The Great Rotation

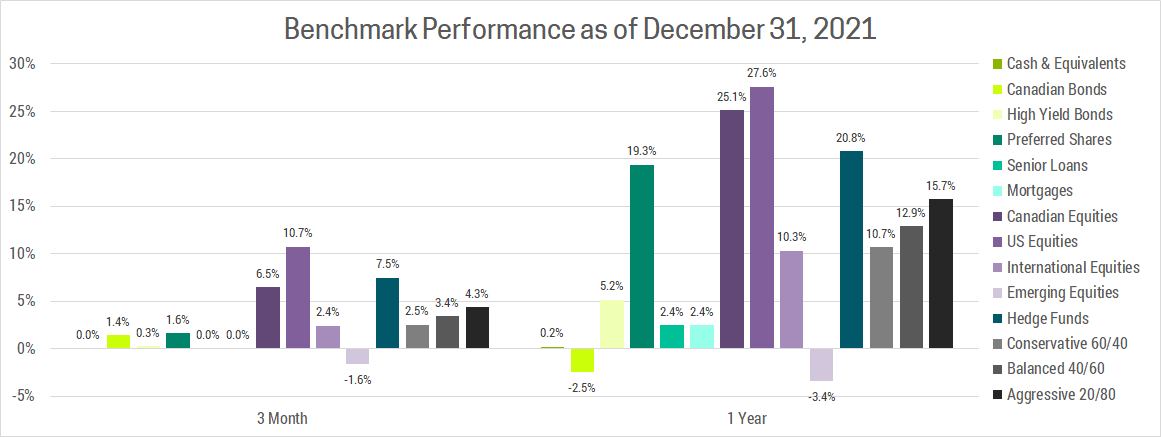

Volatility picked up in Q4 as the underlying strength of the economic recovery was challenged by Omicron and persistently high inflation, which has prompted central banks to discuss interest rate increases. Meanwhile, existing government stimulus measures have been winding down and renewed stimulus seems less likely given inflation concerns, high government debt burdens and political bickering, particularly in the US. Despite all this, Q4 saw markets close slightly higher to cap off a strong year of double-digit performance.

Inflation: Inflation will recede from the current peak as supply chain bottlenecks slowly resolve, but this relief will only be temporary. Underlying pressure from rising wages and housing costs will keep inflation around 3% vs the market consensus of 2% - 2.5%. Furthermore, as case numbers decline and the economy reopens further, inflation will shift from goods to services, which make up a far greater share of overall spending.

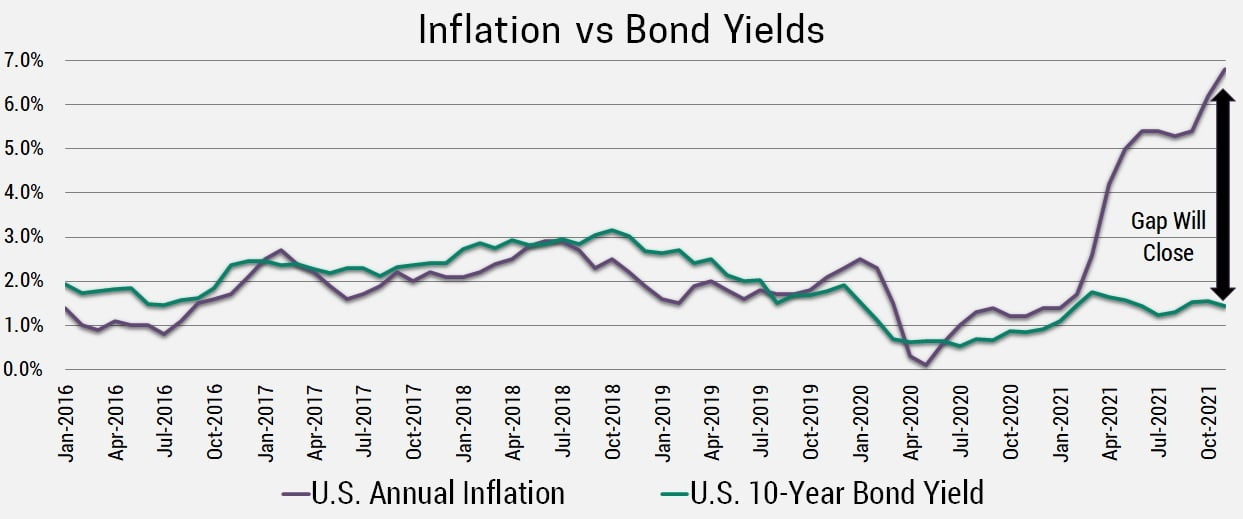

Rising Interest Rates: Persistently higher inflation will force central banks to raise interest rates faster and farther than they, or the market, currently expects. For reference, last March the Federal Reserve was planning its first rate hike in 2024. Now they plan 8 hikes, totalling a 2% rise, by the end of 2024, which by our estimates is still not enough to curb inflation. The chart below highlights how complacent the bond market is with 10-year yields at 1.5% despite inflation a 6.8%.

