Is AI a Bubble?

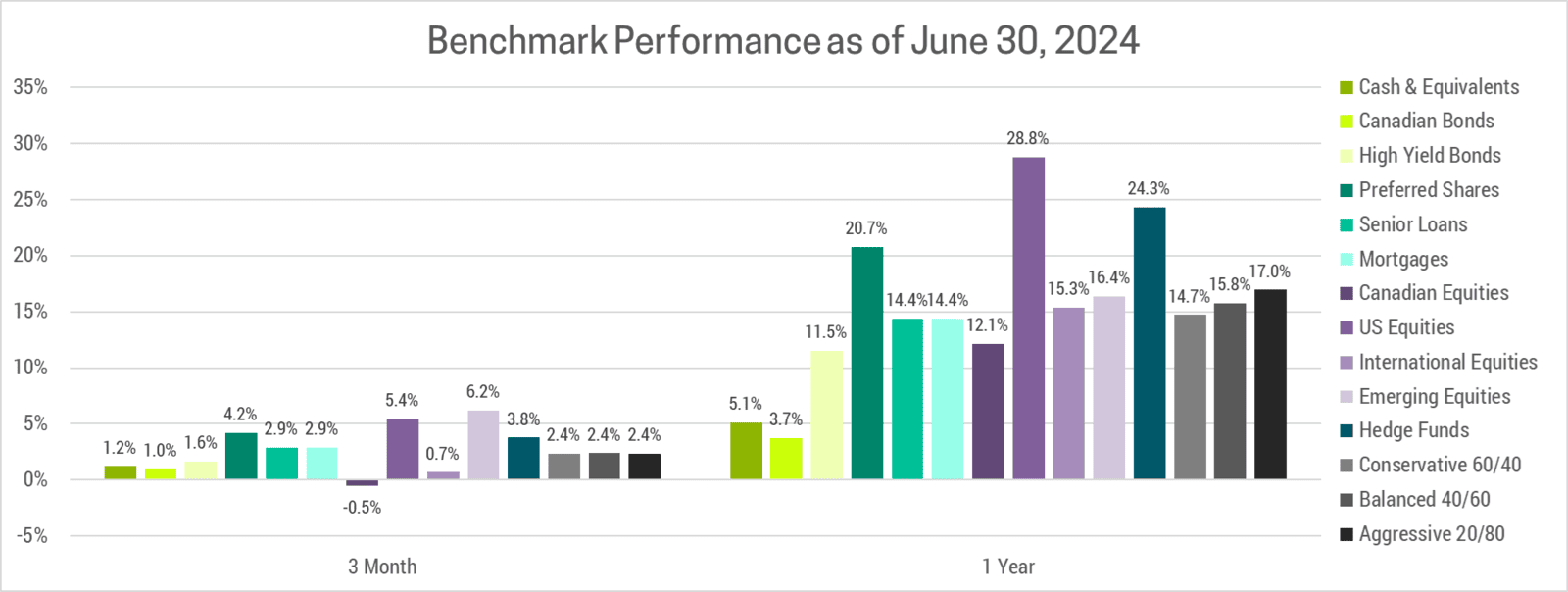

The market rally that began last November continued in Q2 albeit at a more modest pace. Global economic growth has been choppy but positive and earnings continue to grind higher. Recession fears are fading, but signs of sticky inflation have surfaced. As a result, investors have tempered their expectations regarding the timing and magnitude of central bank rate cuts. We expect this adjustment will continue through the remainder of 2024 as global economic growth surprises to the upside.

IS AI A BUBBLE?

