High Expectations Leads to Disappointment

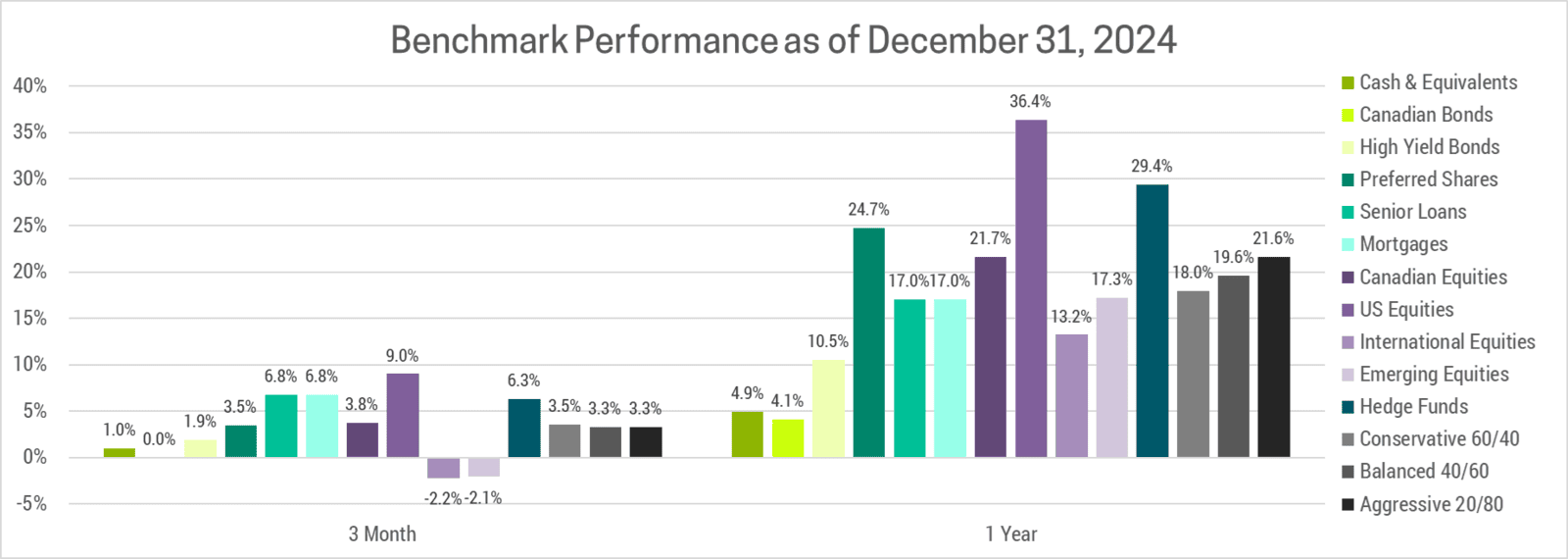

2024 was a phenomenal year for investors. Nearly every asset class was up dramatically, benefiting from a strong global economy, central bank interest rate cuts and the expectation of more to come. We are very pleased with our portfolio’s performance this year, but caution that 2025 is likely to exhibit more volatility and less upside for reason’s we’ll discuss in this newsletter.