COVID: Trying to predict the future around a virus that mutates and spreads so rapidly is a dangerous business. Just look at the IHU variant discovered in France this week! That said, we seem to be in the final innings of this pandemic as vaccines and natural infection push us towards herd immunity. Treatment options are also more advanced, particularly with the advent of Pfizer and Merck’s anti-virals which were approved by the FDA in December. Finally, there is an evolutionary tendency for variants to become more transmissible and less deadly over time. Statistically, a virus that causes severe illness is less likely to spread than one with more mild symptoms. A bed-ridden host can’t spread a virus as easily as someone who is relatively unaffected going about their daily business. This is why we expect variants to generally become less deadly, but more transmissible over time. Omicron likely represents a significant step in the transition from a pandemic to an endemic disease.

Economy: While rising covid cases are likely to dampen growth in Q1, it is only a temporary setback. The strong economic reopening and recovery will continue to broaden in 2022 as more countries contribute to what we expect will be a synchronized global expansion by year-end.

We expect 2022 to be a year of widespread rotations. Investors will transition from long-dated assets that benefit from low interest rates (long-term bonds and growth stocks) into cheaper, more cyclical sectors and markets. As the economic recovery broadens, we’ll see investors move from safe haven countries and currencies like the US, into those that have lagged, like Europe and Japan. As risk appetite increases, investors will shift from large to small companies and safer developed markets to riskier emerging markets.

Ultimately, what has worked for investors over the last economic cycle is unlikely to work this time around because the economy is fundamentally different.

The previous decade was characterized by low inflation, falling interest rates, low growth and rising valuations. The coming decade is shaping up to be the exact opposite, with higher inflation, rising interest rates, higher growth and falling valuations. Investors who are too slow to realize this monumental shift is taking place, stand to underperform dramatically over the coming decade.

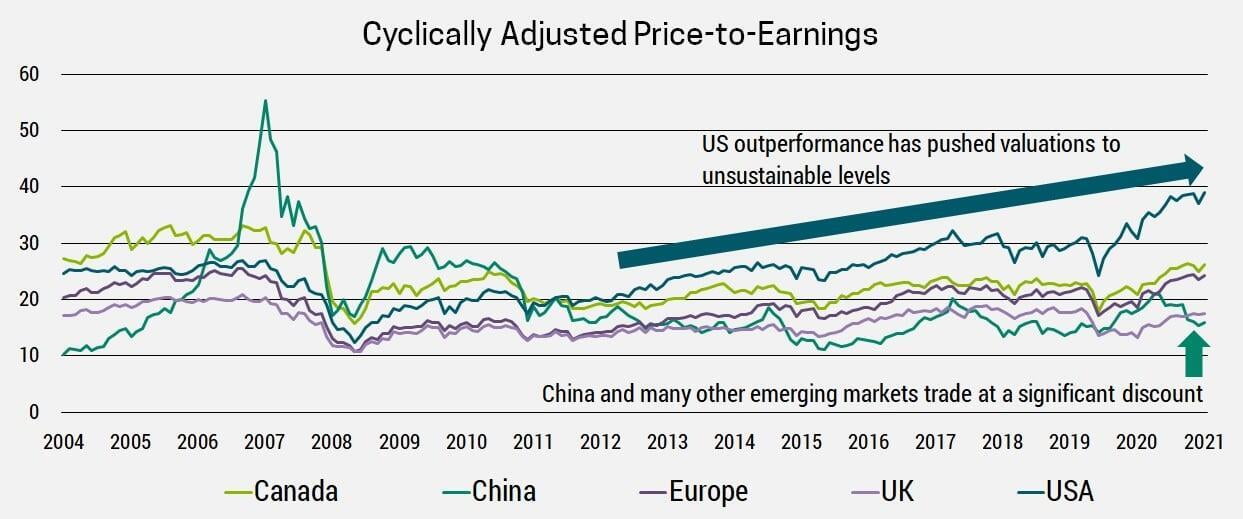

With any investment, what matters most in the long-term is the initial price you pay (valuation) and the earnings it generates over time (growth). Typically, there is a trade off, as high growth investments are expensive, while cheap ones either grow slower or are in decline. China and many other emerging markets are expected to grow faster due to better demographic trends and a technological catch-up that leads to faster productivity gains. The IMF forecasts 5-year average real growth rates of developed markets at 1.6% vs emerging Asia at 5.3%. That’s more than triple the growth rate! Furthermore, as seen in the chart below, China and many other emerging markets are now trading at a significant discount.

