be scaled down to focus on industries of key strategic importance. Regardless, it appears that Europe will be the relative winner through all this. Their tariffs were expected and are relatively lower than other exporters who compete for U.S. consumers. Meanwhile, the significant escalation towards China could end up diverting cheap exports to the EU, further boosting their economy.

PORTFOLIO STRATEGY

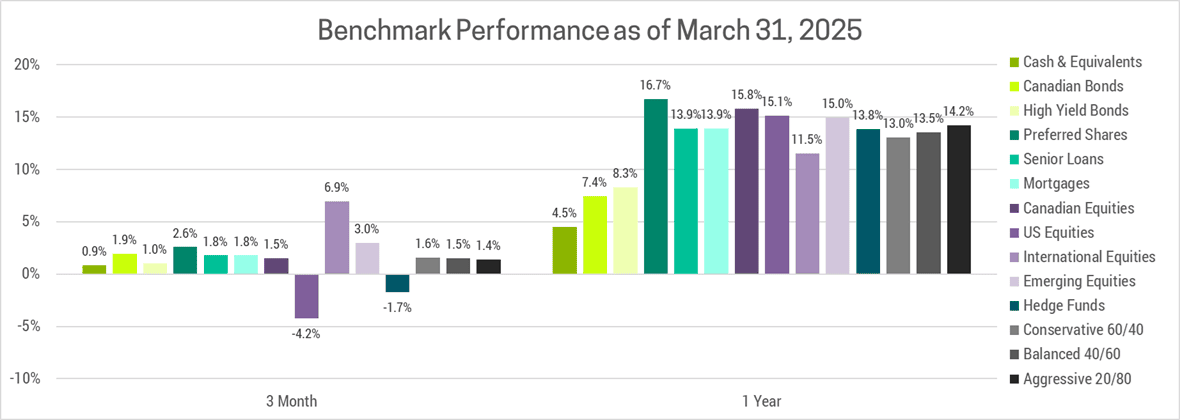

As always, our investment strategy is focused on the fundamentals, including sales, earnings, growth, debt, inflation, interest rates, risk, etc. This is what underpins our overweights in Europe, Japan and Emerging markets and our corresponding underweights in U.S. Tech/Growth and Canada. In Q1 2025 nearly every one of our overweights/underweights has outperformed, none more so than our International Value strategy which was up nearly 20%. This has provided a buffer against today’s sell-off.

While this outperformance has narrowed the valuation gap between markets, we think our positioning has more room to outperform. The consensus view surrounding U.S. exceptionalism has only just begun to unwind. We expect ongoing investment flows into cheaper foreign markets will cause the valuation gap to narrow further. Europe in particular looks poised for accelerating growth as consumers begin to spend the significant excess savings accumulated during the pandemic and the uncertainty stemming from the war in Ukraine. Germany who has amongst the lowest debt in the developed world has announced borrowing for infrastructure and to revitalize it’s ailing manufacturing industries. Broader EU spending on defense should further boost growth.

The current market volatility will undoubtably provide some long-term buying opportunities to those who can stomach the risk. If you’re sitting on excess cash, or expecting a tax-refund this year, I would recommend getting the money invested.