US Financial Crisis 2.0?

As you may know, last week Silicon Valley Bank (SVB) became the second-biggest bank failure in U.S. history. We wanted to provide you with a brief note explaining what happened, what’s next and how it impacts our portfolio strategy.

WHAT HAPPENED?

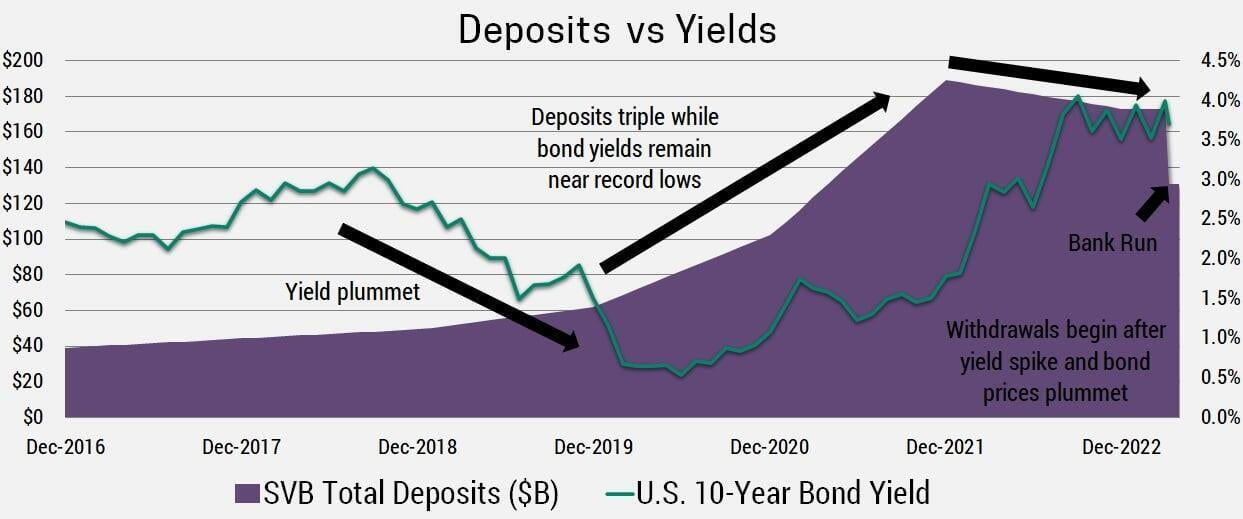

During the pandemic, SVB which primarily deals with companies in the tech sector saw their deposits triple. Then they did what pretty much every bank does when they receive deposits; they keep some on hand for withdrawals, lend some out to borrowers and invest the rest in “low-risk” government bonds. What makes this banking crisis unique is that the main issue which led to SVB’s collapse was losses they experienced on the bond portfolio due to the rapid rise in interest rates. Effectively, deposits flowed in rapidly while interest rates were low and bond prices were high, then as the tech sector began to struggle last year customers began to withdraw when interest rates had risen and bond prices collapsed.

As SVB was forced to sell bonds at a loss to meet the withdrawals, they decided to raise capital from the markets last Wednesday March 8th. Investors panicked causing the share price to collapse which led to a bank run as customers lined up to withdraw over $42B (~25% of all deposits) on March 9th alone! On March 10th, SVB was seized by regulators who have worked with the Federal Deposit Insurance Corporation (FDIC) and Federal Reserve to guarantee that all depositors would be made whole. Furthermore, they have provided SVB and others with a back-stop lending facility and closed New York based Signature Bank, over “systemic risk”. The goal, which we believe these actions have achieved, is to restore confidence in the US banking system in order to prevent further bank runs and minimize contagion risk.

WHAT'S NEXT?

Markets are currently focused on the risks for banks, but we shouldn’t forget about the upside opportunities this situation is creating, specifically:

- Net Interest Margin: Higher interest rates mean bank profit margins should grow, as the gap between what they pay on deposits and what they charge for loans grows.

- Higher Bond Yields: They are generating a significantly higher yield on their bond portfolio’s today than what they were a year ago.

- Cheaper Valuations: The drop in bank share prices provides and attractive entry point for long-term investors.