How is it possible to buy a high growth investment at a discount? Simple, there’s more risk! Many of the topics we’ll discuss represent a risk to investing in China, but as we dive in remember that cheap valuations and high growth means investors have a lot of upside if worst-case scenarios don’t pan out. Also, because these risks are well known, markets won’t be surprised by them, leaving relatively less downside.

In 2018, a trade war began when the Trump administration imposed tariffs in an effort to reduce their trade deficit with China. There has been a de-escalation under Biden, but with the pandemic winding down, markets expect conflict between the two superpowers will begin to escalate once more. Make no mistake, US/China relations are broken and any truce will be temporary. This is a battle over global economic and technological supremacy that is likely to drag on for decades to come.

Unfortunately, the US doesn’t seem to have a cohesive approach at this time. The democrats prefer a multi-national approach to trade, but a decade of isolationist policies means they will need to focus on rebuilding relationships with allies before they can be used as leverage to pressure China. With US mid-term elections this November, the democrats will be busy at home trying to secure control of the House and Senate. This will be a difficult task and the most likely outcome appears to be a divided Congress that is less likely to tackle China in a meaningful way.

Even if a trade war escalates, it is not safe to assume the US would win. Many countries look to America for security, but they look to China for prosperity and will try to avoid picking sides. If forced to do so, many of the fastest growing countries will side with China. Since a trade war would hurt everyone, we view the risk of significant escalation as being low, particularly over the next 2-3 years where domestic politics will be prioritized.

While the US attempts to lead by keeping their rivals down, China is moving to build a new world order in their image. After coming to power in 2012, Xi Jinping has purged rivals and solidified his control. Now Xi is preparing to ask the party for a 3rd 5-year term, the first since Mao. He has launched a campaign dubbed “common prosperity” that seeks to eradicate capitalist excesses like inequality. China’s top 1% own over 30% of the country’s wealth while celebrities and tech companies have gained more control over culture and personal data. This runs counter to the communist party’s ideals and has resulted in a number of recent crackdowns, including:

- Cryptocurrencies: Banned all crypto transactions and mining

- Foreign Listings: Any company with data on more than one million Chinese users must seek pre-approval before listing overseas.

- Tutoring: Banned private companies from teaching the school syllabus on weekends and vacations or making a profit

- Video Games: Limited online gamers under age 18 to just three hours per week

- Real-Estate: Housing is expensive relative to incomes, largely due to rampant speculation which the government is trying to curb (re: Evergrande)

Outside of the economy, there is a cultural crackdown as the government has locked up over one million Uyghurs. Free speech and thought are becoming more restrictive as “Moral review councils” and public shaming force people in-line with communist party ideals. Their relentless approach of “zero-covid”, whereby entire cities are locked down seems increasingly out of touch with the new reality of Omicron. All this has spooked foreign investors and sent the FTSE China 50 Index has down over 30% from its highs last February.

The question is how much further they go regulating additional industries. So far it's focused on industries that pose the greatest risk to the communist party (eg. Tech and Education which shape the minds and discord of citizens). We don’t expect it to go much further because the communist party wouldn't want to risk too much economic damage as that would also undermine their control. They also need innovative companies to achieve their stated long-term goals:

- 2025: Become the dominant power in 10 leading technologies including AI, robotics, aerospace, biopharmaceuticals and quantum computing

- 2035: Be the innovation leader across all advanced technologies

- 2049: Be unambiguously #1 to coincide with the 100th anniversary of the People’s Republic of China

Regulatory risk is likely to be a bigger issue globally going forward as other countries are also grappling with inequality and the growing power of corporations. The Biden administration has assembled a strong anti-trust team targeting big tech, the EU is clamping down as well, plus with record government deficits they will squeeze corporations and wealthy individuals financially (eg. the 15% global minimum tax agreement). Investors may not have any place to run from regulatory risk.

Even if global investors shy away from China, their citizens are the largest buyers. While outsiders may view things differently, Chinese citizens are pleased with their place in the world and nationalism is at an all-time-high. They also face strict capital controls that make it difficult to invest overseas. With the communist party clamping down on real-estate speculation, most domestic Chinese savings will flow into the stock market and support prices long-term. Furthermore, China’s central bank is easing policy to stimulate growth while most developed markets are tightening to combat inflation.

In summary, it’s been a tough year for investors in China. Markets are clearly worried about a trade-war that we believe is unlikely to escalate in the coming years and extrapolating a regulatory clampdown into other industries that we don't believe will be targeted. Plus, markets are ignoring similar risks globally. While there are clearly risks to our view, there is also significant upside. China's stock market is off over 30% from their February 2021 highs, so we believe it represents a good risk/return trade-off at this juncture. In short, Chinese equities are cheap, long-term growth is compelling and the worst of the trade-war and regulatory crackdown is likely behind us.

If you have any questions, comments or would like to become a client please do not hesitate to reach out. You can email me or schedule a free 30 minute consultation using the link below.