Russia Invades Ukraine

As you know, on February 24th, Russia launched a large-scale military invasion of Ukraine. The news is unfolding rapidly and covered in great detail by news outlets, brave journalists and individuals, so we will not re-hash those details here. Instead, we’ll be focusing on the impact of this crisis on economies and financial markets.

HOW TO INVEST DURING A CRISIS

Whenever events like this transpire, the natural human response is to protect yourself. This leads most investors astray as they sell investments and hold excess cash. This is rarely the correct strategy. Risk and return are inherently linked for all investments, which is why returns tend to be highest when risk is elevated. As such, the correct strategy is often to buy more when markets fall, or to paraphrase Warren Buffet, “be greedy when others are fearful”.

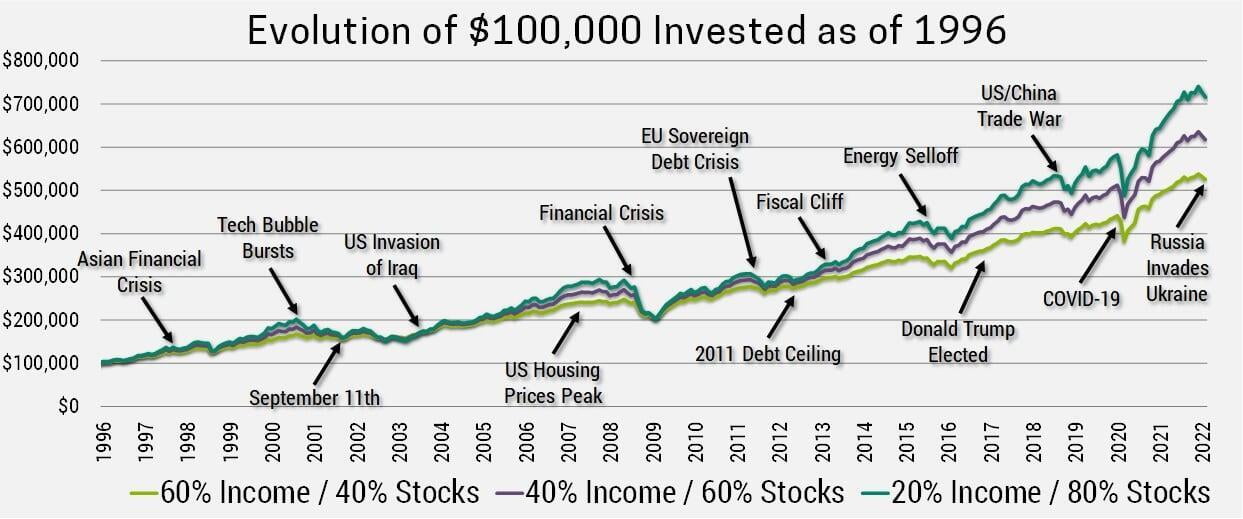

The chart below illustrates this point by showing the benchmark optimized portfolio performance since 1996. Not only does it show how buying during market sell-offs is a lucrative strategy, it also highlights how well a diversified portfolio has protected and grown capital despite the plethora of market events that have taken place.

ECONOMIC IMPACT

As of January 31st, Russia only made up 2.9% of the emerging markets index, so the direct impact on markets has been limited. The global economy will experience some collateral damage from sanctions and trade restrictions, but this too is manageable. The most concerning impact, in our view, is whether China would be emboldened to invade Taiwan. These countries make up over half of the emerging market index, 34% and 19% respectively. Furthermore, Taiwan makes up over 60% of global semiconductor manufacturing, an integral input to almost everything in the modern age.

We were particularly concerned about this when the first round of Russian sanctions were announced last week, as they amounted to a slap on the wrist. Fortunately, sanctions have now been ramped up dramatically with targeted SWIFT restrictions and freezing of the Bank of Russia (BoR – Russia’s Central Bank) foreign reserves. While this is a significant blow, the BoR will remain solvent as a quarter of their foreign reserves are held in Gold, and 12% in Yuan which remains accessible at this time. While they are unlikely to go bankrupt in the near future, the reputational and economic costs to Russia cannot be understated. Here is just some of the fallout:

- Ruble depreciated over 30% vs the USD.

- To protect against further depreciation and shore up their financial system, the BoR more than doubled the key interest rate from 9.5% to 20%.