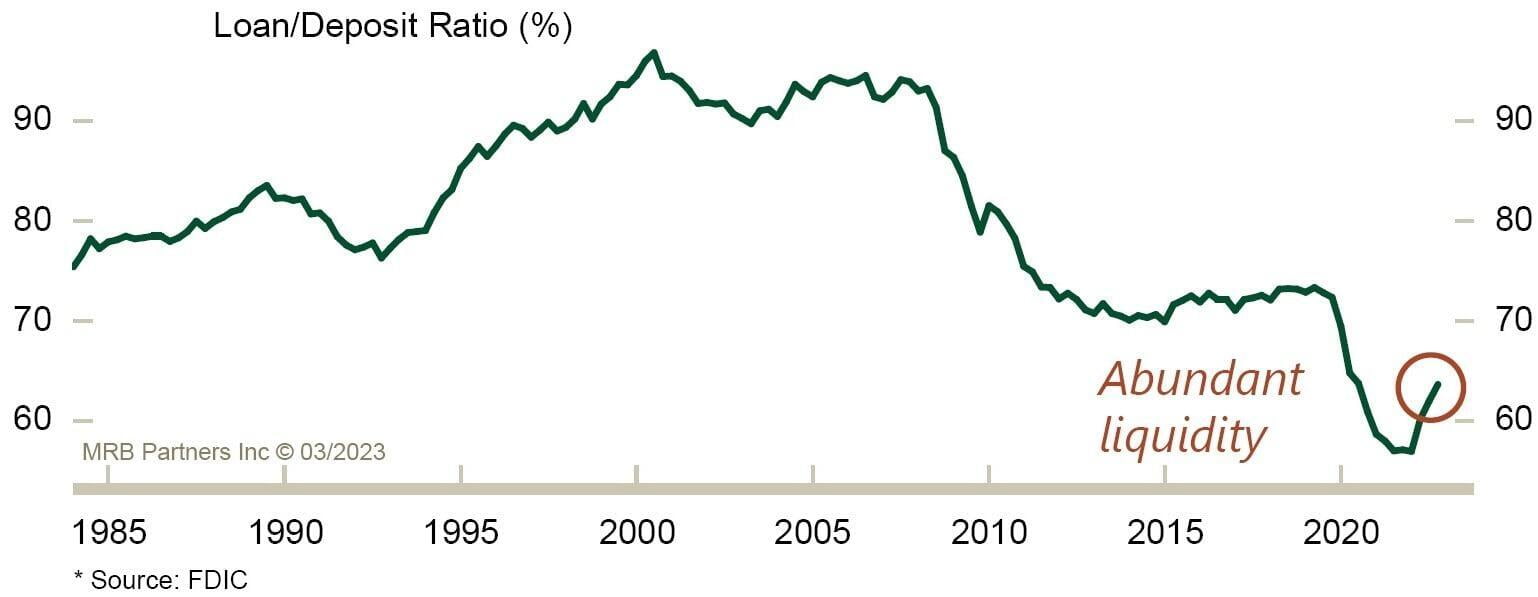

The main risk markets are focused on is total unrealized losses on bank held securities that have ballooned to $620 billion in Q4 2022, but it’s important to put this number in perspective. First, this number has already declined as a result of SVB’s collapse, since the fear it instilled caused yields to drop and bond prices to rise. Second, this represents just 3.2% of total bank deposits of $19.35 trillion. Third, these only turn into actual losses if the banks are forced to sell to meet the demands of customers/creditors, which is why the Federal Reserve acted so swiftly and forcefully to restore confidence by backstopping the US financial system. Even without this backstop, banks themselves are in great financial shape, largely a result of lessons learned during the 2008 financial crisis.

We expect the economy will remain resilient, which means ongoing demand for new loans and limited loan losses. Even if the economy gets worse, banks have been conservative by putting aside large loan loss reserve cushions. These reserves currently total over $200 Billion, which is more than double the value of all non-current loans.

Furthermore, the sell-off has made US bank stocks even more attractive from a valuation standpoint. In fact, relative valuations are very near their post 2008 financial crisis lows. This is yet another example of investors fighting the last war as they expect a repeat of 2008 with contagion risks spreading across the entire financial sector. We believe this is unlikely due to all the reasons laid out in this report, which means this is an excellent buying opportunity. But don’t just take our word for it, as Warren Buffett famously said,

“be fearful when others are greedy, and greedy when others are fearful.”

PORTFOLIO IMPACT AND STRATEGY

For our client portfolios there is good news and bad news. The bad news is our overweight exposure to US banks has hurt performance. We remain very positive on US banks and may add to our position, but this is a stark reminder of why we have broadly diversified portfolios in the first place. No matter how much you like an investment you never know what the future may hold and your best protection is diversification. The good news is, interest rates have dropped dramatically since this crisis began as the Fed is now reconsidering whether to hike rates further. This will relieve some stress on the financial system and likely allow the expansion to continue longer than it otherwise would have. Also, we had a great start to the year due to our overweight in Europe which has cushioned the blow somewhat.

That’s it for now. We’ll be back shortly with our Q1 2023 commentary. If you have any questions, comments or would like to become a client please do not hesitate to reach out. You can email us or schedule a free 30-minute consultation using the link below.