DEBT BURDENS

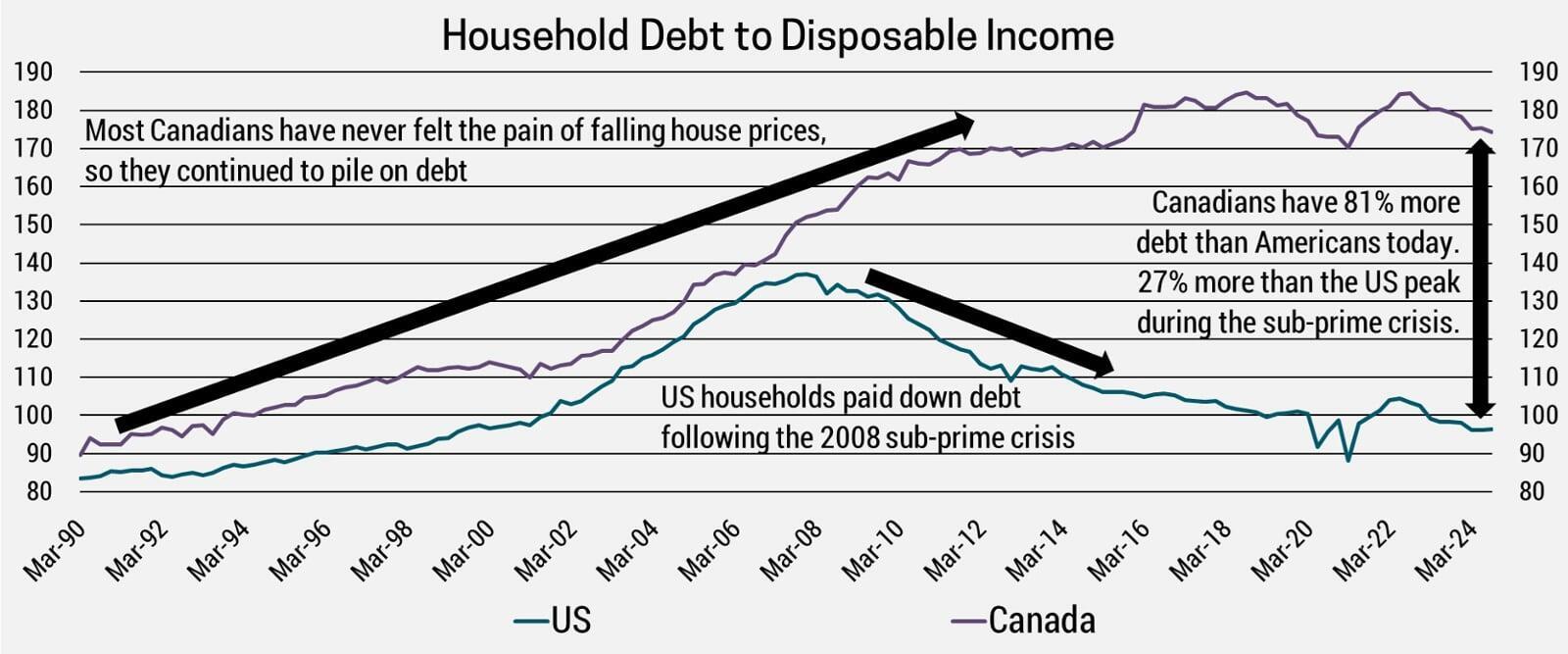

At the beginning of 2024, investors and central banks thought interest rates were restrictive. As we have argued repeatedly, this really varies by country:

- Canada: A multi decade rally in home prices has resulted in excessively high consumer debt. Since the longest fixed-rate mortgage is 5 years, most borrowers have already felt the impact of higher rates. Interest rates started to rise 3 years ago, so the remaining low fixed-rate mortgages will be reset over the next 2 years.

- US: The subprime crisis of 2008 caused the US housing market to burst and ever since Americans have been paying down their debt. Since borrowers have the ability to lock in 30-year fixed mortgages, many have been unaffected by the rise of interest rates.

In short, Canadians carry more debt and at higher interest rates than Americans.

As a result, the impact of central bank rate hikes was significant for Canada. As Canadians spent more on interest payments they had less available to buy other things, causing the economy to stagnate and inflation to plummet to 1.9%. Meanwhile, the US economy was relatively unphased by interest rates. Growth has continued and inflation has stagnated at 2.7% (core inflation, which excludes volatile items such as food and energy, is still 3.3%).

The Bank of Canada (BoC) has economic justification for more rate cuts, unlike the US Federal Reserve. The Fed may still cut in 2025, but less than the consensus believes and we believe this would be a policy mistake leading to higher inflation. If the Fed stops cutting rates, Canada faces a dilemma. Continued rate cuts in Canada widen the interest rate gap between the two countries, making the CAD less attractive compared to the USD. This weakens the CAD further, increasing the cost of imports which leads to inflation in Canada. Therefore, we expect neither the Fed nor the BoC will not be able to cut rates as much as the consensus believes.

