Central Banks Walk a Tightrope

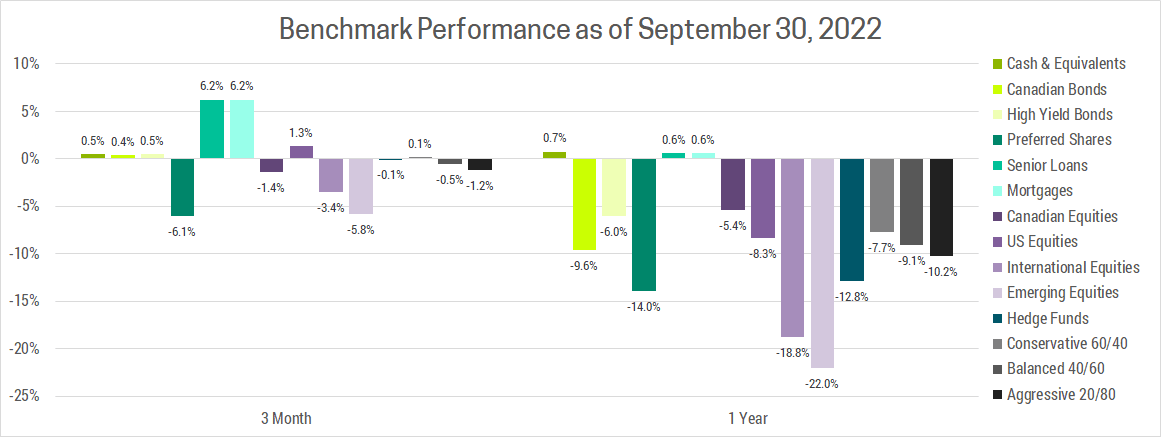

All market cycles are unique, but the last 3 years have been a roller coaster like nothing we’ve seen before. The pandemic prompted the S&P 500 to experience the fastest 30% correction in history, then the second fastest recovery of all time. Exorbitant stimulus and rock-bottom interest rates fueled excessive risk taking as investors piled into all manner of speculative investments. Ultimately this led us to the highest inflation rate in 40 years, forcing central banks to pivot and raise interest rates aggressively, sending nearly all investments dramatically lower. The average investor, as represented by Vanguard’s Balanced ETF Portfolio (Ticker: VBAL) is now down about 15% year-to-date, ending off slightly lower than where they were before the pandemic even began!

If you’ve been watching the markets closely, you’ll notice something strange going on. Good news for the economy has become bad news for the markets. This is counter-intuitive, but the reason is actually quite simple. The main problem facing markets is high inflation, which is when prices rise because of too much demand and/or too little supply. When inflation began to spike the consensus from markets and central banks was that this was “transitory”, a temporary result of pandemic era supply chain disruptions. We spoke out against this narrative in our Q1 2021 newsletter, which pointed to several key underlying trends that would drive inflation sustainably higher this decade, which we’ll revisit below:

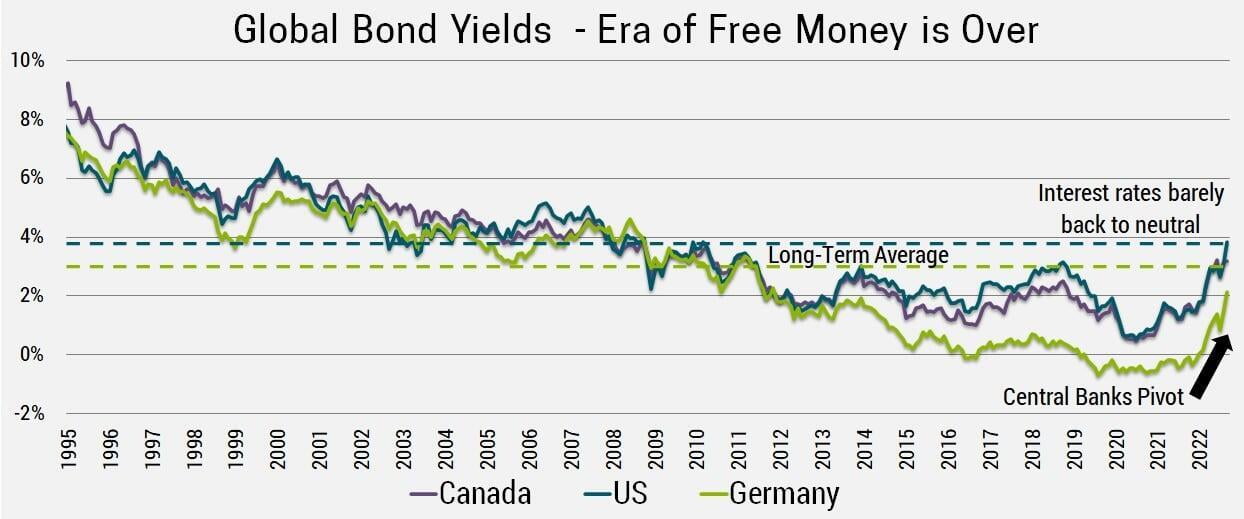

- Central banks wanted inflation: This seems crazy in hindsight, but at that time the Fed was on record stating their goal of achieving above average inflation going forward to offset below average inflation over the previous decade. They did this by keeping interest rates low and buying bonds to put downward pressure borrowing costs which stimulated demand. Mission accomplished, whoops!

