Range-Bound Markets

Markets were range-bound in Q2, as positive economic news was offset by stronger inflation and therefore higher interest rates. A notable exception was significant upside for companies involved in AI. We are not inclined to chase this trade as big-tech valuations which were high to begin with have become excessive. For instance, NVIDIA which makes chips that are vital for large language models like ChatGPT is currently trading at 40X sales. Put differently, for every dollar you invest in the company, it’s only generating 2.5 cents of annual revenue!

RANGE-BOUND MARKETS

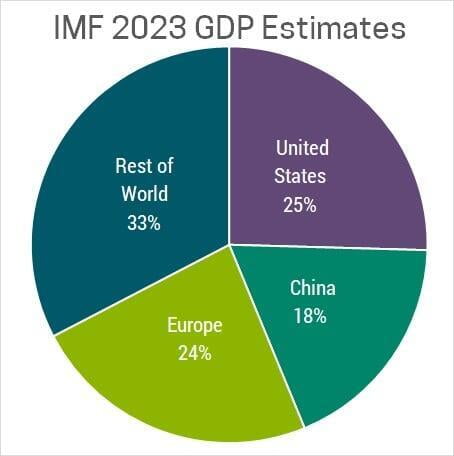

Our expectation continues to be that the global economy will prove resilient in the face of interest rate hikes. China is reopening from their draconian covid-zero policy. The US and Eurozone paid down their debts last decade as a result of the 2008 sub-prime and euro debt crisis. Together, these countries represent over two thirds of global GDP, which is why it’s hard to imagine a global recession while their economies remain solid.

Unfortunately, stronger economic growth exacerbates the inflation problem. Good news on the economic front becomes bad news for inflation, leading to higher interest rates and a corresponding drop in asset prices. The reason is that all assets are valued by forecasting their future earnings, then discounting them back to the present based on prevailing interest rates. The higher interest rates are, the lower the valuation we arrive at. This is particularly impactful for growth companies who derive more of their value from the distant future.

To understand why this is likely to lead to range-bound markets, let’s look at the most popular valuation metric, Price/Earnings (P/E). Economic growth means higher earnings, which leads to rising prices if the P/E ratio remained constant. Unfortunately, stronger growth also leads to higher interest rates, which means the valuations investors are willing to pay shrink. The reverse is also true, as a weak economy means lower earnings, but that’s offset by falling interest rates which leads to higher valuations.

Another way you can think of this relationship is via opportunity cost. When interest rates were low, the yield on risk-free investments was essentially zero. As a result, investors were incentivized to take risk and own stocks which pushed up their valuations. Now that interest rates are higher, investors can generate a ~5% yield on risk-free high interest savings accounts, GIC’s or short-term government bonds. As a result, valuations on stocks typically fall since investors have viable alternatives available to them.

Given these counter-balancing forces we don’t see significant upside or downside in the market until the inflation problem is resolved. Bringing inflation down to the 2% target will ultimately require central banks to raise interest rates even higher and keep them there until it causes a recession (more on that later). Our analysis suggest that is still at least a year away, but we will continue to monitor the data closely.