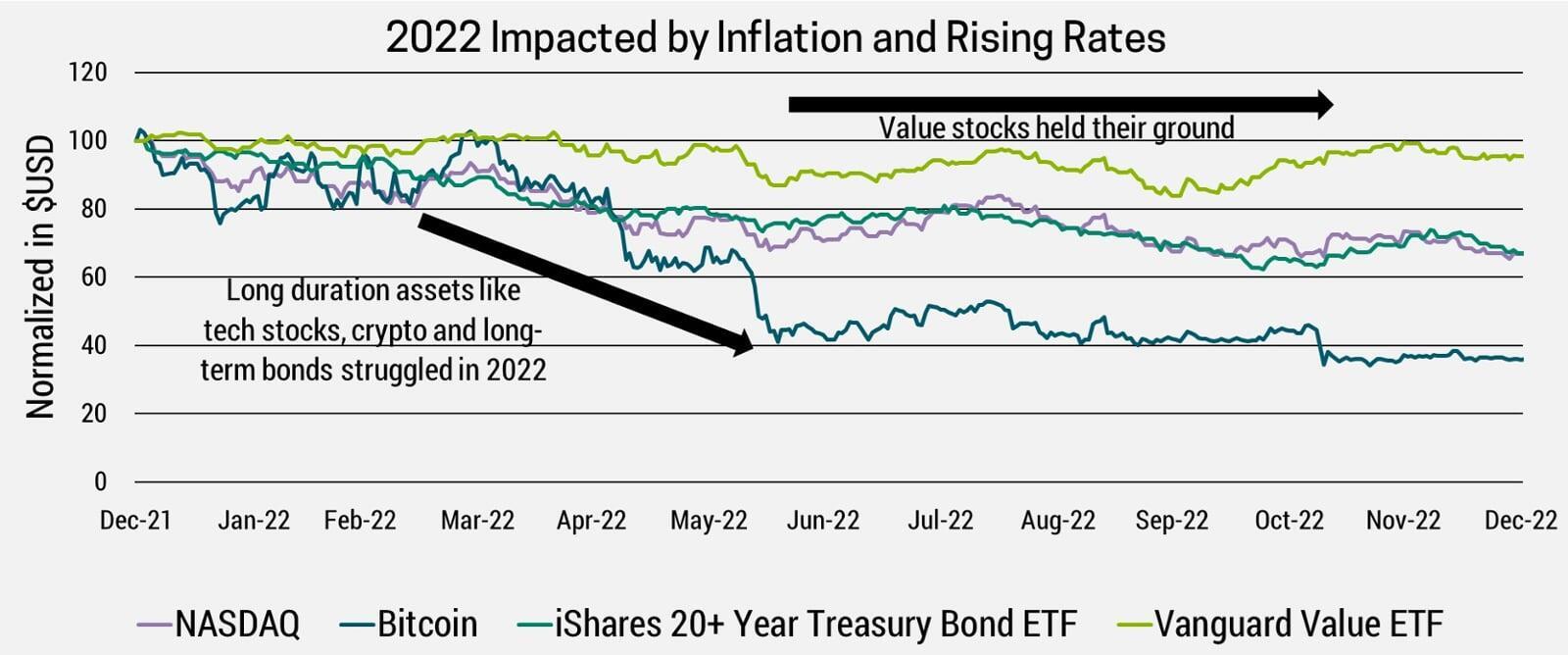

If interest rates don’t get cut as much as markets expect, then valuations will come under pressure once again. We expect the impact to be similar to 2022 albeit smaller in magnitude. Given the similarities, we recommend investors use 2022 as a guide. Assets that struggled in that environment will likely struggle going forward, though instead of the significant losses seen in 2022, we expect modest underperformance from these asset classes. Meanwhile, value stocks which held up in 2022 should be able to grind out modest gains in 2025.

EXPECTATIONS SHAPE MARKETS

Many investors think the Republican sweep will extend the period of American economic dominance, as tax-cuts and de-regulation should be good for corporate profits. History is littered with examples of when the “obvious” bet doesn’t just turn out to be false, but markets move in the exact opposite direction. Take the US energy sector as an example. In 2016 when Trump first took office, he hyped up drill-baby-drill, pipeline approvals and reduced regulation. In that environment, the obvious bet was for energy stocks to take off. Instead, it was the worst performing sector, losing nearly half its value in the 4 years following the 2016 election. Then Biden takes office in 2020, abolishes the Keystone pipeline and pumps hundreds of billions into renewables though the Inflation Reduction Act. Paradoxically, the energy sector tripled while renewables lost two-thirds of their value since Biden won the election.

