Inflation Forces Central Bank U-Turn

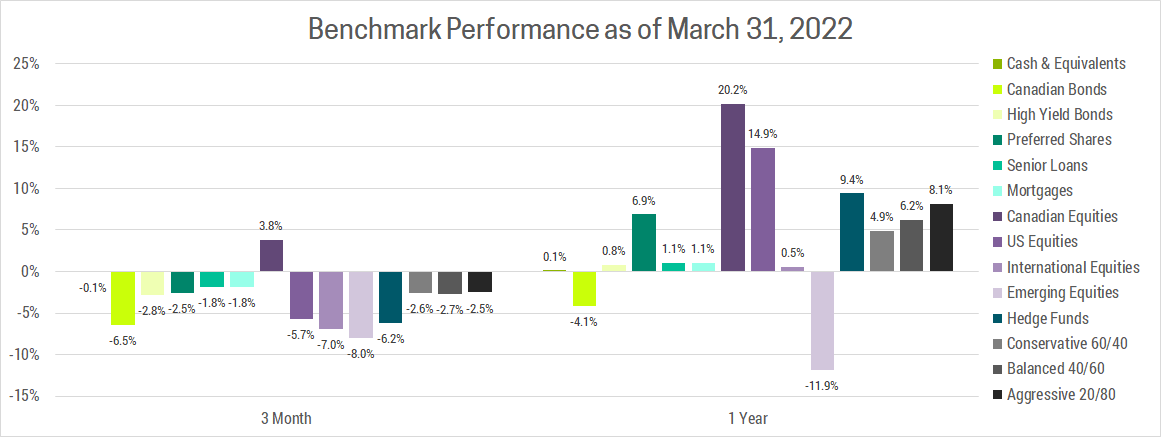

Markets have had an exceptional run since the pandemic lows, in which nearly every major asset class posted significant gains. In sharp contrast, this quarter saw nearly every major asset class fall. Fortunately, our client portfolios outperformed due to our maximum underweight in bonds and growth stocks. These have been amongst the hardest hit and while their weight in our benchmark is modest, they represent the largest asset classes in a standard 60/40 portfolio. As a result, the average investor, as represented by Vanguard’s Balanced ETF Portfolio (Ticker: VBAL) was down about 5% this quarter.

LOW INTEREST RATES AND ASSET BUBBLES

Investors have gone on a wild ride these past few years and to find out what comes next, we’ll need to look back and analyze how we got here. In March 2020, which feels like a lifetime ago, the pandemic began which caused significant economic shutdowns and forced governments to introduce record amounts of stimulus. Central banks slashed interest rates and began buying up debt to push borrowing costs down. While this was necessary to keep the economy running and shore up consumer balance sheets, it had the added consequence of driving up asset prices.