SAVERS VS INVESTORS

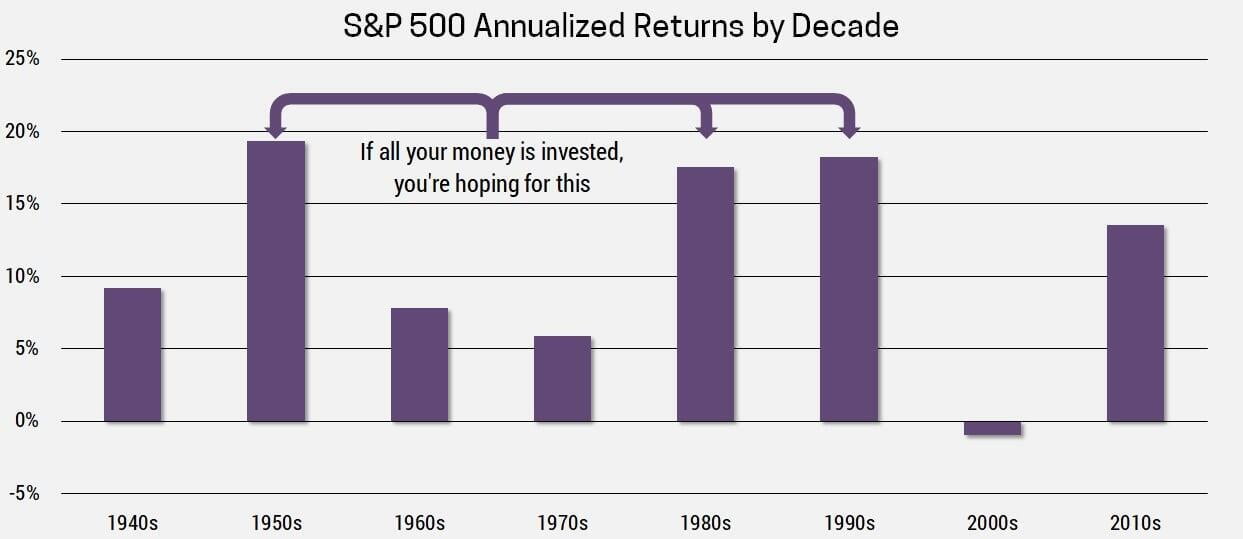

If markets stay range bound as we expect, this presents a wonderful opportunity for savers. To understand why, let’s look at the annual returns by decade for the S&P 500 (I’ve used the US because it’s easier to get long-term performance data). Market cycles don’t line up neatly with calendar decades, but the point is to highlight the boom/bust nature of markets on investors.

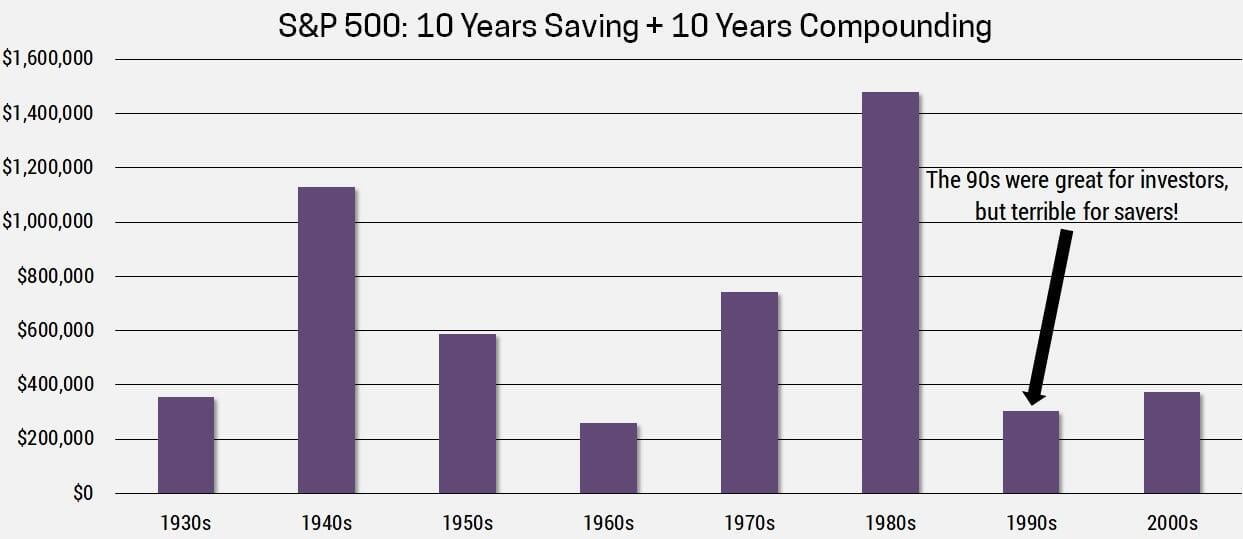

But what happens if you’re a saver who is consistently putting money into your financial portfolio? To illustrate this, let’s assume you’re saving $10,000 each year for 10 years during the decade, then you stop saving and simply compound your investments for an additional 10 years.

In this example, the 1940s and 1980s are the clear winners. That’s because the ideal environment for savers is weak markets where they can average in at low valuations. Then there is a market boom only after the savings are fully invested. If you take an even longer-term view, the inflationary 1970s which has many parallels with our current predicament, was the best time to save. Interest rates were high causing valuations to stay low, then it was followed by one of the greatest economic booms in history, which culminated in the peak of the dot-com bubble. It’s never easy putting money into the markets when they’re falling, as you see your hard-earned savings stagnate or decline. I don’t know if this type of market environment will last for a year, 5 years or 10, but I do know it’s typically the best time to build a financial nest egg.