How is this the case? Markets are forward looking so expectations get priced in well in advance. Expectations for energy were high in Trumps first term and the industry was unable to meet those lofty targets. The reverse was true under Biden. This concept can be applied to today’s lofty expectations for bitcoin, which is up almost 50% since election day. This seems logical given significant crypto donations to the Trump campaign, subsequent promises to de-regulate and installing crypto friendly individuals in key roles (including Paul Atkins as new SEC chair). Investors currently have high expectations for most of the US market. With valuations near record highs, there’s very little room for error, so even a modest disappointment could result in a significant sell-off. With that in mind, let’s look at some ways the US exceptionalism trade might be derailed.

TRUMP'S TARIFF THREATS

A big question on investors minds and a risk to the global economy is whether Trump goes ahead with his threat of substantial tariffs on all imported goods. Anything’s possible so I believe it’s more important than ever to remain properly diversified. That said, we expect Trump is primarily using tariffs as a bargaining tactic and that they will ultimately be smaller and apply to less countries/goods than is currently anticipated. Here’s why:

- Lose-Lose: Markets think the US will win a trade war, but that’s only on a relative basis. Since the US is a net importer it should suffer less, but it will suffer nonetheless. Trump did not campaign on losing, even if Americans lose less than their trading partners. The cost of tariffs will be passed onto US consumers resulting in higher inflation, at a time when inflation is already stubbornly high. For further proof, we can look back at 2018 when the US-China trade war threatened global growth which caused Trump to de-escalate. He was not willing to throw the economy into a recession then and we expect the same this time around.

- Intertwined Markets: In 2023, the S&P 500 generated 28% of it’s revenue from foreign countries. Tariffs will hurt these companies, particularly those with global supply chains like information technology, which generated 59% of it’s revenue from overseas. Retaliatory tariffs make this problem even worse, so there will likely be lots of self-interested companies lobbying for lower tariffs or exemptions.

- Playing the Long Game: While not a major consideration for politicians, investors should consider how tariffs reduce productivity in the long-term. By making foreign imports more expensive, it effectively shelters domestic industry from competition, which is what drives innovation. As a result, industries sheltered by tariffs become dependent and will struggle to compete on the global stage.

