Trade, Wages and Fed Fueling Inflation

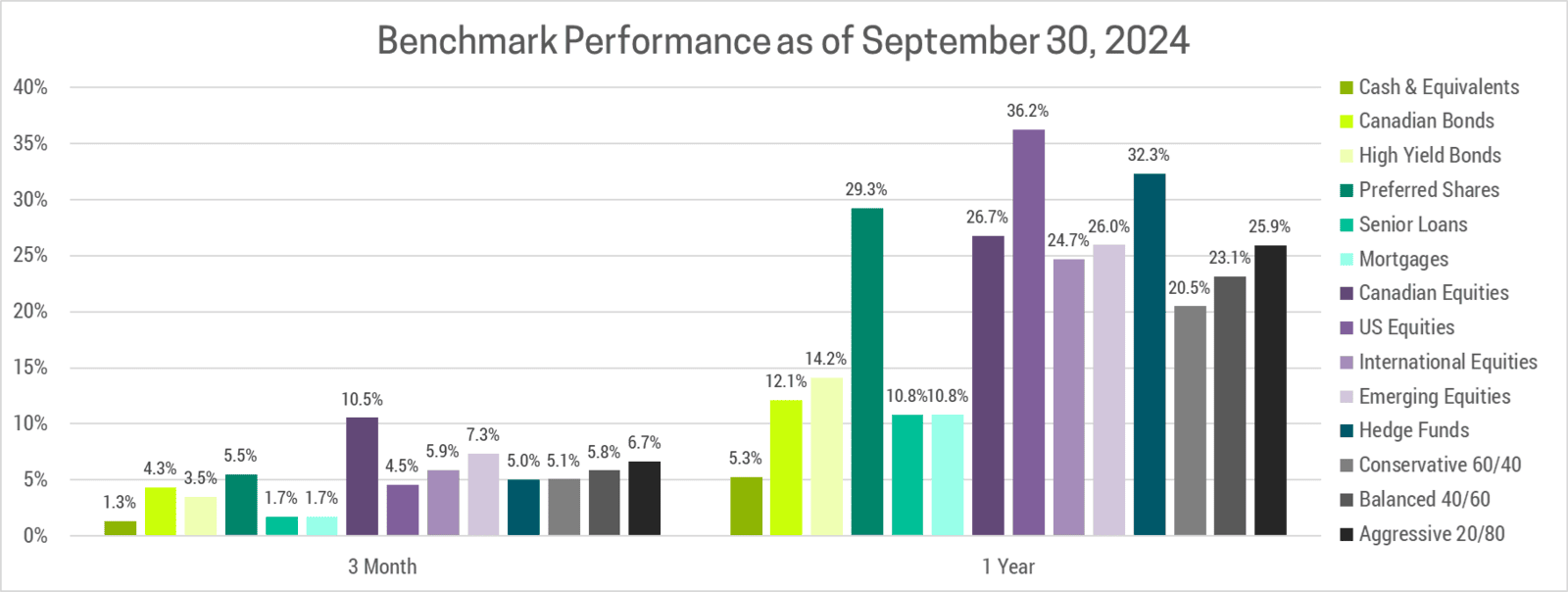

Markets continued to rally in Q3 as recession fears faded, inflation slowed and central banks began to implement their long promised rate cuts. China added to the optimism by announcing a significant stimulus package with potentially more to come. As a result, every major asset class was up with stocks leading the way.

