Canada's Housing Affordability Crisis

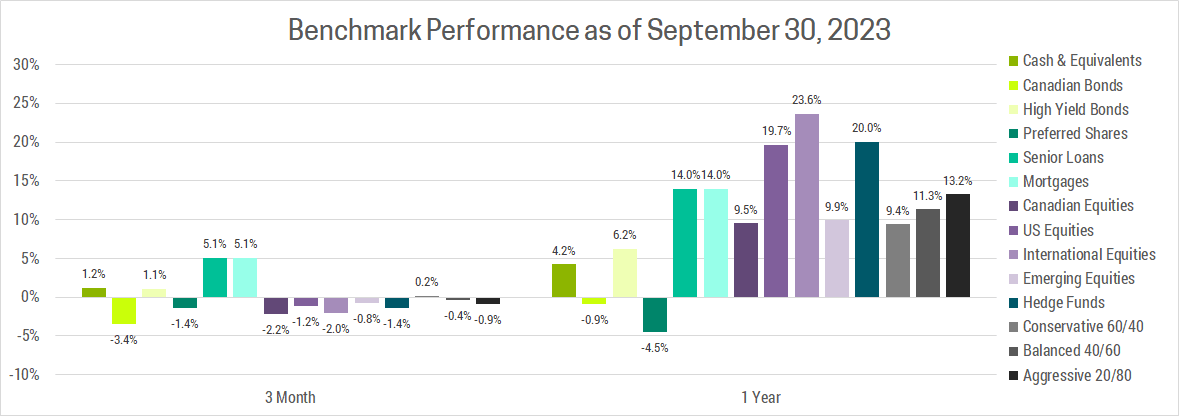

Similar to Q2, equity markets were largely range-bound in Q3, as positive economic news was offset by stronger inflation and therefore higher interest rates. You can see the impact of this most acutely for Bonds, which were amongst the worst performing asset class on a 3 month and 1 year basis. To understand why, imagine you buy a bond yielding 3% and then interest rates jump to 5%. Other investors would not want your bond when they can simply buy a new one paying a higher rate, which means you must sell at a discount. The longer the time to maturity, the greater the discount, which is why long-term bonds (25+ year maturities) have lost over half their value over the past 3 years.

RANGE BOUND MARKETS

Our overall economic view has not changed materially from last quarter, in that we expect the global economy will prove resilient, leading to sustained inflationary pressure and therefore persistently high interest-rates. In this environment, markets are likely to remain range-bound as good news on the economic front morphs into fear of sustained inflation and high rates. Investors must be patient, staying invested in a diversified portfolio which focuses on shorter-duration assets that are less impacted by high interest rates. This will protect investors purchasing power from inflation over the long-term, while paying a respectable ~4% in dividends/interest in the near-term.

