Interest Rates and Inflation: Higher for Longer

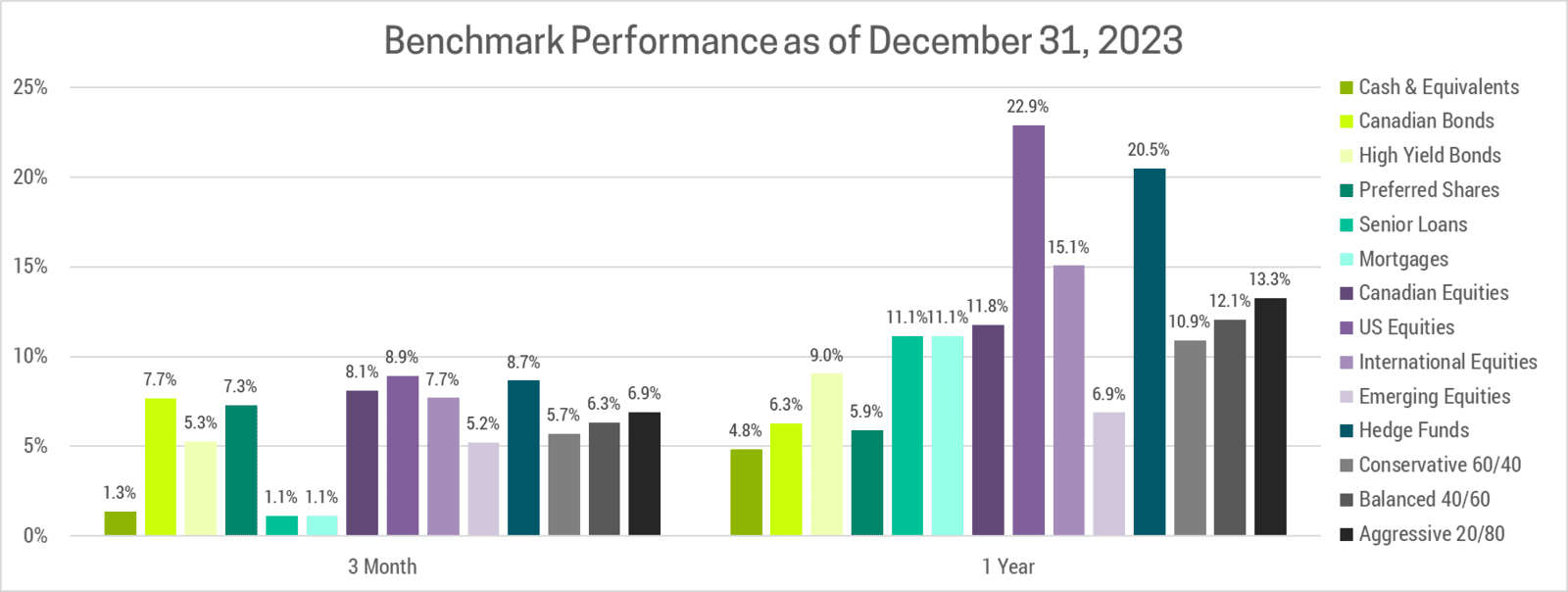

After being largely range bound for most of 2023, markets rallied substantially in Q4 as inflation continued trending down and the consensus began to price in central bank rate cuts for 2024. The result was a pretty decent year in the markets which saw gains across all major asset classes. This was welcome relief following a difficult 2022, where a balanced 60/40 portfolio had its third worst year on record as stocks fell and bonds posted their worst one-year performance in history.

IS A SOFT LANDING POSSIBLE?

