Rhyming With History

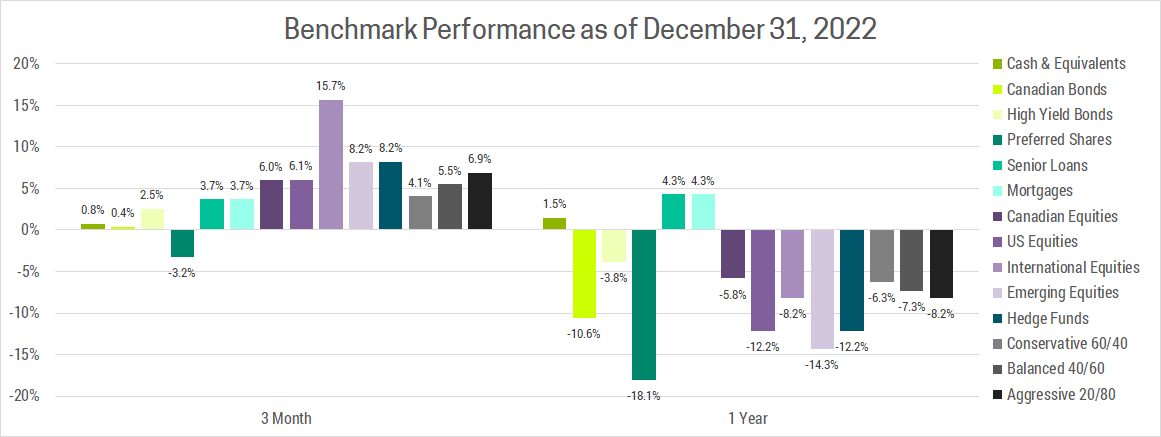

Markets staged a recovery in Q4 on the back of easing inflation and resilient economic growth. This helped recoup some of the losses investors experienced in 2022, but we still saw both global stocks and bonds down double digits through the year. This is quite unusual, as bonds tend to perform well when stocks are falling and vice versa. In fact, in the past 100 years, we have never seen both stocks and bonds down 10% or more in the same year. This meant investors had almost no-where to hide as we saw nearly every major asset class close 2022 in the red.

A BRIEF RECAP

2022 was yet another tumultuous year in the markets. Inflation surged to a 40 year high, as excessive pandemic era stimulus from governments and central banks created robust demand at a time when supply was hampered by covid disruptions, the war in Ukraine and labour shortages. This caught many investors off-guard, as the consensus believed that inflation was “transitory”, a temporary result of pandemic supply chain disruptions that would ease over time. This view is highlighted in the Fed’s March 2021 projection that their first rate hike would take place in 2024!

Obviously, things turned out dramatically different as global central banks led by the Fed have ratcheted interest rates dramatically higher. It’s hard to believe, but the Fed began 2022 at just 0.25% and finished at 4.5%! This has resulted in a dramatic re-pricing of assets, particularly long-term bonds and speculative investments like cryptocurrencies, innovation stocks and to a lesser extent, growth stocks. The reason these investments suffered the biggest losses is because they derive most or all of their value from the long-term. As interest rates rise, investors discount future profits more heavily, arriving at a lower valuation.

2023 MARKET THEMES

From the moment interest rates started to rise, there has been a growing chorus of financial pundits predicting an imminent recession, or that we are already in one. Our view is that strong labour markets and healthy consumer balance sheets (particularly in the US and Eurozone) will continue to fuel an economic expansion, albeit at a much slower pace than we saw following the stimulus fueled re-opening boom. Furthermore, the end of China’s covid-zero policy will remove a significant drag from the world’s second largest economy. Once the initial wave of infections passes, this will provide a meaningful boost to global demand while allowing supply chains to heal.

This should provide a window of opportunity for investors as slowing inflation allows central banks to slow/stop interest rate increases and tone down the hawkish rhetoric. With the consensus expecting an imminent recession (albeit a shallow one), there is an extremely low bar which we believe economic growth will surpass. As a result, markets could rally in the first half off 2023. Ultimately this will become self-defeating as slowing inflation will eventually stabilize well above 2% (we’re expecting 3.5%) towards the end of 2023.