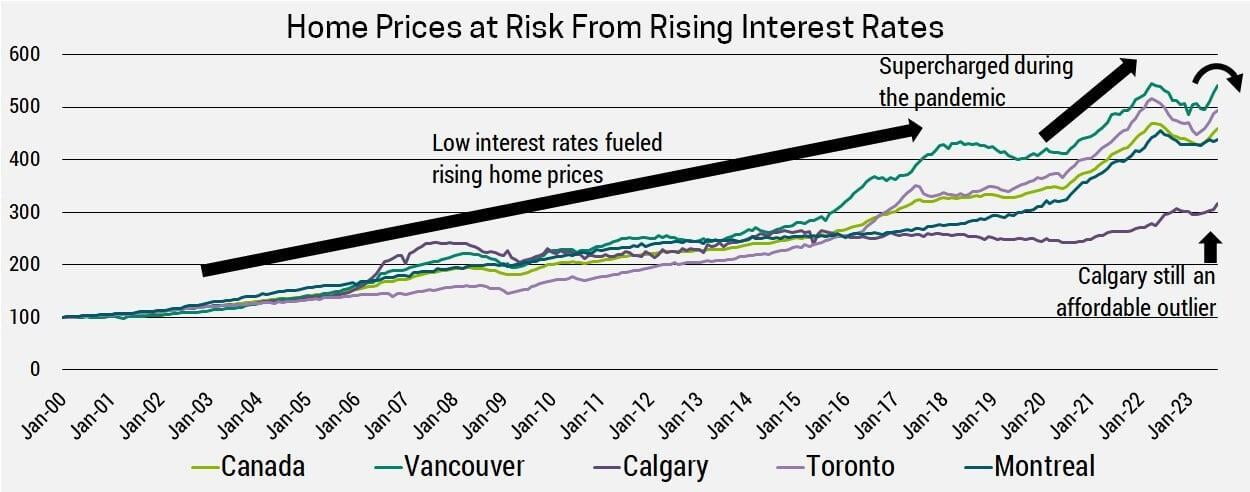

Given how little has changed economically, we wanted to take this opportunity to dive deep into the worrying state of Canadian real-estate, which is particularly at risk due to higher-for-longer interest rates. This is a topic we covered in our Q2 2022 newsletter, “Canadian Housing Flashes Warning Signal”, but a lot has changed since then. The Bank of Canada (BoC) hiked interest rates from 1.5% to 5%, housing sales are down, and prices have cooled in the most over-heated markets. This cooling gave way to another rally in the spring, as the BoC paused rate hikes, which led to optimism we would see rate cuts soon. This hope has recently faded, leading to renewed selling and likely another decline in prices.

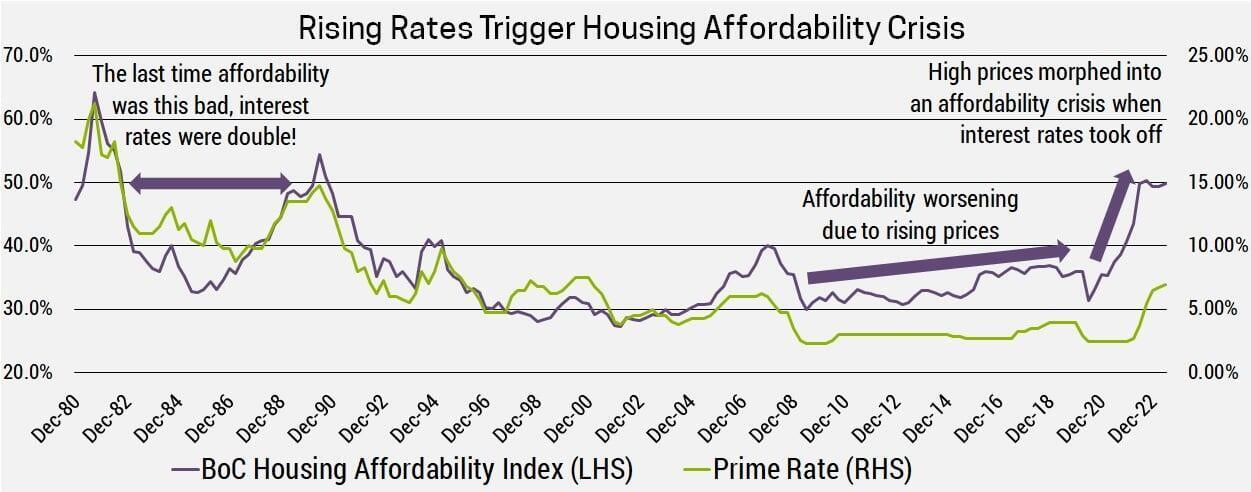

AFFORDABILITY CRISIS

This term has been thrown around a lot recently, so let’s break it down. Affordability isn’t just the price you pay, it’s also the interest rate on the debt. While prices have been steadily creeping up for decades, it was the sudden spike in interest rates that has turned this into a full blown crisis.

The impact of this affordability crisis is wide-spread. First-time home buyers will struggle to afford properties, or even get approved for a big enough mortgage. Stress-tests rules require borrowers to qualify at the higher of 5.25% and their mortgage rate + 2%. With a CMHC insured 5-year mortgage currently at 5.49%, that means borrowers must qualify based on 7.49%! While this might seem ridiculous because interest rates aren’t likely to rise another 2%, the real problem is they don’t have to. At current rates we’re already seeing a growing share of homeowners unable to service their existing mortgage.