ADDING FUEL TO THE FIRE

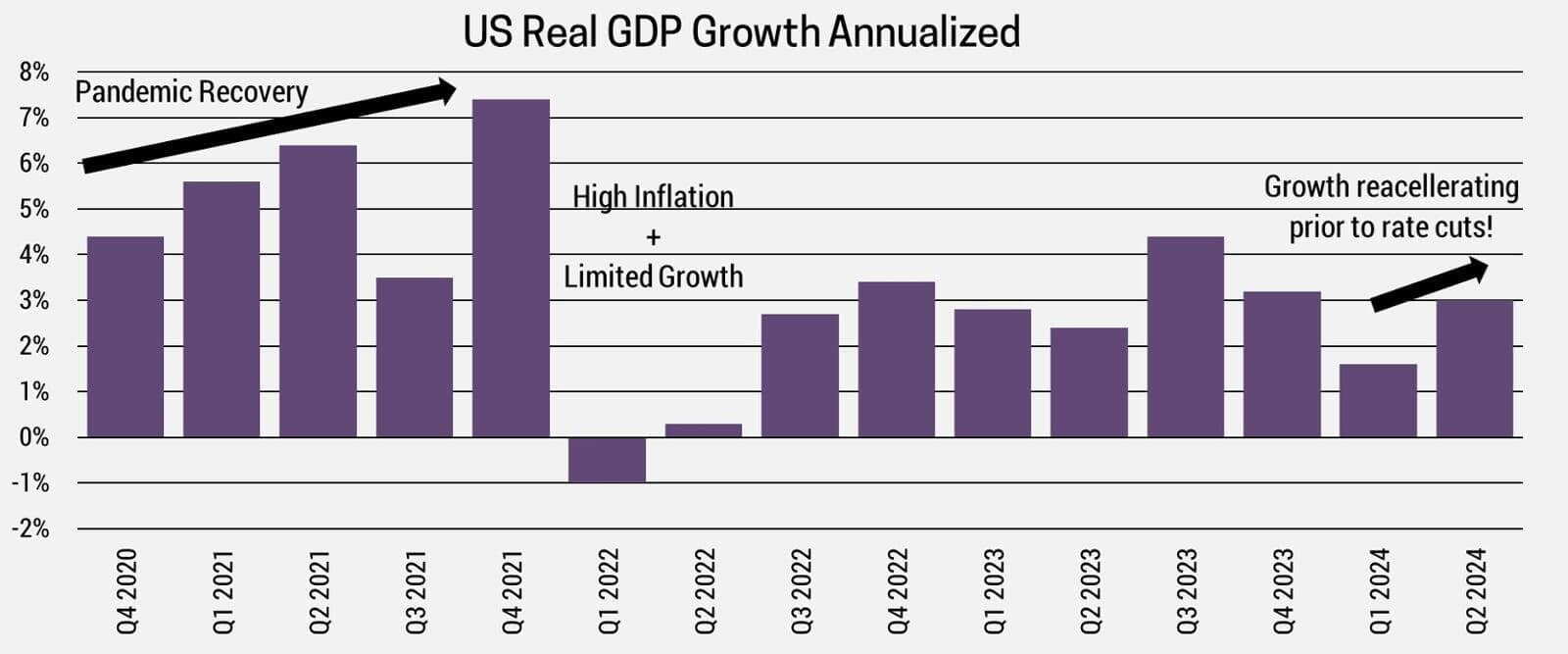

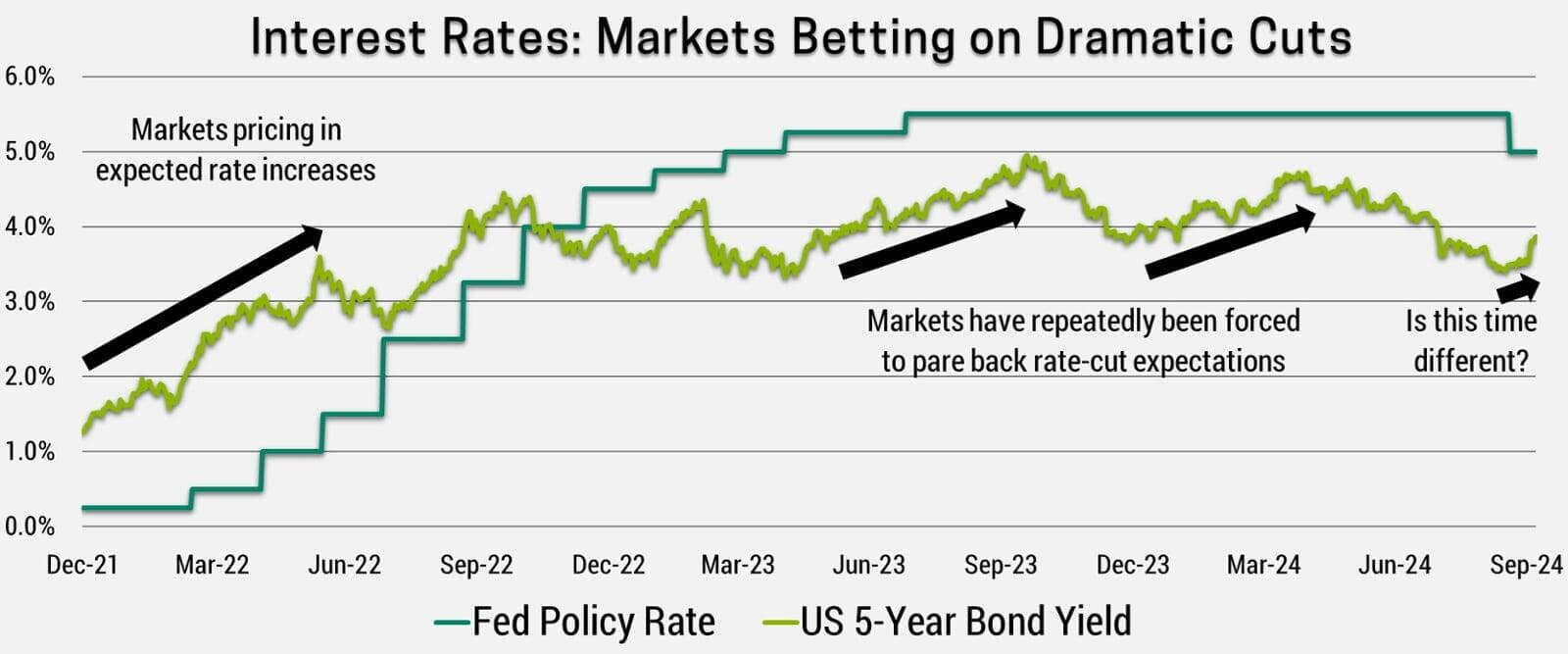

The Fed finally made good on their promise to lower interest rates and did so with a bang, cutting by 0.5% with expectations of more to come. There is little economic justification for this in our opinion and we believe history will view this as a policy mistake. Typically, central banks cut rates when inflation is below target or the economy is contracting, neither of which is currently true. The chart below shows the economy reaccelerated last quarter, despite higher interest rates. Cutting the policy rate now is akin to adding fuel to the fire.

The Fed’s justification is that unemployment has risen, but this is modest and largely a result of higher immigration as opposed to falling demand for labour or layoffs. Meanwhile, they are ignoring above target inflation because it’s currently falling, and they believe it will continue towards their 2% target. This is wishful thinking, based largely on what has happened during the tenure of most central bank officials. Their worldview was shaped over the past 40 years, a period characterized by falling or stable inflation.

This entrenched bias is why the Fed labeled the post-pandemic inflationary spike as “transitory”, a temporary result of pandemic supply chain disruptions that would ease over time. This view is best highlighted by the Fed’s March 2021 projection that their first rate hike would take place in 2024! The Fed was subsequently forced to hike rates, but clearly they are eager to return to low rates asap. They have a deeply entrenched view that inflation can never sustainably rise in the long-term, so what happened must be temporary. We will likely need to experience multiple periods of high/rising inflation before central banks adjust their default assumptions.

What is happening with inflation today is reminiscent of the 1980s, albeit in reverse. Repeated inflationary spikes in the 1970s instilled a belief that inflation would always return unless forceful action was taken. This culminated with the Fed funds rate at an unprecedented 19% by 1981, causing not one, but 2 deep recessions. Inflation collapsed from a high of 15% to a low of 2.5%, but investors always feared it would return and panicked every time it rose even slightly. We outlined this idea in detail in our Q4 2022 Newsletter titled “Rhyming With History”. I’d suggest revisiting it as the ideas presented there will continue to shape markets for years to come.

HIGHER INFLATION FOR LONGER

Perhaps the only compelling narrative for lower inflation going forward is due to AI related productivity gains. Unfortunately, to keep inflation as low as it was these past few decades, the productivity gains would need to be greater than those from the personal computer, internet and many others. While this is possible, we’d expect meaningful AI productivity gains will take many years to materialize and will likely be outweighed by other factors. Here's the key reasons we believe inflation, particularly in the US, will begin to reaccelerate in 2025:

Tight Labour Market: For proof, look no further than the success of unions in recent collective bargaining disputes. Average wages in the US rose over 4% during the past year.