OVER-INDEBTED ECONOMIES

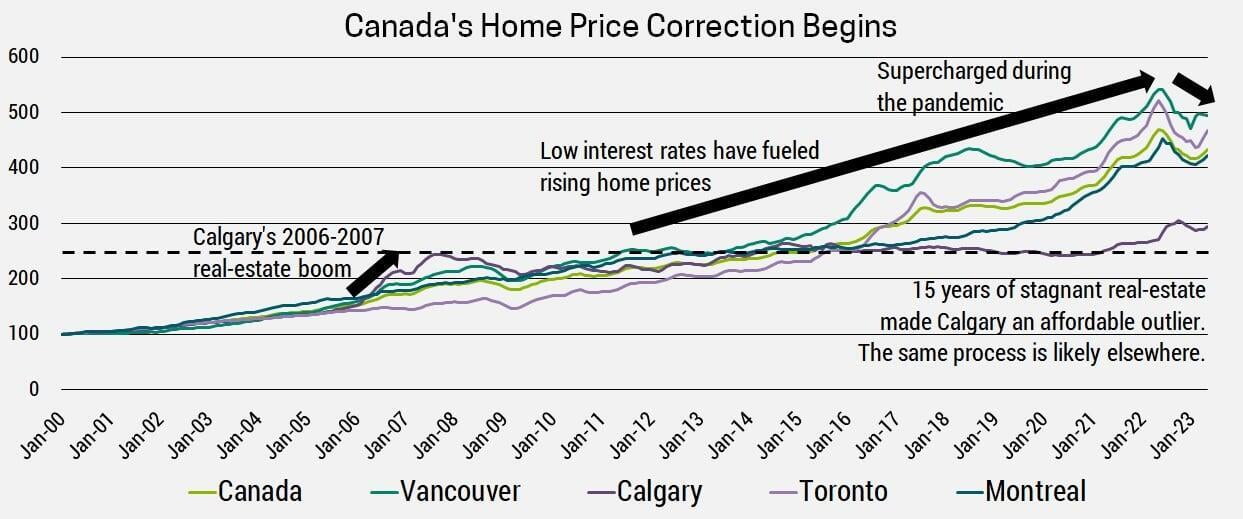

Since we’ll likely need a global recession to cure inflation and bring an end to this range-bound market, the obvious next question is what triggers the recession. Ultimately, it will be a result of interest rates remaining higher for longer, which will cause a significant part of the global economy to fail. We believe the countries that avoided the debt crises of last decade are likely candidates. This includes Canada, Australia and others that have seen real-estate prices and therefore debt levels surge to record highs causing an affordability crisis. To resolve this issue, we see two likely scenarios:

- Base Case: Consumers continue to make their higher mortgage payments, but are only able to do so by cutting back on all other spending. This results in a slowing economy or mild recession, but in the absence of extensive layoffs the real-estate market stabilizes, and wage growth allows affordability to return over the coming decade. This is similar to what the Calgary real-estate market experienced following the 2006-2007 boom.

- Worst Case: We enter a significant recession, where mass layoffs result in a wave of forced home sellers. Buyers can’t afford to get in since a resilient global economy buoyed by the US, Europe and China means interest rates remain high. Real-estate prices drop as a wave of defaults ensue.

PORTFOLIO STRATEGY

While we’re optimistic we’ll avoid the worst, our base case is still not particularly attractive. This is what underpins our continued underweight stance on over-indebted economies like Canada.

We’re also maintaining our overweight in short-term/floating rate debt and value stocks. The valuation gap between growth and value stocks is excessive. As an example, US growth stocks are nearly twice as expensive, trading at a forward P/E ratio of 28.5, relative to the US value index at 14.6. Growth companies should trade at a premium, given their growing/stable earnings, superior profitability, and stronger balance sheets, but the question is how much of a premium. The current ~95% premium looks excessive, particularly compared to the long-term average of ~30%. It looks even worse when you consider that periods of high/rising interest rates (like we’re experiencing now), tend to result in a smaller premium for growth stocks. Within our portfolios we are finding even more attractive opportunities with many stocks trading at a P/E below 10.

Range-bound markets encourage flexibility in our short-term investment strategy. Our base case is that markets rally for the remainder of 2023 as economic growth remains resilient and inflation continues trending down. If markets rally as we expect, our plan is to use that strength to reduce equity exposure. We would then hold these proceeds in the Purpose High Interest Savings Fund (ticker PSA), which is currently offering an extremely attractive 5.06% yield. This strategy has only become viable in the last year, as yields were below 1% as recently as March 2022. If our base case doesn’t play out and markets fall, we would be inclined to buy risk-assets.

Over the medium-term, we are looking to increase our bonds allocation to help protect portfolios from the inevitable recession. This will likely occur if bond yields rise significantly (ie. Investors capitulate to our view of inflation staying higher for longer). It could also occur if economic data weakens to the point of a recession looking probable on a 6-12 month time horizon. We will continue to monitor the situation closely.

FINANCIAL PLANNING STRATEGY

We continue to recommend prioritizing debt repayment, particularly if you have debt with an interest rate over 6%. If you have no debt, or it’s locked-in at a low rate, then our expectation of a range-bound market provides an opportunity to continue building out your investment portfolio at more attractive valuations and yields. If you’re in retirement or are otherwise in the draw-down phase of your financial life, then it’s worth considering downsizing. The real-estate market in Alberta, where the vast majority of our clients reside, has been relatively strong due to limited supply.

While we continue to believe that Alberta will be amongst the strongest real-estate markets in Canada, this is not due to optimism here. We are simply the cleanest, dirty shirt when compared to Ontario and BC. While these overpriced markets have already seen double digit sell-offs, our analysis suggests further downside and/or stagnating prices will be necessary in order to resolve the affordability crisis.

If you have any questions, comments or would like to become a client please do not hesitate to reach out. You can email me or schedule a free 30-minute consultation using the link below.