- Government stimulus: Record stimulus during the pandemic was necessary initially to prop-up the global economy, but they took this too far. The result was robust demand at a time when supply couldn’t keep up, leading to higher prices/inflation.

- Globalization: Offshoring to lower-cost jurisdictions was a major force in reducing costs and therefore inflation these past few decades, but the pandemic and trade/physical wars have highlighted the fragility of global supply chains. As a consequence, countries are repatriating manufacturing, sourcing from multiple suppliers and hoarding inventory of key components, all of which results in less production and higher prices.

- Wage Growth: Unemployment rates were still elevated in Q1 2021, but we raised this as a risk and it’s become the key driver of inflation today. Services makes up the largest portion of the consumption basket used to calculate inflation, and the biggest input cost for services is wages. Now that inflation has taken hold and unemployment is low, workers are demanding raises to compensate for the higher cost of living, but this increases input costs for companies which are passed on to consumers in the form of higher prices. You can probably see where this goes, it’s a positive feedback loop where higher prices begets higher prices.

This brings us to the counter-intuitive state of markets today. The Fed et al. have pivoted 180o and are now focused on lowering inflation by breaking the inflationary positive feedback loop. By raising interest rates, they are effectively taking money out of people’s pockets by increasing the interest payments on debt and the cost of capital for companies. This reduces demand, slowing the economy and job growth, which increases unemployment and lowers the rate of wage increases. Once the data shows the interest rate increases are having the desired effects, central banks will be able to tone down the rhetoric, which should allow markets to gain a solid footing.

As such, bad news for the economy is good news in the fight against inflation, which is the main issue for markets.

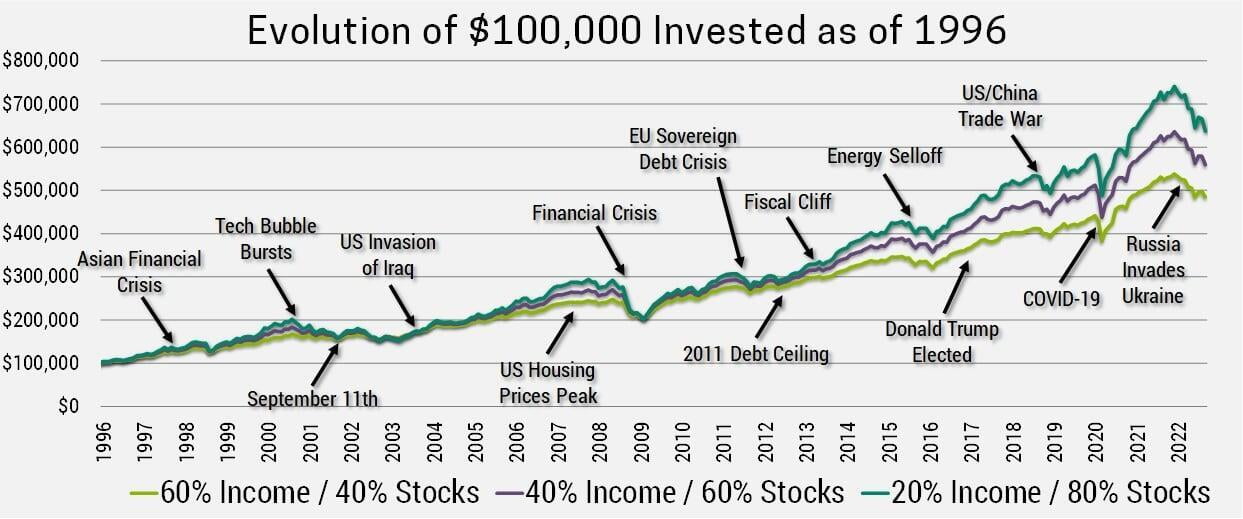

In short, stubbornly high inflation will require ever higher interest rates that will ultimately choke off growth, leading to a recession. That may sound bad, but it would resolve the inflation problem and keep in mind that recessions are a feature of modern economies. They’ve happened roughly every 5 years since the end of World War II. Despite this fact, markets have done a wonderful job of growing wealth over time. We also need to remember that markets are forward looking and with current economic sentiment at the lows seen during the height of the pandemic, the 2008 financial crisis and the 2000 dot-com bust, it’s reasonable to assume markets are already pricing in a recession. The question is, will the reality be better or worse than expectations?