When inflation took off, central banks were forced to slam on the brakes by dramatically hiking interest rates. The goal was a “soft landing” where the economy slows enough to bring inflation down to the 2% target without entering a full-blown recession or hard landing. When inflation peaked at levels not seen in four decades, the likelihood of achieving a soft-landing seemed vanishingly small. Just look at this headline from October 2022:

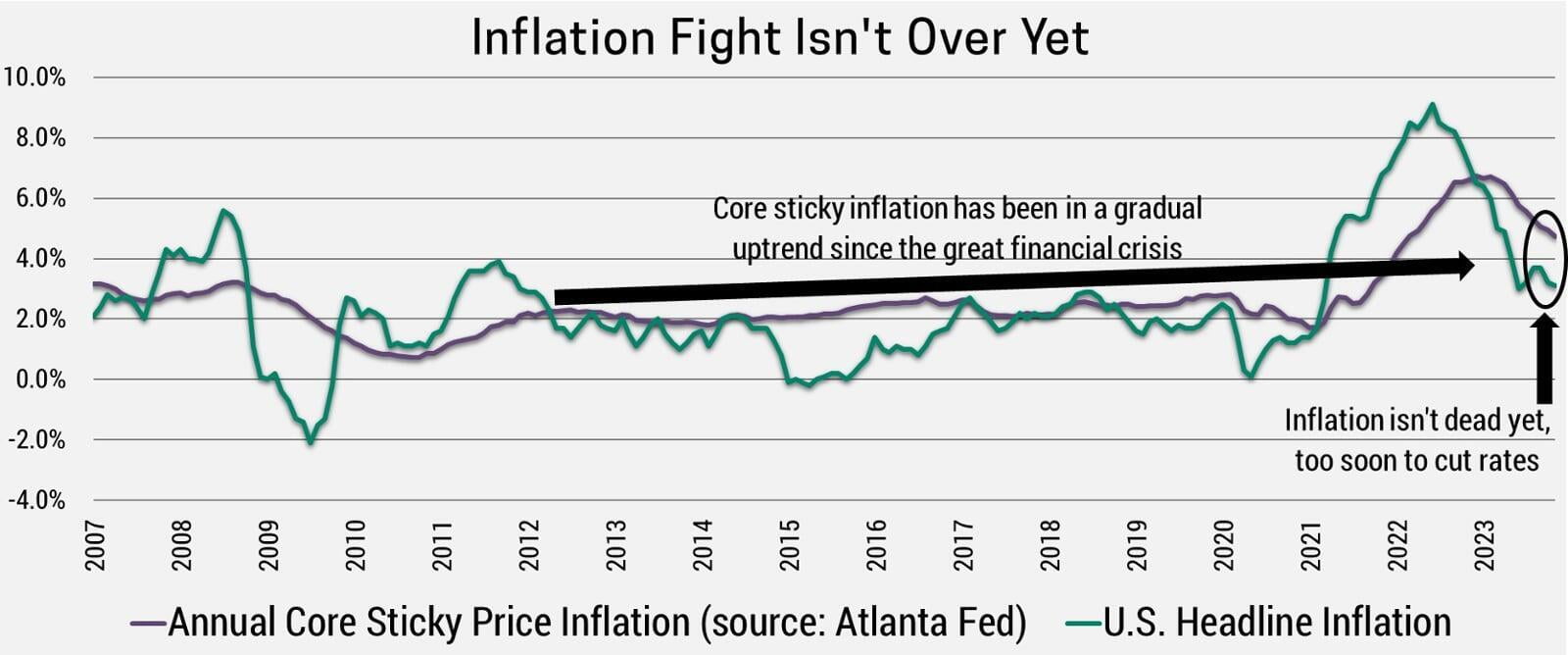

With US inflation currently at 3.1% (same as Canada), and recession fears fading, the consensus has begun to price in a soft landing with an expected 1.4% of total Fed rate cuts this year and more to follow in 2025. This is the primary driver behind the market rally these last few months. Unfortunately, we believe the market has gotten ahead of itself. While significant progress has been made bringing down headline inflation, sticky price inflation which excludes volatile components like food and energy remains uncomfortably high at 4.75%.

NO LANDING

While pundits continue to debate a soft vs hard landing, we believe the global economy is headed for a “no landing” scenario. Inflation is likely to decline further in the first half of 2024, largely due to easy year-over-year comparisons (Inflation didn’t drop below 4% until June 2023). After failing to reach the 2% target, we expect inflation will rise once more in the second half of 2024 as the global economy re-accelerates.