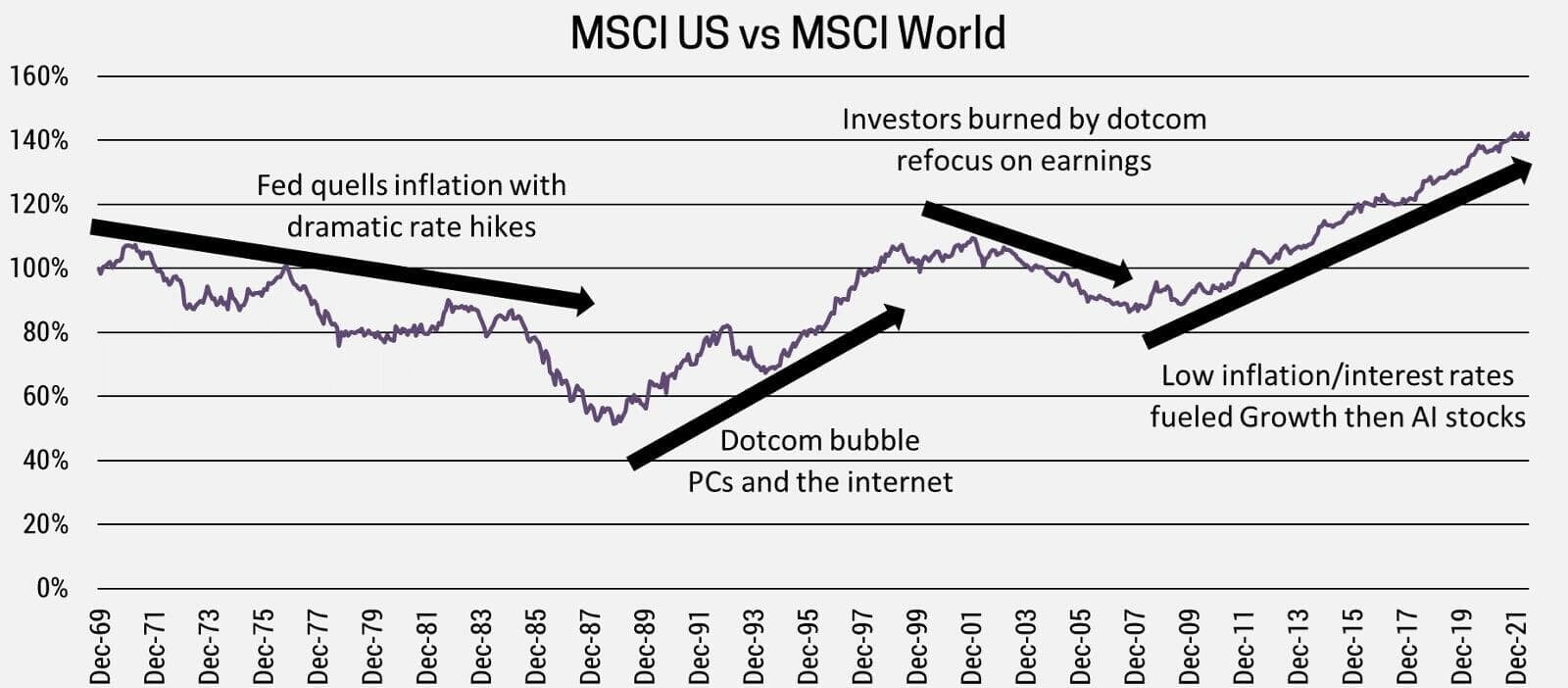

The most exciting segment of the market continues to be AI, which has fueled the explosive rally in US Technology share prices. Their ability to consistently beat earnings estimates has given investors the impression that earnings have driven this rally, but this is untrue. It ignores the fact that non-tech companies are also beating their earnings estimates. Last years fear of a recession resulted in low earnings expectations, then a resilient economy allowed most companies to easily clear this low bar. Currently the US Technology sector makes up 20% of US earnings, a share that has not changed significantly in over a decade. Meanwhile their share of US market value has soared to 32%, reminiscent of the late 1990’s dot-com bubble.

Ultimately, earnings drive long-term upside in the markets. The rapid increase in AI valuations could be justified by expectations that earnings will rise rapidly. This is reasonable, AI is a once in a generation disruptive technology that will likely go on to influence nearly all aspects of our lives. That said, forecasters constantly overestimate how quickly change will happen in the short-term and underestimate how much things will change in the long-term. We fail to account for individuals’ aversion to change, as ultimately technology needs to be adopted by people, which takes time.

Take the 1990s dot-com bubble as an example. Looking back at it 24 years later, the impact of the internet has been greater than even the most optimistic forecasts at that time. It permeates nearly every aspect of our lives today. Unfortunately, the valuations investors were paying was predicated on the internet being adopted far more rapidly than ended up being the case. You could argue investors who bought at the peak in March 2000 were right, but they paid too much and invested too soon and ended up losing 78% of their investment when the bubble burst. They wouldn’t break-even on those investments until 2015.

