US Election Implications

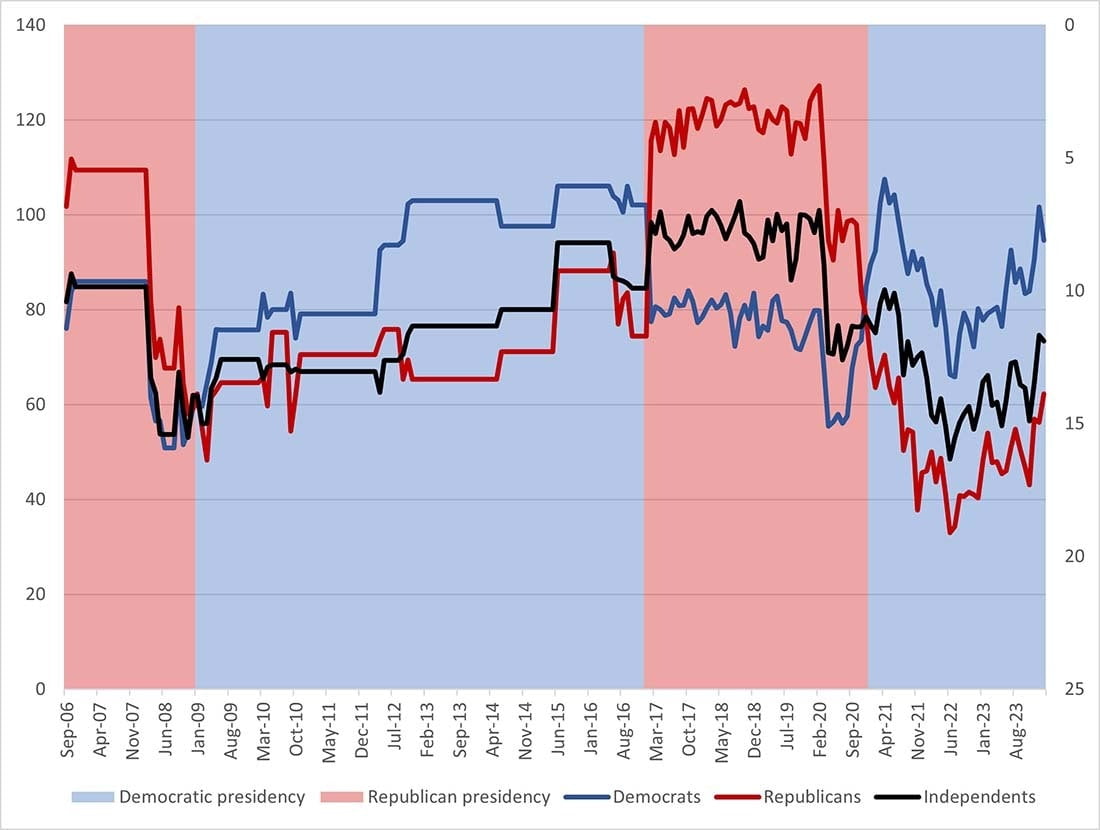

Before diving into the election, it’s important to recognize that politics is not a significant driver of market returns. Politicians get way too much credit when the economy is strong and too much blame when it’s weak. Furthermore, our view is clouded by our own political affiliation. The chart below shows US consumer sentiment broken down by political affiliation. It shows that how people feel about the economy has more to do with whether “their” party is in power than how the economy is performing.

Emotions tend to cloud our judgement and politics plays off our emotions more than anything else. To be a successful investor, you must instead focus on the fundamentals including valuations, growth rates, margins, interest rates and inflation. These matter far more to markets in the long-term and have the added benefit of being more stable and predictable.

US ELECTION IMPACTS

While the election results appear similar to 2016, the economic environment is different in 3 key ways that we believe will shape markets going forward:

- Valuations: US markets are 40% more expensive relative to earnings than they were in 2016.

- Inflation: The US economy has far more inflationary pressures, as we have discussed at length. This will lead to sustainably higher interest rates going forward.

- Debt and Deficits: When Trump was first elected, the prior year saw a budget deficit of $440 Billion while this time he’ll be handed a projected $1.83 Trillion annual deficit.