Ultimately, a global recession will be required to cleanse inflation from the system. The most likely cause is restrictive interest rates, it’s just a question of how high they have to go and how long they need to stay there. This is the primary topic we’ll address in this newsletter, and it builds on many of the topics we discussed in our Q4 2022 newsletter. If you haven’t read that, or would like a refresher, I encourage you to check it out here.

The main takeaway is that we have entered a more inflationary environment, but investors have been conditioned by the deflationary 2010s to believe that all roads lead back to low/stable inflation and interest rates. As a result, each time inflation rises they assume it’s temporary, or easily solved, or that acting too aggressively might cause deflation again.

ARE INTEREST RATES RESTRICTIVE?

Most investors just look at the headline central bank policy rates. Given the record amount of debt carried by Canadians, we would argue the Bank of Canada’s current policy rate of 5% is sufficiently restrictive to bring down inflation. This was largely confirmed by the 1.1% decline in Q3 real GDP (ie. Inflation adjusted). Q2 was revised up to a 1.4% gain, but it’s clear the economy has slowed dramatically and may be in a recession.

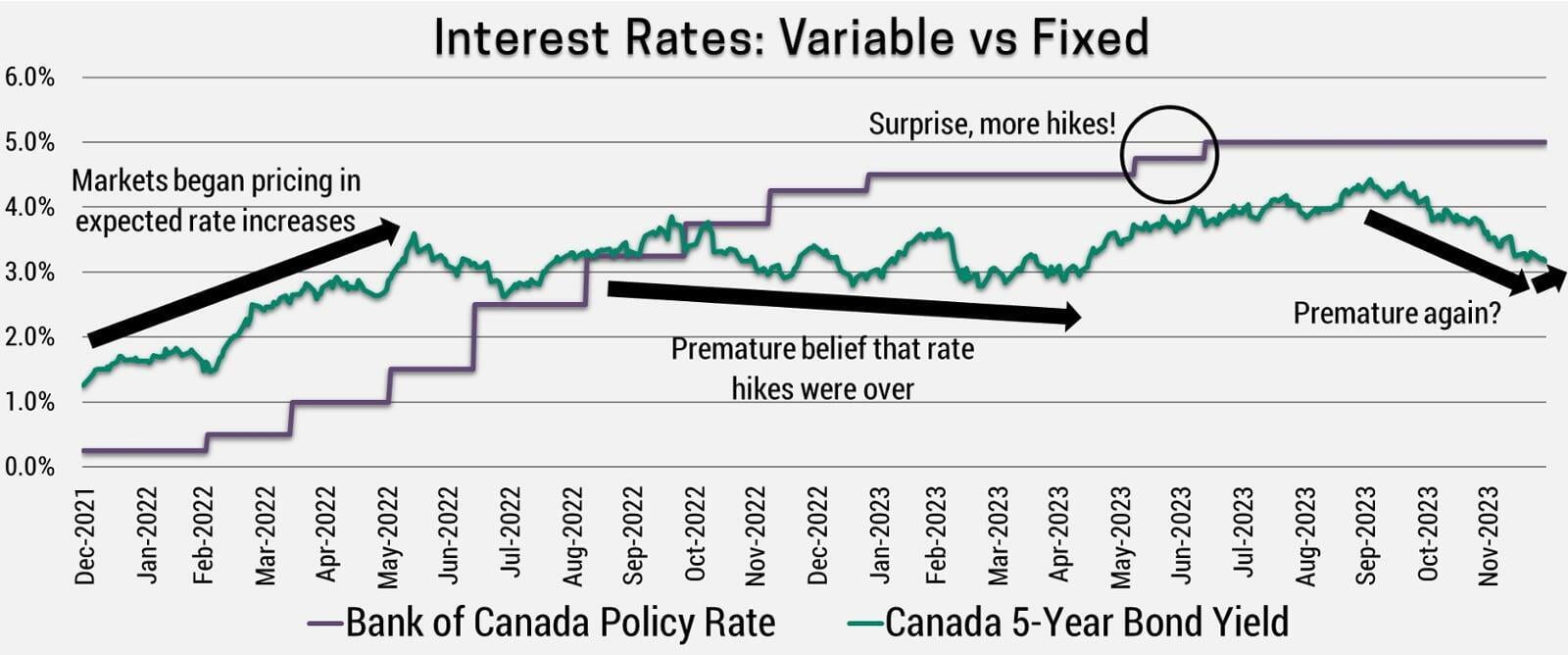

Unfortunately, central bank policy rates only represent short-term and variable rate borrowers. What about the majority of global debt which is borrowed over longer fixed terms? These rates incorporate expectations of where interest rates are headed in the future. With a soft-landing and dramatic rate cuts already priced in, fixed rates are relatively low and not sufficiently restrictive in our view. The 5-year yield in Canada dropped by 1% in Q4 2023 to just over 3%, a level we first breached back in June 2022 after the Bank of Canada hiked their policy rate to 1.5%. As a result, fixed rates have been flat over the past 18 months, while the variable is up 3.5%!