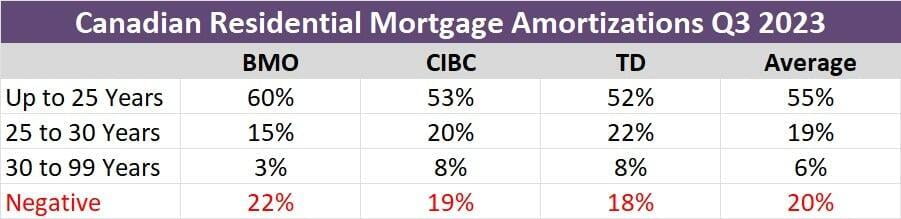

TD, BMO and CIBC reported that ~20% of all outstanding mortgages are now negative amortization, meaning borrowers are unable to make the “interest-only” portion of their payments. The residual is then added to the principal, extending the loan in order to avoid default. This is essentially a stop-gap measure to avoid a wave of defaults, as it relies on interest rates falling dramatically. If they don’t (as is our view), then this problem will only worsen as more and more fixed-rate mortgages come up for renewal. Currently only 40% of mortgages have seen their payments increase as a result of higher interest rates, but this will rise to 100% by the end of 2026.

Just 18 months ago there were no mortgages with terms longer than 30 years, today that figure is 26%. If rates don’t fall, the rising proportion of Canadians with negative amortization mortgages will be forced to sell, default or be saddled with debt they can never repay. Banks could be on the hook for significant loan losses, as only 35% of outstanding mortgages are currently CMHC Insured. This figure drops to 22% for loans issued from April 2020 to April 2022 as real-estate prices reached nosebleed levels. To be clear, these borrowers had to come up with a 20% downpayment to avoid CMHC insurance, but their equity could quickly get wiped out as prices fall and debts rise on the growing share of negative amortization mortgages.

WHERE DO WE GO FROM HERE?

“If something cannot go on forever, it will stop.” - Herb Stein

I don’t think anyone believes a situation where families can’t afford to buy and owners can’t afford to stay is a tenable solution, but there is widespread belief that this can continue. This view tends to be based on 3 core hopes, none of which are credible when you look closely.

HOPE 1: INTEREST RATES WILL DROP

In newsletters as far back as Q2 2020, we have discussed how the economy has entered a more inflationary period. The US and Eurozone, the globes two largest consumers spent the last decade and a half paying down debt, which is why their economies have been so resilient in the face of higher rates. In over-indebted Canada, our economy shrank 0.2% in Q2 (looks even worse on a per-capital basis, that factors in population growth) as consumers spend more of their paycheques on housing, leaving less available to spend on everything else.

While a recession in Canada typically means interest rate cuts, the BoC is unlikely to do so as it would result in a falling CAD. All else being equal, investors would rather own a currency which is paying them a higher interest rate. Furthermore, if the US and Eurozone avoid recession (as we expect), this sustains global inflationary pressures and likely results in even higher rates in those countries. Canada, which is already straining under current rates, will be unable to keep pace and as the interest rate differential widens investors will flee to other currencies resulting in a falling CAD. As this happens it raises import costs thereby further stoking domestic inflation.

As such, the BoC has the unenviable position of choosing between the housing market and inflation. Their mandate is inflation, but I find it hard to imagine they would throw the housing market, and with it the Canadian economy, under the bus in the dogged pursuit of 2% inflation. Instead, I think they will try to spread the pain by keeping interest rates high enough to support the CAD and bring inflation down, but low enough to keep the housing bubble from bursting (more of a slow decline). This could entail another 10-20% near-term price correction, followed by 5-10 years of stagnant prices so incomes have a chance to catch-up to prices and eventually restore affordability.