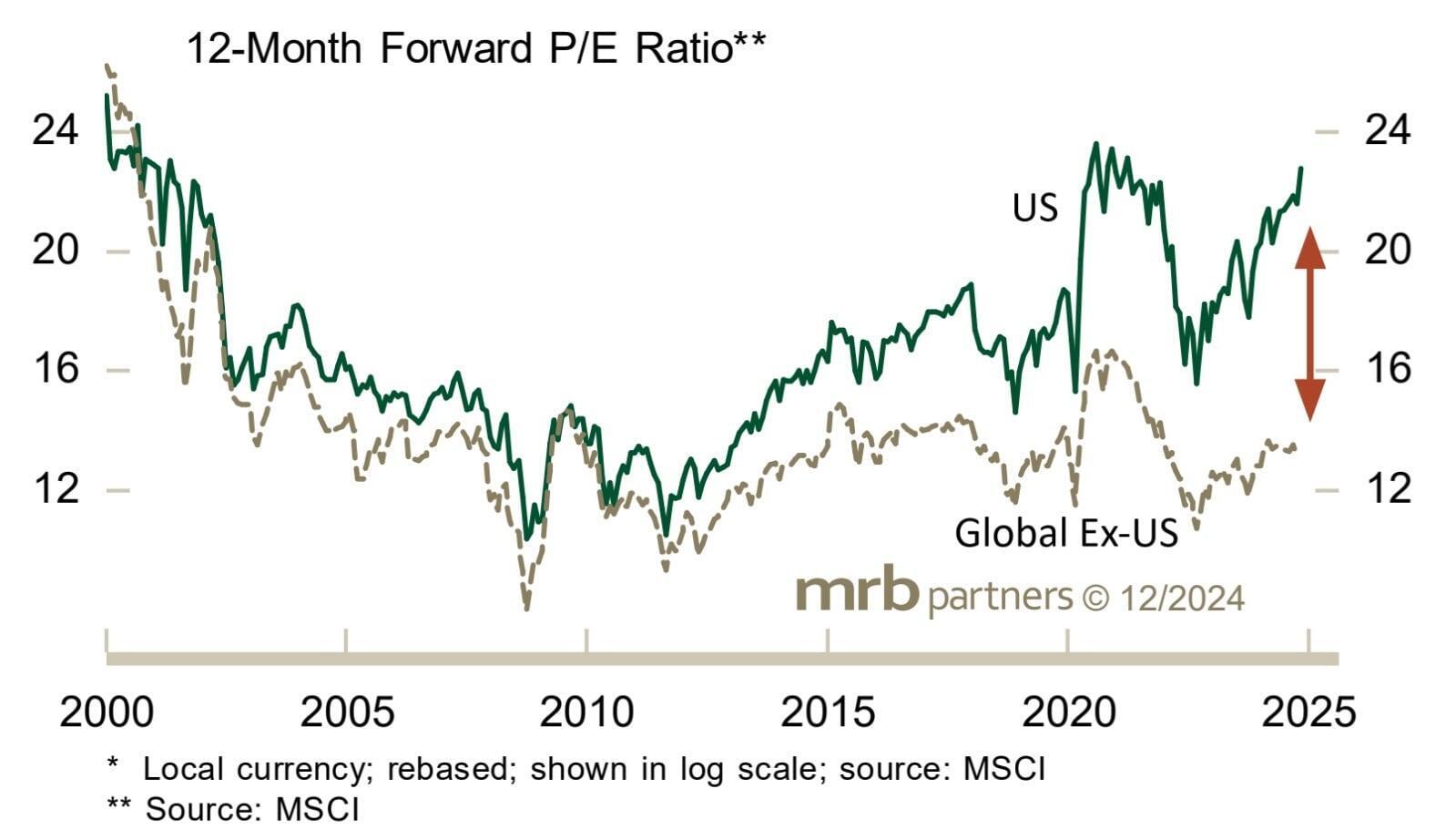

US VALUATIONS

Over the past two years, the US stock market has outperformed. This is partly due to faster profit growth, but even more so because investors are willing to pay more for those profits. In fact, the premium investors are paying for earnings in the US relative to the global market (excluding the US) is the highest its ever been! The US is not just expensive relative to its peers, it's expensive relative to its own history. The forward P/E ratio was only higher for a short time in the late 1990s dot-com bubble and at the beginning of the pandemic when profits collapsed due to economic shutdowns.