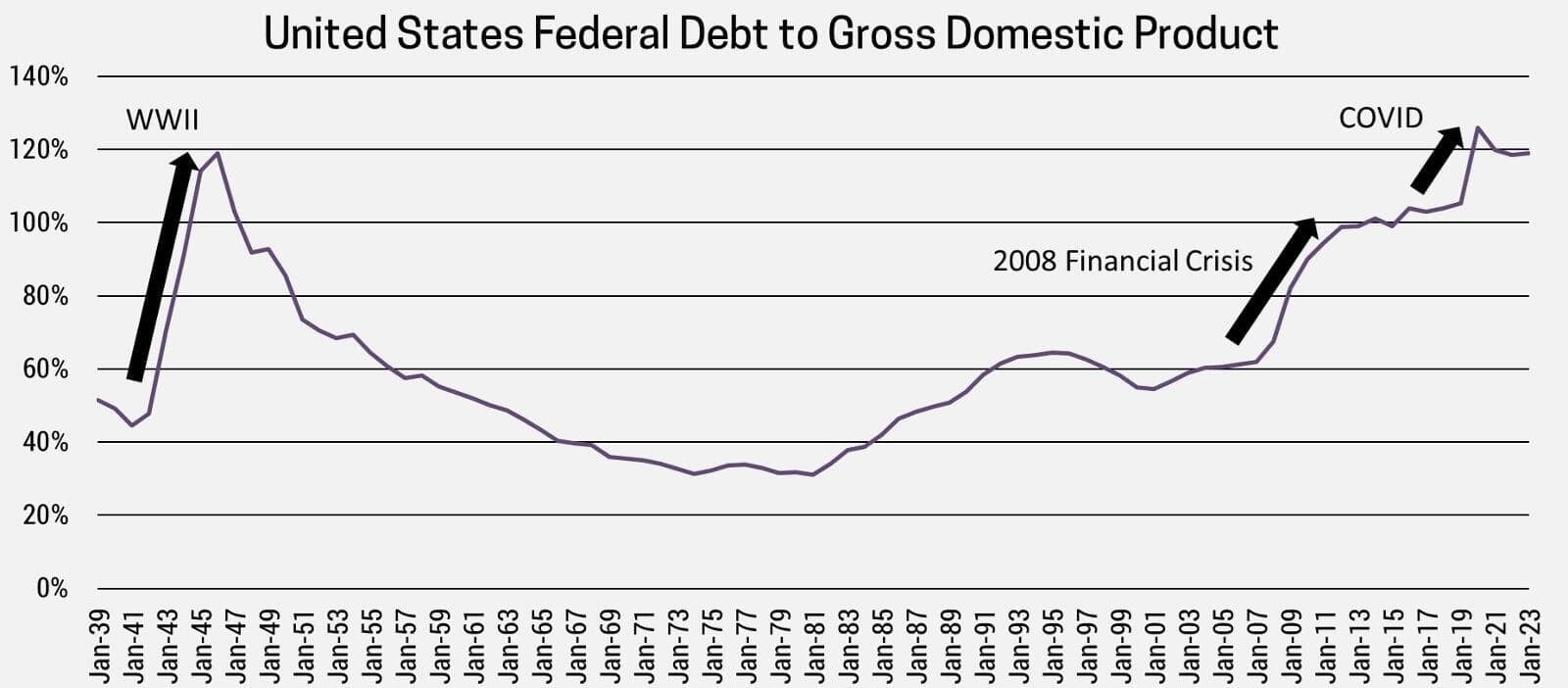

US Government total debt now stands at $36 Trillion, which is high but still manageable given the size of their economy. After all, debt was this high following WWII and over the following decades it was paid down. The real issue is the rising interest rates on the debt and the deficit trajectory. The Congressional Budget Office (CBO) is currently forecasting $32 Trillion in additional deficits over the next decade. That assumes the 2016 Trump tax-cuts expire, which he campaigned on renewing and would add another $5 Trillion to the debt.

This means total US debt would more than double over the next decade!

For the debt-to-GDP to remain stable (let alone decline), Trump will need to dramatically cut spending, raise taxes or grow the economy at 7.2% per year, which is basically impossible. Prudent investors should assume a combination of these factors, while positioning for higher US government debt and interest rates.

ECONOMY

Trump plans to pay for the tax cuts by implementing tariffs. These are paid by US importers who will ultimately pass the cost onto consumers resulting in higher prices. As such, our view that inflation will remain above target has strengthened given last night’s result. De-regulation and tax cuts will be pro-growth, so our view that the economy will remain strong has also been reinforced. On the negative side, higher inflation and a stronger economy will lead to higher interest rates.