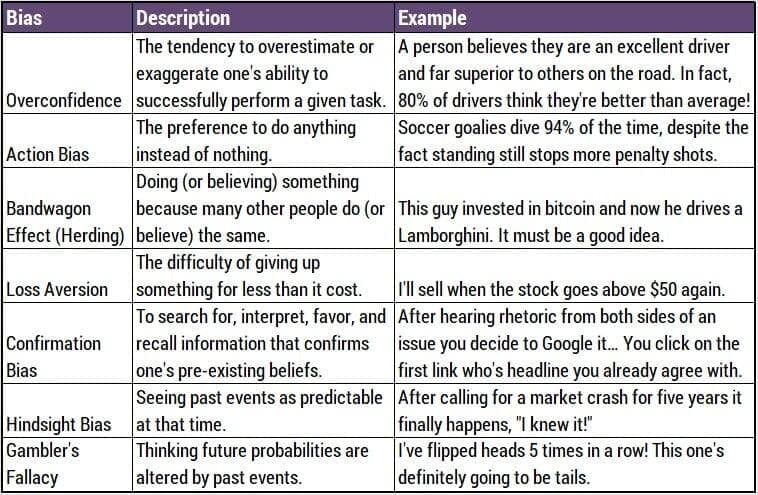

BEHAVIOURAL FINANCE

So why do investors consistently make the same mistakes? It’s because we’re human beings that are susceptible to all manor of biases. There is an entire field of study called “Behavioural Finance” which focuses on psychological, social, cognitive and emotional factors that negatively impact financial decision making. The table below highlights some of the most important biases:

These biases have always been a part of investing, but I believe they are even more prevalent now. The firehose of information available online means you can always find something to feed your confirmation bias. Technology has made it easier to trade stocks, fueling our action bias by making it harder to pursue a long-term buy-and-hold investment strategy. Filter bubbles have supercharged the bandwagon effect as people become surrounded by online communities who share similar views and are rarely exposed to dissenting opinions. The sheer abundance of data makes it easy to dig up information that makes the past seem far more predictable than it actually was.

You might think these technological forces would be mitigated by our improved understanding of behavioural biases. Unfortunately, this is not true. Nobel Prize-winning psychologist Daniel Kahneman, known as the "grandfather of behavioural economics" was asked if spending a lifetime researching the topic had mitigated their influence on him. His answer was blunt, “No”.

PROCESS BASED INVESTING

If understanding bias does not prevent it, then what’s the best way to avoid the pitfalls of behavioural biases? You need to build a process that mitigates it, or ideally capitalizes on the biases of others. Then adhere to it, particularly during times of uncertainty or crisis, when emotions run high. Having a good process is like being the house at a casino, it does not result in success every day. It simply tilts the odds in your favor which results in long-term outperformance.