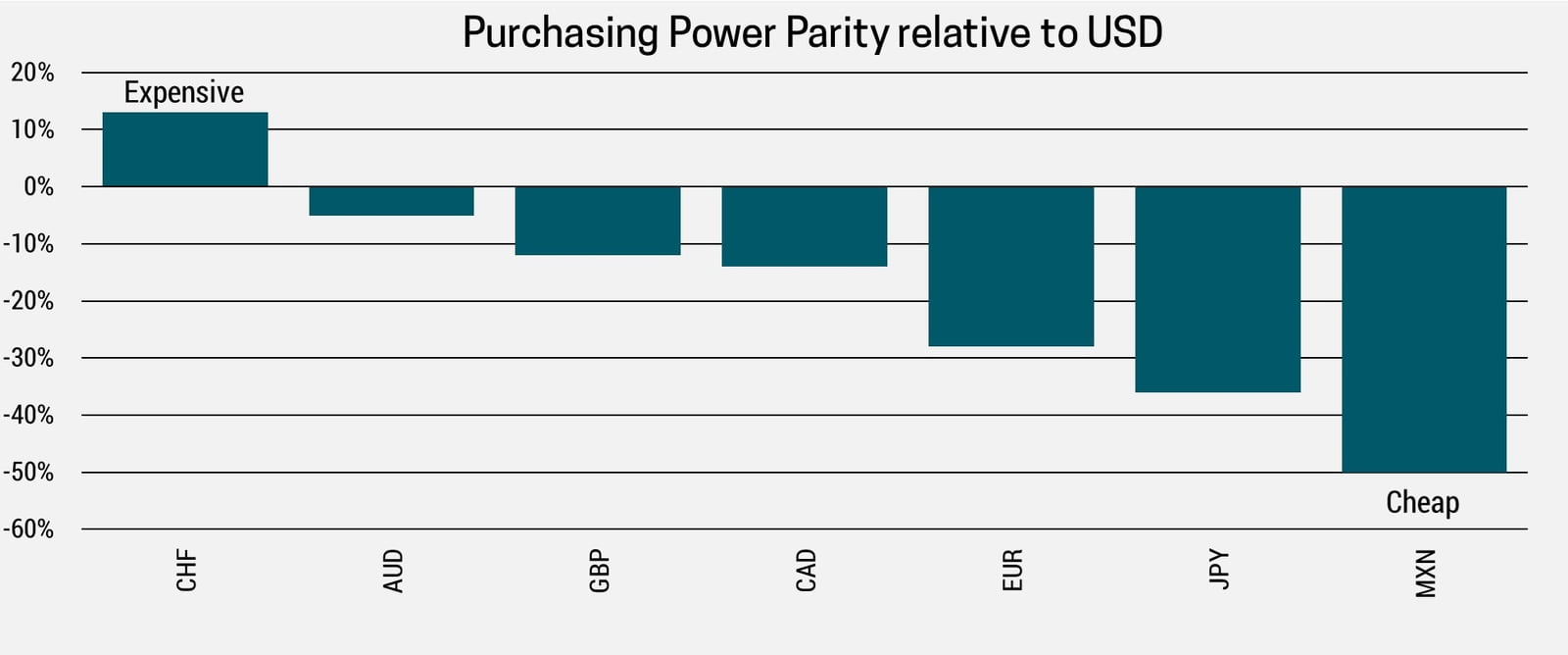

Falling USD: A falling currency raises import costs causing inflation. Investors rush into the perceived safety of the USD during a crisis, but it tends to weaken during an economic expansion, which is our expectation. Purchasing power parity measures the cost to buy a comparable basket of goods and services in different currencies. By this measure, the USD is significantly more expensive than every other major currency except the Swiss Franc.

Reduced Globalization: There is a growing risk of protectionist policies, regardless of who wins the election. Both Republicans and Democrats are in favor of tariffs, trade barriers and re-shoring manufacturing. Ultimately, this will result in higher prices for consumers and explaining this relationship will be the main topic for the remainder of this newsletter.