HIGHER FOR LONGER

It’s not just the level of interest rates that matter, but how long they stay there.

In Canada, where the longest mortgage term is a 5-year fixed, we’ve already seen about half of mortgages renew at higher rates. Coupled with our higher debt burden this has already resulted in stalling economic growth as 20% of mortgage holders can’t even make the interest portion of their payments. As the remainder renew it will result in even more economic weakness. Meanwhile, the most common mortgage for the US is a 30-year fixed and they have a smaller household debt burden. As a result, the impact of higher rates has been much more muted, which is a big reason why their Q3 real GDP growth rate was an impressive 4.9%!

This fixed-rate debt is why we see such a long lag between a change to central bank policy rates and its full impact on the economy. Historically there was a 1-2 year lag, but we expect this lag has widened, as governments and corporations have taken advantage of historically low interest rates to lock in borrowing costs for longer periods of time. In fact, the average term on debt has nearly doubled over the past 30 years. This ever-increasing lagged effect is why we believe fixed rates will need to go higher and/or variable rates will need to stay at their current levels longer than the consensus believes.

PORTFOLIO STRATEGY

In our Q2 2023 newsletter we stated, “If markets rally as we expect, our plan is to use that strength to reduce equity exposure.” As outlined in this newsletter, markets have gotten ahead of themselves in the belief that inflation and interest rates will continue to fall. As such, we have begun to reduce our equity overweight and will allow the portfolios dividends and interest to accumulate in the Purpose High Interest Savings Fund (ticker PSA), which is currently offering an extremely attractive 5.3% yield.