- The Russian stock market has been closed since Feb 28, but US traded ETFs that track the Russian market are off ~80%. They are also likely to be booted out of most major indexes, forcing further liquidation and severely limiting their long-term investor base and access to capital.

- Multiple countries are going after the prized luxury assets (cars, homes, yachts) of Russian Oligarchs.

- There is a growing cultural boycott as retailers ditch Russian products and companies cut ties.

- Russian athletes have been banned from the IOC, FIFA and UEFA, Formula One and more.

As a result, there is enough fear of economic collapse that Russians have been lining up at ATMs to withdraw cash. We believe Russia will avoid an economic collapse and hyperinflation, but will undoubtedly enter recession and experience significant economic pain. We believe that the severity of these sanctions will be enough to deter China from pursuing a similar strategy in Taiwan. Furthermore, in Autumn this year, the Chinese Communist Party will hold their 20th National Party Congress which is expected to hand Xi Jinping control for another 5 years. It is highly unlikely Xi would gamble his political future by doing something as reckless as invading Taiwan leading up to this pivotal moment.

WHAT'S NEXT?

Ultimately, what happens in the short-term is up to Vladimir Putin. Trying to predict the actions of a madman is difficult, but over the medium-to-long-term we believe the following is likely:

- War is Contained: Russia invaded Ukraine to prevent it from joining NATO and becoming more closely aligned with the West. We don’t expect the war to extend westward beyond Ukraine as an attack on a NATO member, which share a mutual defense treaty, would be suicidal. The NATO military budget is ~17X larger than Russia’s, and that’s before their economy was devastated by sanctions. Furthermore, the US and Russia have 73 years of experience avoiding direct conflict. Moving south is equally unlikely as it would bring them closer to conflict with China, one of the last major economies still willing to do business with the Russians.

- Oil and Gas: With the US and EU already struggling with high energy prices and overall inflation, they are unlikely to sanction Russian Oil and Gas. The Russians are equally unlikely to cut off exports as their economy is already in shambles and without Oil and Gas we forecast the BoR would be effectively bankrupt in 1-2 years. Over the long-term the world will diversify away from Russian energy and high costs will accelerate the transition towards renewables.

- Putin is Finished: This act of aggression will prove to be the beginning of the end for Vladimir Putin. The blood split and economic pain experienced by Russian citizens rests squarely on his shoulders and will eventually fuel a domestic revolt. Unfortunately, as Putin sees the walls closing in on him, he is likely to become even more brutal and violent.

- Economic Growth: We do not expect a meaningful hit to global growth. That said, the outlook has become far more uncertain and requires close monitoring of business/consumer surveys and spending to determine if negative headlines affect decisions and therefore become self-fulfilling.

PORTFOLIO IMPACT AND STRATEGY

For our client portfolios there is good news and bad news. The bad news is our overweight exposure to international and emerging markets, who share larger economic ties with Russia and Ukraine will receive more collateral damage from sanctions, trade restrictions and higher energy prices. As is typical during times of uncertainty, investors flee to the perceived safety of the US dollar and US assets, which we are underweight. Ultimately this will turn out to be short-sighted, as war and sanctions are likely to make the inflation problem worse. The good news is, we have already positioned portfolios for an environment of higher inflation. This benefited us greatly leading up to this crisis and should benefit again as the immediate shock of recent events subsides.

Why does this make inflation worse? It obviously has the immediate impact of rising commodity prices. Russia accounts for 11% and 14% of global oil and gas production respectively. Russia and Ukraine together produce nearly a quarter of the world’s wheat. Any uncertainty around production or sanctions gets passed on to consumers in the form of higher costs and therefore higher inflation. Over the long-term, a world with more geopolitical uncertainty will force companies to diversify their supply chains. It will simply be too risky to source from a single country and this added complexity leads to higher costs. In short, businesses will shift their focus from efficiency to resiliency.

Given all the uncertainty and how quickly events are unfolding, we will be monitoring the situation closely. If it appears this crisis will in fact derail the economic expansion, we will adjust our investment positioning, but this is not our base-case scenario. If you have any questions, comments or would like help managing your investments, please do not hesitate to reach out. You can email me or schedule a free 30 minute consultation using the link below.

Kind Regards,

Kenton Shouldice, CFA

Founder and CEO