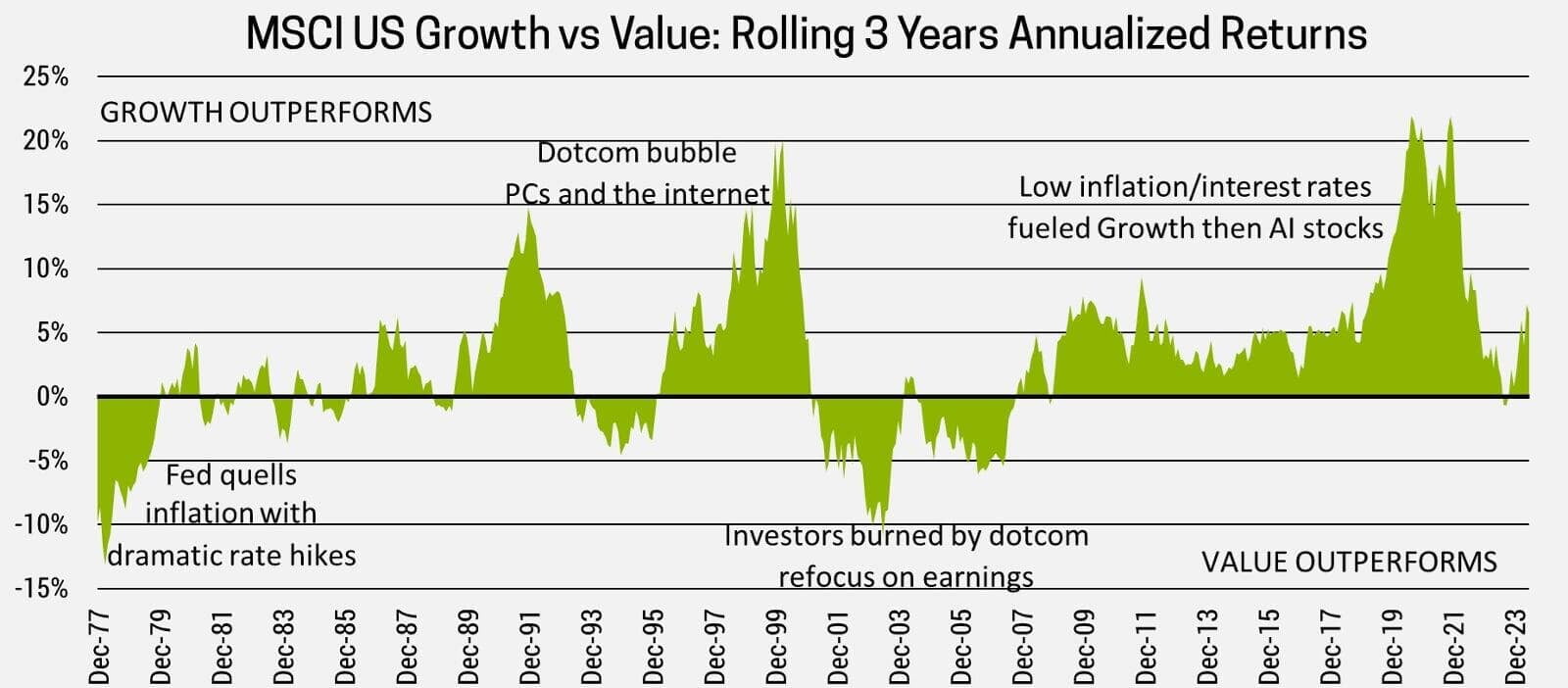

Right now, growth investing is in vogue and nothing has benefited more than US technology. Could the outperformance continue? It’s possible in the short-term, but in the long-term the odds are stacked against this. Valuations are stretched, expectations are high, risks are being ignored and there are limits to how big these companies can get.

The US already accounts for 65% of global market value, of which 32% is just 6 companies; meaning Microsoft, Apple, NVIDIA, Alphabet/Google, Amazon and Meta/Facebook make up over 20% of global market cap!

“Trees Don't Grow to the Sky” is a popular German proverb because humanity has consistently made this same mistake of extrapolating growth too far.

MARKETS ARE CYCLICAL

Most of you are familiar with Warren Buffet, arguably the most successful investor of all time and someone I often quote in my newsletter. Less people are familiar with his business partner Charlie Munger, who began his investment career in 1962 and worked up until his passing last year at age 99. While he achieved amongst the best investment track records in history, it did not come without a few hiccups along the way. “I’ve been through a number of down periods. If you live a long time, you’re going to be out of investment fashion some of the time.”

Right now, there’s a long list of strategies that are out of fashion. It’s easier to state what’s in-fashion and that’s US mega-cap AI/growth stocks. We believe that avoiding this pocket of excess will be the most important asset allocation decision of the next decade. It’s not because we expect the sector to implode, or that AI is all hype, it’s simply that they have front-run their fundamentals and it may take 10+ years before the change they are envisioning is implemented at sufficient scale to justify their current valuations.

To illustrate our point, it can be helpful to look at things from a long-term perspective. There are 2 big investment themes at play here, Growth vs Value and US vs the World. The current string of US Growth outperformance is the longest in history, whether we measure it by length or magnitude. The charts below highlight just how significant this outperformance has been.

PORTFOLIO STRATEGY

We continue to avoid US growth stocks which cost twice as much as everything else, trading at a forward P/E ratio of 31.2, relative to the US value index or World ex-US index at 15.7 and 15.5 respectively. The current premium is excessive when compared to the long-term average of ~30%, especially when you consider that periods of high inflation/interest rates (like we’re experiencing now), tend to result in a smaller premium for growth stocks. It’s impossible to time when these cycles will turn, but the extreme valuation premium of US growth stocks makes the risk/return trade-off unappealing.

Markets are cyclical and historically the best strategy has been to ride momentum over the short-term when greed, overconfidence and herding push market darlings to new highs. Then rebalance from expensive to cheap before momentum slows and greed turns to fear. We continue to prefer short-term/floating rate debt, Europe/Japan and Emerging Market stocks. They are all out-of-favour, cheap and poised to benefit from the higher inflation/interest rate environment where economic growth and trade expands.