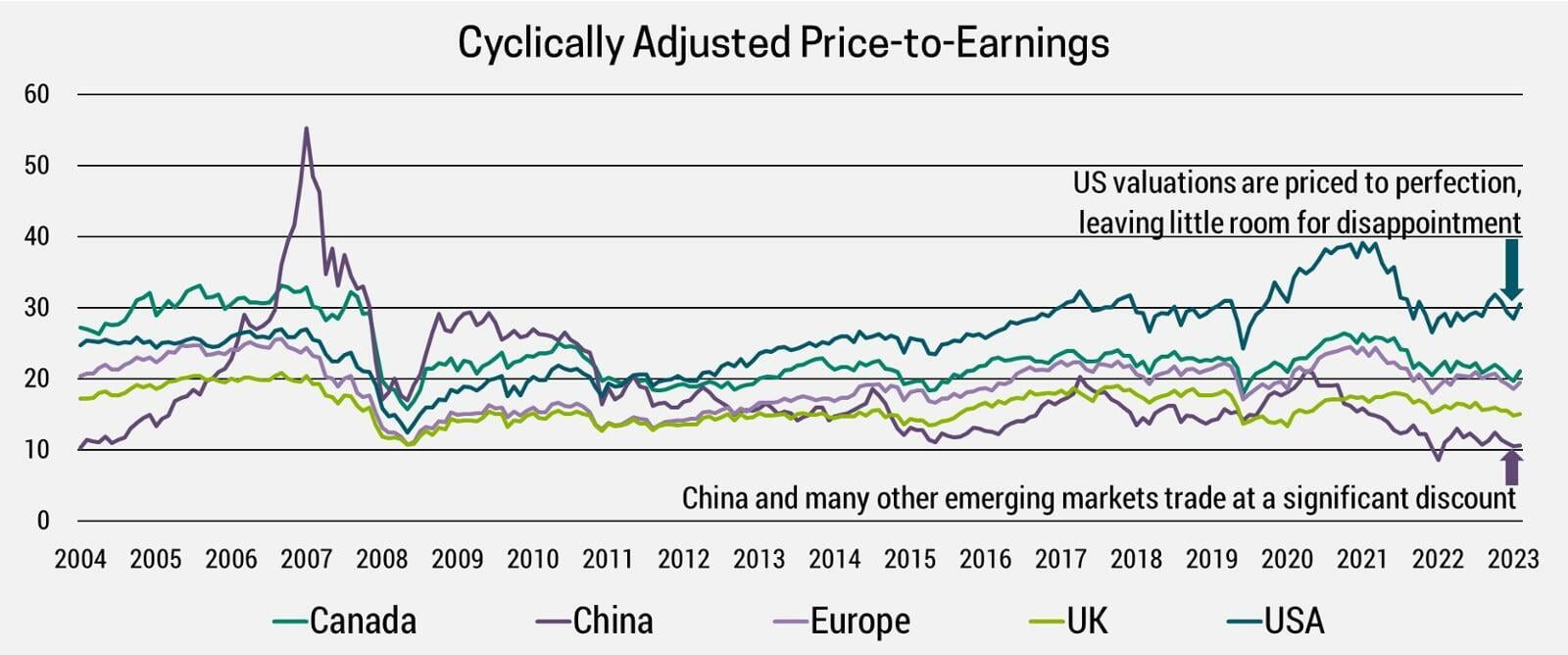

The theory we introduced in Q2 2023 of markets being “range-bound” is still intact. As such, our strategy will depend on what markets do going forward. If the current rally continues, we will increase our high interest savings weight further. If markets sell-off, we would be inclined to buy stocks. Due to excessive valuations, largely in US growth stocks, our preference is to own international and emerging markets which trade at a discount (see chart below). We remain uninterested in bonds at this time, since they offer less upside than stocks and are exposed to the same core risks of higher inflation and interest rates.

We are looking at strategies that are uncorrelated with both stocks and bonds, which we plan to add to portfolios prior to the next global recession. We continue to believe a global recession is unlikely in the next year, but it’s quite likely in Canada due to excessive consumer debt, which is why we remain underweight.

UNKNOWN UNKNOWNS

Our portfolio strategy is focused on the most significant risk for markets, higher inflation and interest rates, largely because investors have become too complacent about these risks. Unfortunately, this is far from the only risk investors face. For instance, 2024 will have elections in more than 60 countries representing half of the world’s population. There’s potential for geopolitical escalation, disruption from AI, climate change, and a myriad of other risks we can’t even imagine, otherwise known as “unknown unknowns”.

With high interest savings at 5.3%, it’s easy to contemplate throwing in the towel and keeping everything in cash. This would be a mistake, as historically a diversified portfolio performed far better over time despite the plethora of market events that have taken place. Cash is just another asset class which can make up a part of a diversified portfolio. It’s not a long-term investment, it’s just prudent to increase that weight now given the elevated risks and higher yield on offer.

Lastly, if your mortgage is coming up for renewal, we currently recommend a 5-year fixed. It provides stability on your single largest expense during a time of economic uncertainty and inflation. Also, you’re locking in expected rate cuts that may not materialize as quickly or dramatically as the consensus believes.