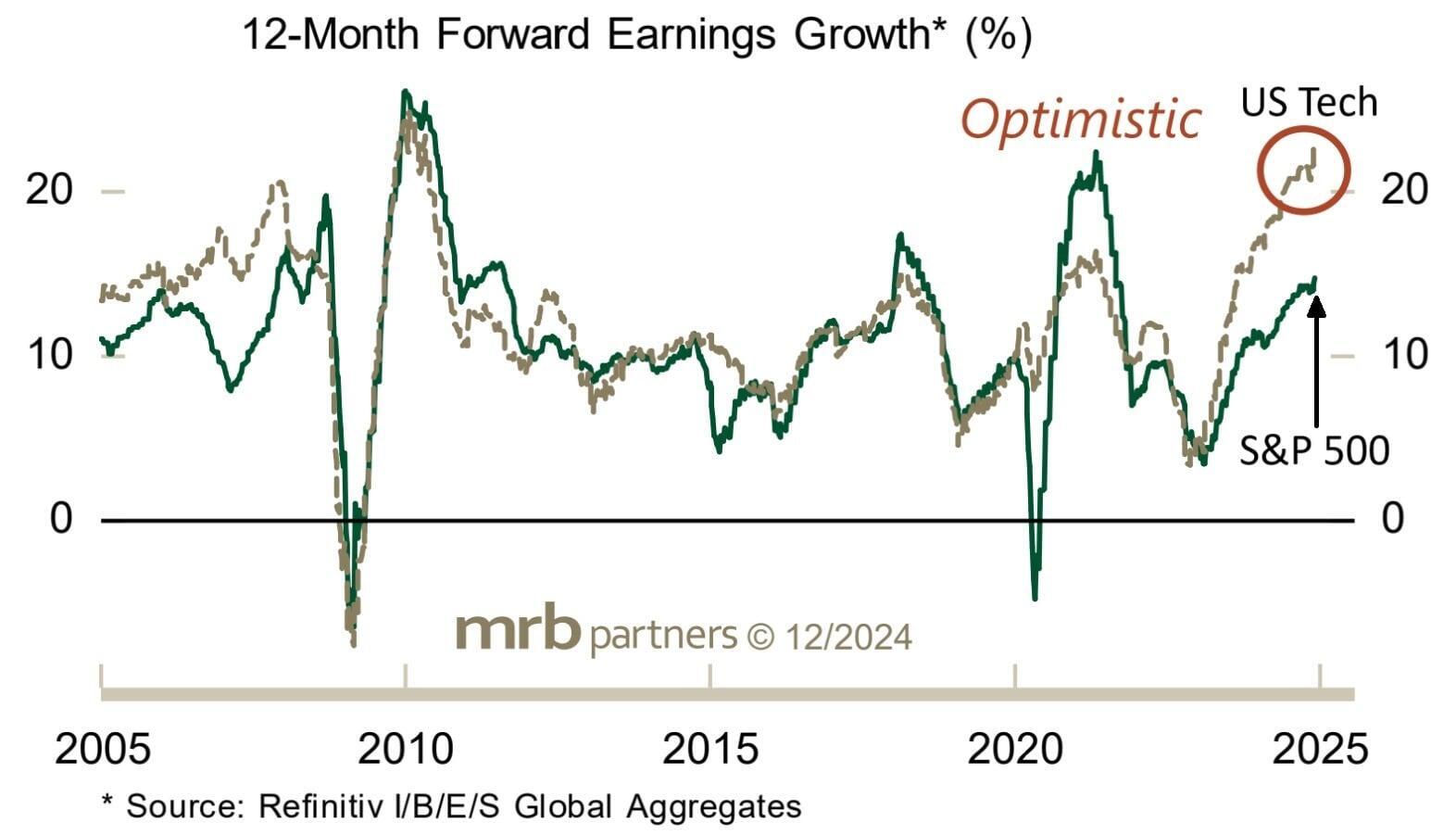

US tech stocks are trading at a forward P/E ratio of nearly 30! That’s crazy given how hard it will be for them to improve on already high revenues, earnings and profit margins. To get a sense of how high expectations are, consider that US tech forecasted earnings growth for 2025 is 23%. That’s an extremely high bar to clear, as it would require the largest companies on the planet to grow their earnings at the fastest pace in 15 years! Even the broad US market earnings growth forecast looks optimistic at 15%.

THE YEAR AHEAD

We will no longer have the tailwind of central bank rate cuts and high valuations have become a problem. Our base case is that valuations decline but earnings growth more than offsets, leading to modest gains for the markets. That said, there are 2 significant risks we are monitoring that could derail markets this year.

- Rising Interest Rates: If the 10-year US government bond yield hits new highs (above 5%), this will be a strong indicator that the market is beginning to worry about sustained long-term inflation and the unsustainable US fiscal path. Specifically, how massive deficits are expected to widen further during an economic boom, which is when prudence suggests you should be running a surplus.

- Policy Risk: With Republicans controlling all 3 branches of government and the majority in the Supreme Court, there is almost no limit to the policies they could pass. They could be market positive, or negative, but with less guardrails it is clearly a risk. Our view on the implications of the US political change has not materially changed since our commentary following the election results. If you haven’t already read it, I recommend checking it out here. Our focus going forward is on the policies enacted by the Trump administration as opposed to the rhetoric.

PORTFOLIO STRATEGY

We continue to favor markets with lower valuations that are less sensitive to higher interest rates and inflation. This includes an overweight in Europe, Japan and Emerging Markets and a corresponding underweight in Canada. Our US exposure is focused on banking stocks, which have reasonable valuations, benefit from deregulation and are insulated from tariffs given that most of their revenue is generated domestically. On the Income side of our portfolios, we favor short-term and floating rate debt, which currently pay higher yields and are less sensitive to rising interest rates.