In our view, the global economy should prove more resilient than the market expects, but some regions are at far greater risk than others. Countries like Canada, Australia, the U.K. and others that escaped the worst of the 2008 financial crisis have continued to pile on debt. The risk this poses was on display when the U.K. released a financially irresponsible budget last month, causing investors to flee the British pound and government debt markets. The Bank of England was forced to step in and buy long-term government debt to stabilize markets while the government had to walk back their plans to cut taxes.

Meanwhile, the US and significant parts of the Eurozone that suffered their own debt crisis’ last decade have been busy paying down debt. These economies can handle higher interest rates, and since they collectively make up the majority of global GDP, we are likely to see global interest rates rise even further to fight against stubbornly high inflation. This means more pain to come for over-indebted households like Canadians, which have roughly double the amount of consumer debt per person as the US. Knowing this, you’d think the Bank of Canada would avoid raising interest too fast/far. Unfortunately, they have little choice. If they don’t keep pace with the Fed, the Canadian dollar will plummet (it’s already dropping due to recent interest rate divergence), which results in higher import prices and even more inflation. For more perspective on the precarious state of Canadian housing and the economy, check out our Q2 2022 newsletter.

Regional disparities aside, it is clear global interest rates have to rise more. This may be shocking to some who think current interest rates are already high, but this is only in comparison to the last decade which saw weaker than average growth rates as a result of global deleveraging. If we take a longer-term view, the current level of interest rates remains low. Even after central banks implement the additional rate hikes they’ve projected, that will bring us to a point where rates are neutral, neither stimulative nor restrictive. If we’re going to get inflation under control, interest rates will need to rise further, or at the very least stay where they are (not be cut as the market expects).

Given our view that interest rates will go higher, and/or stay there longer than the consensus expects, our advice is to avoid sitting on too much cash. If you have variable rate debt, or debt that matures in the next year we recommend paying it down. If you were fortunate enough to lock in a low fixed rate, get the cash invested. Cash is comforting to hold at times like these, but it’s guaranteed to lose value in the long-term as inflation eats away at its purchasing power.

European equities should do well given excessively cheap valuations, a result of inflation issues, war and a related energy crisis. That said, European natural gas inventories are effectively full and high prices have already dented demand, so they are in a better position to weather the winter storm than most investors expect. Household finances are much healthier than a decade ago, which provides resilience in the face of well-known headwinds.

In short, sentiment towards European equities is excessively negative, so you don’t need much good news to see significant upside.

More than anything, we’re focused on avoiding asset classes that are most exposed to higher interest rates. This is why we remain underweight long-term government bonds and have instead preferred short-term and floating rate debt, where yields increase with rising interest rates. It’s also why we avoided speculative investments like cryptocurrencies and innovation stocks that don’t produce profit and therefore rely in cheap financing to survive. We’ve been underweight growth stocks, which see their valuations decline as higher interest rates discount their long-term earnings more severely than value stocks.

Our most recent underweight was stocks in countries like Canada, where housing bubbles have created over-indebted households that will struggle under the weight of ever higher interest rates. Our next potential underweight would be over-indebted governments, which face the same issues as over-indebted households, only they can borrow at fixed rates over longer terms. This delays their day of reckoning until interest rates rise even further and stay their longer, a risk we continue to monitor.

So far in this commentary, we’ve focused on the myriad of problems investors face, but it’s important to remember that this is not new. We’ve handled inflation before, faced geopolitical conflicts and gone through bubbles, recessions, debt crisis’s and more. The chart below highlights how well a diversified portfolio has protected and grown capital despite the plethora of market events that have taken place.

It’s human nature to worry. Constantly being on the lookout for threats was a useful trait for our ancestors, but it’s counter-productive for investors. Excessive worrying can cause you to miss the big picture. For instance, higher interest rates are hitting borrowers hard now, but inflation is eroding the debt burden over time (ie. The debt is fixed and will be repaid with less valuable future dollars) and investment portfolios now generate a higher yield. Furthermore, if we weren’t facing problems, stocks wouldn’t be trading at such a steep discount to where they were just a year ago. Since starting valuations are a key driver of future returns, this bodes well for long-term investors.

Good things happen very slowly, whereas bad things tend to happen all at once. Headlines highlight the bad, as this is what grabs our attention, but we need to keep a cool head and focus on the long-term. Otherwise we end up like the comic below.

As Max Roser pointed out, “Newspapers could have had the headline ‘Number of people in extreme poverty fell by 137,000 since yesterday’ every day in the last 25 years.” There’s no doubt the relentless march of progress will continue in the future, despite temporary setbacks. This is why it pays to invest in the markets, it’s a proxy for progress which humanity is exceptionally good at over the long-term.

If you have any questions, comments or would like to become a client please do not hesitate to reach out. You can email me or schedule a free 30-minute consultation using the link below.