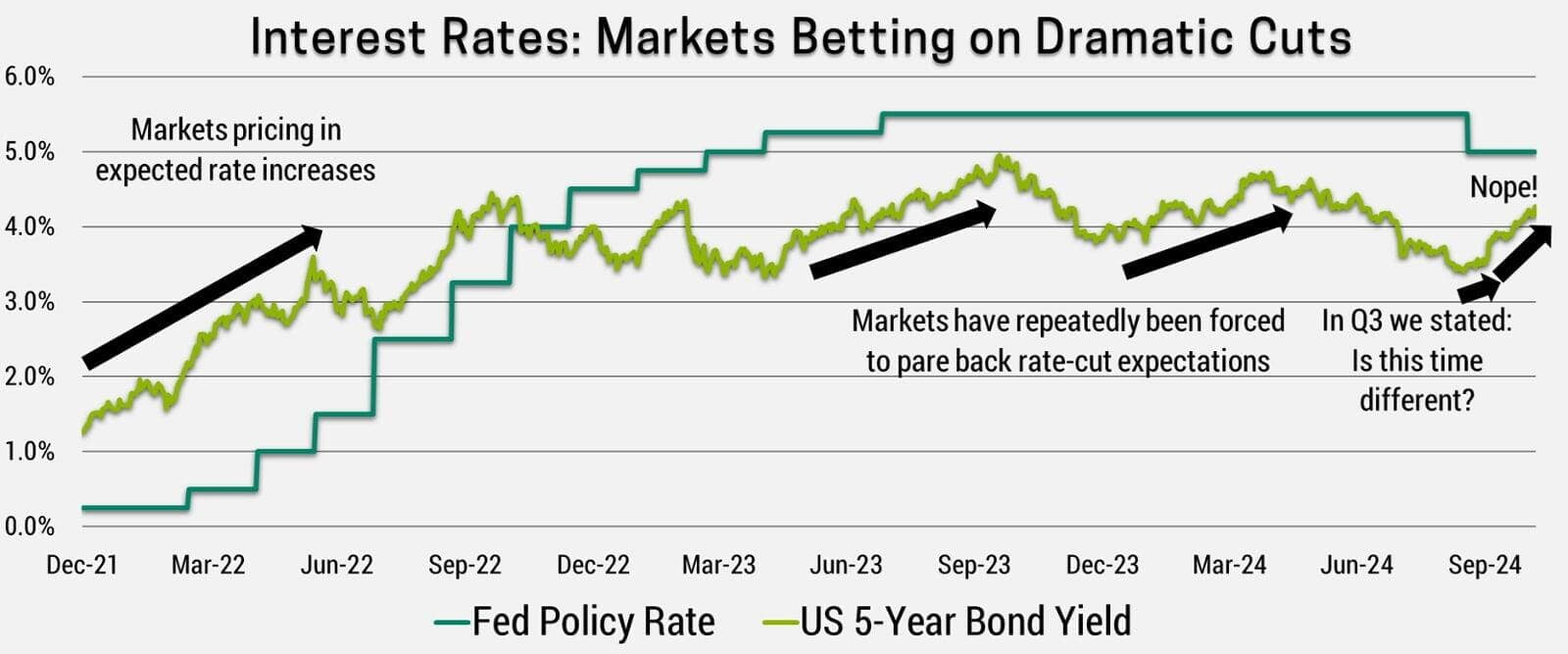

Trump may put pressure on Fed chair Jerome Powell to cut rates, as he did during his first term. The Fed is supposed to be independent and has resisted pressure in the past, but ultimately this only impacts short-term rates. Markets will be a major guardrail to interest rate policies in the long-term. If they see widening deficits and higher inflation, then bond investors will become increasingly uncomfortable and unwilling to lend money without being compensated in the form of higher interest rates. We’re already seeing this play out as seen in the chart below from our last newsletter, updated to show the subsequent spike in interest rates.

This is what happened to Liz Truss, UK’s prime minister who proposed unrealistic fiscal policy, after which bond markets rioted and she was booted from office within a month. This is unlikely to happen to Trump, but it does constrain his ability to implement all the policies he’s campaigned on. Our expectation is that Trump will reduce the magnitude of his policies (ie. More modest tax cuts and tariffs).

CONCLUSION

In general, politics impacts the markets less than people think. That said, we are not being complacent about the risks simply because politics hasn’t mattered much historically. The Republicans will control all three branches of government so will have the ability to implement dramatic policy initiatives that could have larger impacts. This uncertainty is why diversification is such a core element of successful investing.

Our portfolios are performing very well as we’ve been underweight bonds which are suffering given the risks of higher deficits and inflation. We are also benefiting from our significant position in US banks, which were up over 10% today. US Banks will benefit from deregulation and given that most of their revenue is generated domestically, they are less sensitive to tariff risks. This is a good diversifier for our International and Emerging market exposure, which we like for a myriad of reasons discussed in previous newsletters, but will be negatively impacted by tariffs. That said, we believe tariffs will be rolled back given the inflationary and budget constraints. We will continue to monitor the situation closely.