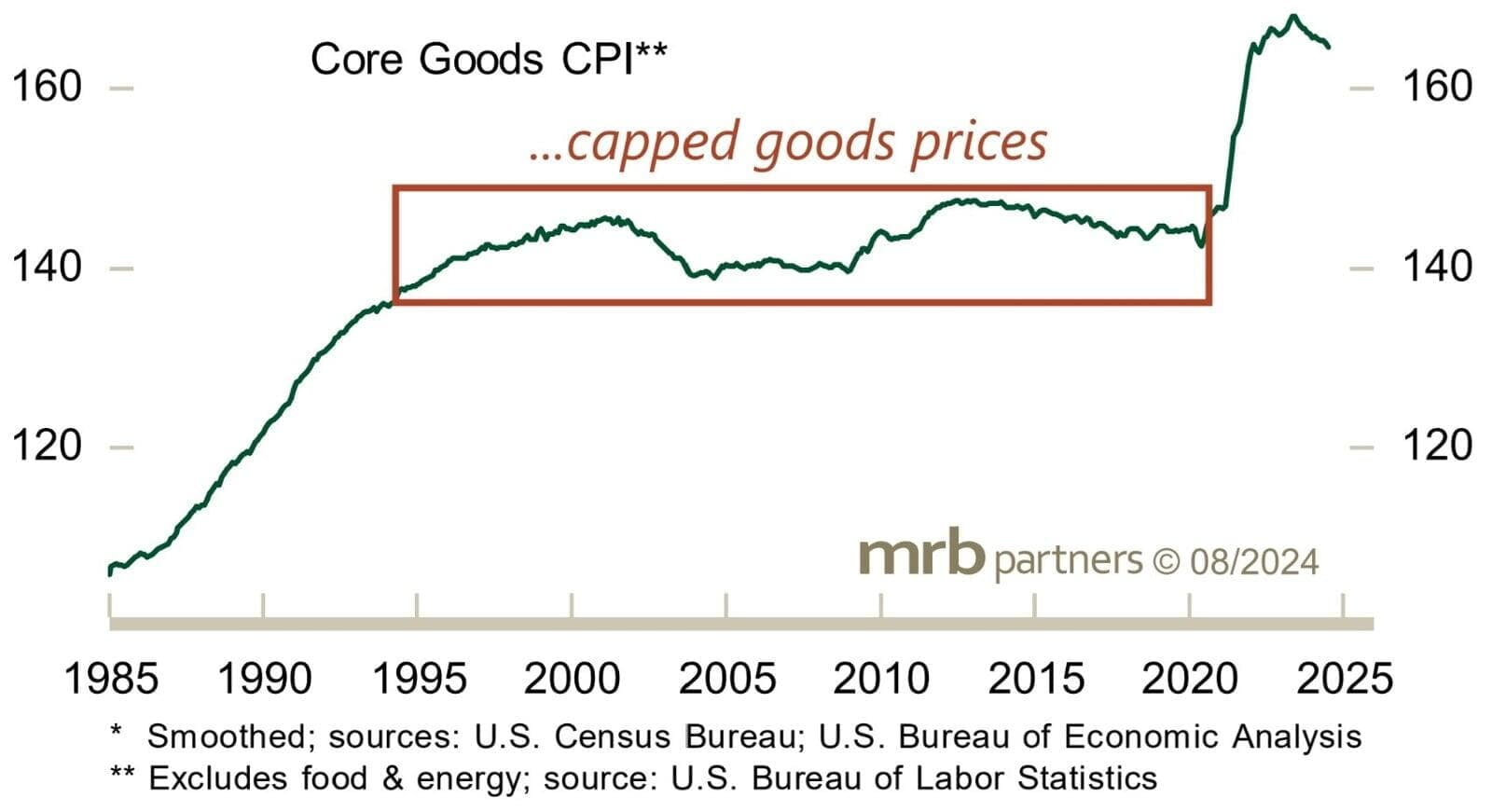

BENEFITS OF GLOBAL TRADE

The dramatic expansion of global trade over the past 3 decades has dramatically reshaped the world as we know it. It began with the North American Free Trade Agreement (NAFTA) in 1994, followed by the World Trade Organization (WTO) in 1995, and accelerated dramatically when China joined the WTO in 2001. Trade allows countries to specialize in what they do best and trade for the rest. Whether it’s commodities, agriculture, technology or manufacturing, each country has its own unique set of circumstances that give it a competitive advantage in certain areas. They can then overproduce in that area, export the excess to other countries and import whatever they cannot efficiently produce themselves. This results in more goods produced at a lower cost and is the key reason goods inflation has been almost non-existent over this timeframe (see chart).