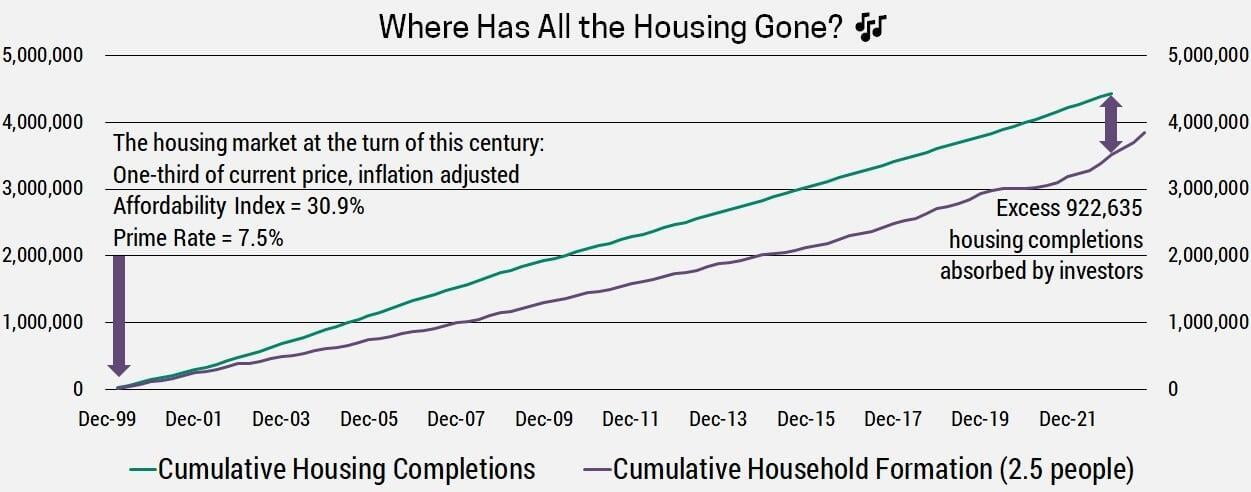

HOPE 2: LACK OF HOUSING SUPPLY

It is true that inventory (unsold homes on the market) is currently near historically lows (though it is rising). Unfortunately, the reason is that a significant portion of housing supply has been scooped up by investors (domestic and foreign), who were attracted by the perceived stability of Canadian housing, strong historical price performance and record low borrowing costs. As these trends begin to reverse, we expect investor demand will soften and many will begin to sell their investment properties.

With the lack of readily available data for the Canadian housing market, how do we know the role investors have played? Well, we can see that housing construction has outpaced household formation (2.5 people her household) over the past few decades. As such, the most likely conclusion is that investors made up the difference.

HOPE 3: DEMAND FROM RECORD HIGH IMMIGRATION

It’s unclear if the government continues with its ambitious immigration targets, given the growing pressure on rents and from political rivals. Even if they do, our friends at MRB Partners hammer the point home by asking 2 simple questions:

- “Is Canada planning to attract only wealthy immigrants that can afford homes at current sky-high prices?” This is unlikely, especially when you consider that historically Canadians who moved here make 20% less than those that were born here (The Conference Board of Canada, 2015)

- “Is Canada able and willing to create jobs for new immigrants that pay far more than existing Canadians currently earn?” This is equally unlikely, especially considering that Canada could soon enter a recession, which typically leads to rising unemployment and stagnant wages.

In short, while new immigrants may aspire to own homes, they will find the current market even less affordable. Demand is not simply how many people want to buy, but how many can afford to buy.

HOUSING OUTLOOK AND ADVICE

The outlook for Canadian real-estate varies widely by Province. Alberta, which avoided much of the run-up in prices and is supported by higher incomes, should continue to fare better than expensive markets in BC and Ontario. Properties in places that are attractive to retiree's are likely to hold up better, as downsizing baby boomers are more likely to be all-cash buyers. Meanwhile, properties that appeal to first time homeowners could drop significantly as expensive mortgage rates eat into interested buyers purchasing power.

Here's my advice for Canadians, depending on their circumstances:

Buyers

If you're looking to get in, be patient. I'm not saying do not buy, but you absolutely do not need to FOMO into the largest financial decision of your life. Wait for the right property and don't be afraid to offer far below asking price for houses that have sat on the market for months.

Homeowners

If you can't afford your mortgage payments at prevailing interest rates (5.5% on a 5-year fixed) then you need to consider downsizing or selling assets. You won't be bailed out by lower interest rates. If your mortgage is already over 6% and you have extra savings, consider putting those on the mortgage as well. Lastly, if you’re in retirement or are otherwise in the draw-down phase of your financial life, then it’s worth considering downsizing.

Investors

If you own multiple rental properties, you’ll want to calculate the rate of return they generate. Start with rent, then subtract all expenses including property tax, home insurance, utilities, maintenance, mortgage interest adjusted to 5.5% (if you're locked in lower that’s great, but it's going to renew sometime), lost rental income when vacant, condo fees, property management/your time, etc. This determines your profit, which you divide by the equity in the property to calculate return-on-equity. This can be compared to other investments to decide if you’re better off keeping or selling the property.

GIC's are paying ~5.5%, so you shouldn't be taking risk in a rental property if you're not getting at least this. While GIC rates may come down, the fundamentals of a balanced portfolio suggest 7-8% is a reasonable long-term average from here. These returns can be tax-sheltered inside RRSPs/TFSAs if you have room, and even if you don’t these investments generate tax-efficient eligible dividends and capital gains (unlike rental income which is taxed at your top marginal bracket).

There’s lots to consider, so if you need help please reach out. We still offer complimentary 30 minute consultations, which you can book through the link below.