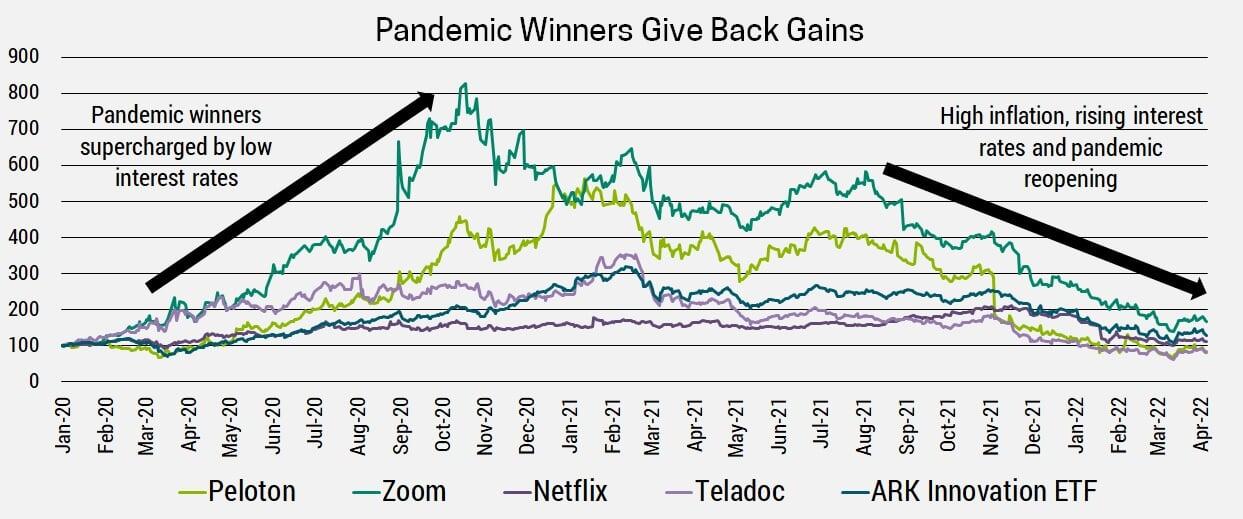

This effect was felt most acutely in assets that derive more of their value from the distant future. Why is this? Investments are fundamentally valued based on the present value of the earnings and cash flow they generate. When interest rates fall, the future is discounted at a lower rate, increasing the value of long-dated assets. Growth stocks like Peloton, Netlfix, Zoom, Teladoc, and more that were already benefiting from the pandemic switch to remote living saw their shares rocket higher. Cathie Wood’s flagship ARK Innovation ETF, which invested heavily in these types of companies saw 350%+ returns in less than a year from it’s March 2020 lows.

Outside of markets, low interest rates have allowed governments to pay for massive deficits. Corporations raised vast amounts of capital as a record 951 companies went public (IPO) in the US last year, nearly double the previous record set at the height of the tech bubble. Homebuyers have been able to afford huge mortgages as home prices soar.

In short, low interest rates have fueled asset bubbles so rising rates should deflate them.

The current environment is the polar opposite of what fueled these asset bubbles. We now live in a world reopening from the pandemic, experiencing strong economic growth, high inflation and rising interest rates. We’ve already seen the carnage in former pandemic winners as they gave back all their gains. Next, we expect the real economy will begin to unwind some of it’s excesses.