Unfortunately, the societal benefit from cheap and abundant goods has not been equally distributed. Generally, globalization has led to large western democracies concentrating on information/knowledge based work while offshoring manufacturing to emerging markets which have an abundance of cheap low-skilled labour. In the developed world, this is great if you’re a highly skilled worker where job prospects have been abundant and your paycheque goes further buying cheap goods from overseas. It’s terrible if you’re in manufacturing, where jobs were cut as businesses struggled to compete with low-cost labour in the developing world. Some of these displaced workers have transitioned into service-based roles, but they generally don’t pay as well and have not absorbed all the job losses. Understandably, this has fueled social unrest and a push for change.

BARRIERS TO GLOBAL TRADE

The knee-jerk reaction of most politicians is to slap a tariff on imported goods. This raises the price for consumers, while benefiting domestic producers who will find it easier to compete. Unfortunately, the cost to consumers more than outweighs the benefits to producers and can be quantified as a deadweight loss. This loss depends on a variety of factors, but to avoid devolving into an economics lecture, let’s just use a simple example.

Let’s say I run the numbers, and it makes economic sense to install a solar array on my roof. The amount I’ll save on my utility bill over time more than outweighs the cost. Then the government adds a 50% tariff to imported solar panels. The added cost makes the project uneconomical, so I decide to hold off. The tariff didn’t result in the purchase of a domestic solar panel as intended, I simply didn’t buy it and so the global economic pie has shrunk. This is a deadweight loss, but it’s only half of the picture as our trading partners will inevitably retaliate in-kind. The end result is a trade war, where both countries suffer, and the winner is whoever loses less.

Nearly all economists agree that free trade is a good thing, but regardless we appear to be headed in the opposite direction. Politicians want to be elected and currently voters hurt by trade (ie. manufacturing in Quebec, Ontario and US mid-western swing states) are a key voting block. We could have avoided this by spreading the benefits of globalization more equitably, but I digress. To be a successful investor you must operate in the world as it is, not as you wish it to be.

With tariffs and trade barriers becoming more likely, investors should prepare for higher inflation and potentially slower growth. We could avoid an economic slowdown if tariff revenue is used to reduce personal tax rates, as this would boost consumer demand. Unfortunately, it would raise prices further, resulting in even higher inflation than tariffs alone. Regardless, corporate profits would take a hit, particularly large multi-national firms that do business all over the world.

PORTFOLIO STRATEGY

The Fed cutting rates is akin to adding fuel to the fire. Initially, this will be cheered as good news by the markets. Borrowers get relief, leading to more spending, higher economic growth and corporate profits. As interest rates fall, investors apply a smaller discount to future profits, thereby boosting asset values. The negative downstream effects on inflation will take time to surface. As a result, our strategy is to remain overweight equities to ride the momentum, while preparing to reduce risk exposure when inflation fears resurface. We are monitoring the bond market closely as rising rates there will be an indicator that the market is pivoting towards our view for higher inflation and therefore less interest rate cuts.

The result could be reminiscent of the 2022 correction where bonds suffered their worst performance in history. As a result, we remain underweight bonds and have a preference for short-term and floating rate debt. US equities have the highest risk exposure to tariffs and trade barriers due to their higher weight in multi-national firms (41% of S&P 500 revenue is from foreign sources) and elevated valuations. Canada remains challenged due to its high level of consumer debt, albeit falling interest rates will provide a temporary reprieve.

Our preference is for International and Emerging markets which trade at a discount, are less exposed to higher inflation and interest rates while benefiting most from China’s recent stimulus. Furthermore, consumers in Europe never spent down their covid stimulus due to uncertainty from the War in Ukraine. While this is obviously ongoing, energy prices there have normalized and consumers are more eager than ever to get on with their lives.