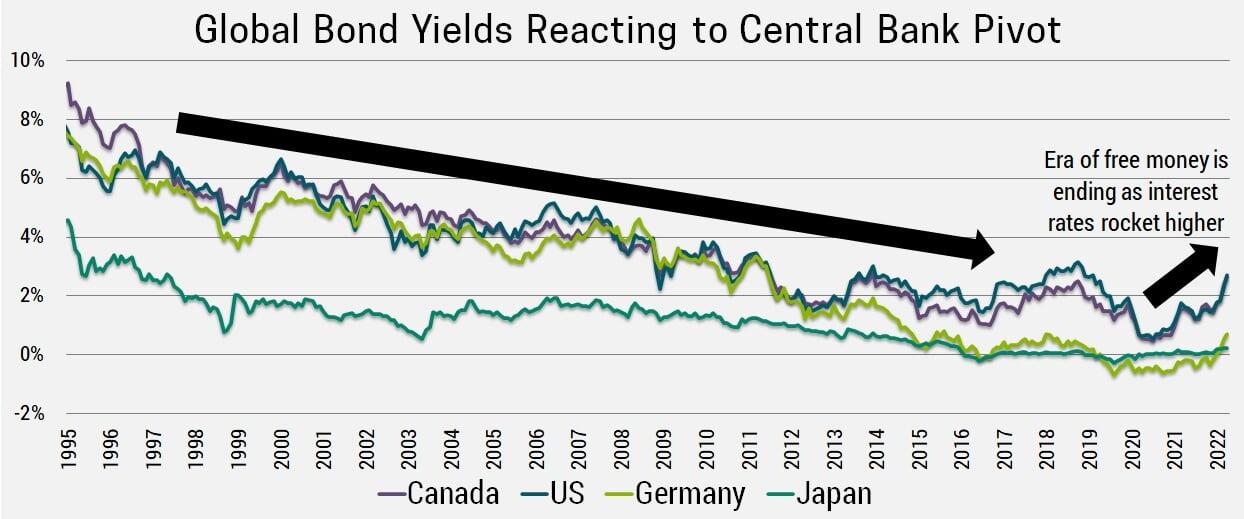

THE ERA OF FREE MONEY IS ENDING

In our Q2 2020 newsletter we wrote, “Once we get a vaccine, we expect demand will come roaring back. Meanwhile, supply could be slow to catch up given the massive damage done to supply chains during this crisis and the ongoing de-globalization trend. As a result, inflation seems likely”. This was a non-consensus view as most investors feared deflation given the massive drop in demand as economies shut down. Once it became clear a depression would be avoided and inflation began to rear its ugly head, investors argued it would be “transitory”. A one-off result of pandemic supply chain disruptions that would ease over time.

The Federal Reserve reinforced this viewpoint by continuing to stimulate the economy and as recently as last March projected their first rate hike in 2024! What a difference one year can make. The Fed just hiked rates this month, 2 years ahead of schedule, and is forecasting a fed funds rate of just under 3% by the end of 2023. The Bank of Canada and many others are following suit, believing this will be sufficient to cool demand and tame inflation.

This would be welcome news for consumers, but investors fear this drastic increase in interest rates will restrict growth too much and lead to a recession. Central banks have put themselves in a difficult spot. They must raise interest rates enough to quell inflation, but not too much as to cause a recession. Meanwhile, the war in Ukraine and ongoing regional covid flare-ups creates further uncertainty while muddying the data central banks rely upon to make difficult decisions. As a result, investors should expect ongoing market volatility in the months ahead.

UNCERTAINTY AND VOLATILITY

In times of uncertainty, it’s important for investors to look through the noise and focus on where we’ll be a year or two from now. The pandemic is well on its way to becoming endemic. This trend will continue, despite periodic flare ups from new variants and easing restrictions. The war in Ukraine is another risk. To the surprise of many Ukraine has put up a heroic fight, forcing the Russian invasion into an apparent stalemate and in some cases, retreat. This increases the likelihood of a temporary ceasefire, which could eventually lead to a lasting peace agreement. If you missed our special report on the war, we recommend checking it out here.

An economic slowdown is an added risk, but we believe it’s premature for investors to begin positioning for the next recession. After all, the Fed has only hiked rates once so far and it will likely take 2 years before they reach levels we view as restrictive. Furthermore, we believe the market is underestimating underlying economic strength, which is extremely robust as evidenced by the tight labour market and strong consumer balance sheets. The current fears of an economic slowdown leading to a recession are overblown. We’re simply seeing growth moderate from extremely elevated levels. In summary,

fear surrounding the pandemic, war and economic slowdown are likely to recede over the coming year. What will remain, is rising interest rates due to stubbornly high inflation.

INFLATION HEDGES

Some view gold as the best inflation hedge, as we have on occasion, but rising interest rates will be a consistent drag on prices. This is because investors searching for a safe haven, will increasingly view the higher yields on bonds as an opportunity cost of holding gold. Coupled with relatively high starting prices, we don’t see much upside for the yellow metal. Commodities is another traditional inflation hedge, but the rally is already very extended leaving relatively little upside.

Instead of owning commodities directly, we prefer to own commodity producers. Canada is a prime example of this and has been amongst the top performing equity markets this year. We’ve benefited from rising commodity prices as a result of the war while being insulated from its direct effects due to our limited trade and significant geographic distance from Russia. Unfortunately, we believe this relative outperformance will be short-lived as oil prices should trend lower over the coming year due to:

- Possible ceasefire in Ukraine

- Rising U.S. production

- Release of US strategic petroleum reserves

- Significant spare capacity in Saudi Arabia

- Possible nuclear deal with Iran

These would all add meaningful supply to a currently tight market. Furthermore, while demand is relatively price insensitive over the short-term, the longer prices remain high the bigger the incentive to reduce consumption by transitioning towards renewables. This is why the famous saying in commodity markets is:

“the cure for high prices is, high prices.”

This should not be misconstrued as a reason to sell commodity producers, after all many of them are extremely profitable even if prices drop well below current levels, as we expect. We’re simply stating that investing in the underlying commodities may not be a great inflation hedge at this juncture.

PORTFOLIO STRATEGY

Fears over the pandemic, war, and moderating economic growth will subside, but inflation is likely to remain as the biggest risk for investors. Unfortunately, protecting against inflation is easier said than done. Traditional inflation hedges like commodities and gold face headwinds, leaving investors with limited options.

We continue to prefer Europe, Japan and Emerging market equities given their lower valuations and modest regional inflationary pressures. This allows their central banks and governments to remain relatively more accommodating (ie. Raise interest rates slower) than the US where inflationary pressures are highest. They have been disproportionately affected by the war in Ukraine, but are currently oversold and would be significant beneficiaries of a ceasefire, which we believe is increasingly likely. They also suffered more during the pandemic given their larger exposure to cyclical sectors, particularly trade and tourism. As the pandemic subsides and these sectors fully reopen, we expect relative outperformance.

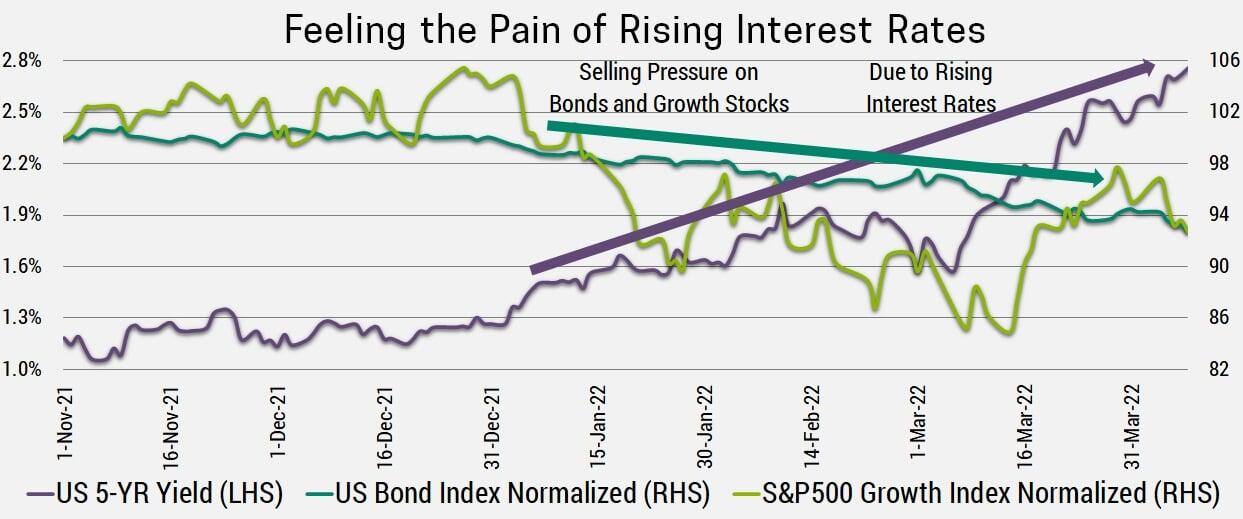

We continue to avoid long-term bonds and growth stocks, which are at greatest risk in a high inflation and rising interest environment. Remember that investments are fundamentally valued on the earnings/cash flow they generate over time. When these occur in the distant future, they must be discounted back to the present using prevailing interest rates. As interest rates continue to rise, assets that generate proportionately more of their value from the long-term will be most heavily impacted. This impact is exacerbated by low starting yields on bonds and high starting valuations on US growth stocks.

If you have any questions, comments or would like to become a client please do not hesitate to reach out. You can email me or schedule a free 30 minute consultation using the link below.