At that point, central banks will need to decide whether to accept above target inflation or raise interest rates even further and likely tip the global economy into recession. The Fed is currently leaning towards the latter, having recently stated they will not adjust their 2% target. This may be their policy, but it could also be posturing as raising the inflation target during a high inflation environment undermines their credibility in bringing inflation back down. Only time will tell which course of action they choose, but regardless we are likely to see either sustainably higher inflation or higher interest rates. Both outcomes are bad for long-duration assets including bonds and growth stocks, which underpins our continued underweight allocation.

FIGHTING THE LAST WAR

It’s been said that “Generals always fight the last war”. Perhaps the most galling example of this was the use of cavalry during WWII, which predictably ended in disaster. Rapid-fire weapons had essentially rendered cavalry charges obsolete decades earlier, but some generals were slow to adapt. Since the pandemic began, many investors, governments, central banks and others were similarly caught fighting the last war against deflation. That last thing they expected was inflation, which had been falling for 40 years and was non-existent following the 2008 financial crisis. Unfortunately for them, the circumstances that created that environment have ended, specifically:

Governments and Central banks wanted inflation: When the pandemic began, the Fed went on record stating their goal to achieve above average inflation going forward to offset below average inflation over the previous decade. Governments were quick to implement record stimulus to boost demand and stave off deflation. We now know they did too much and for too long. While these policies have somewhat reversed, it will likely take restrictive policy now that the ”inflation genie is out of the bottle”. If you’re wondering what “restrictive policy” looks like, it’s higher interest rates (above the rate of inflation) for longer than expected and a reduction in government spending.

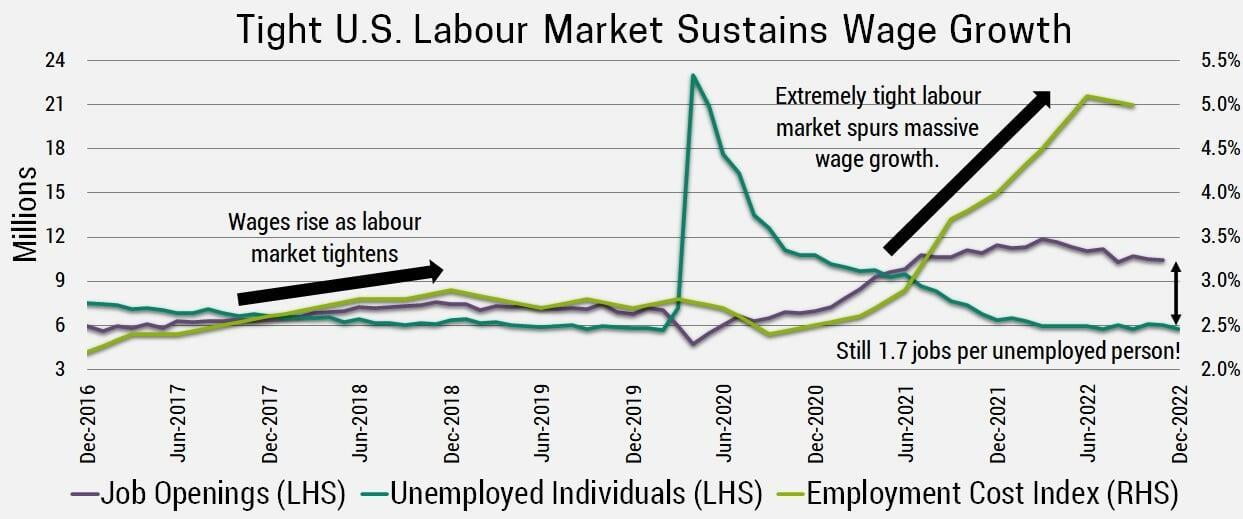

Wage Growth: Tight labour markets have forced companies to raise wages to attract and retain talent. Wages are by far the largest expense for service providers, and as the economy reopens and consumer spending switches from goods to services, these higher wages will filter through into higher service prices. Furthermore, higher wages means consumers have the means to pay higher prices, which sustains inflation going forward.

Globalization: Offshoring to lower-cost jurisdictions was a major force in reducing prices (i.e. deflation) these past few decades. As emerging market wages have caught up and more manual work is automated, there is less savings available by shifting production overseas. Furthermore, the pandemic exposed significant risks in sourcing key components overseas, forcing companies to favor higher cost domestic suppliers in a push for resiliency over efficiency. In short, globalization was a deflationary force that has now run its course and may even begin to reverse.

Deleveraging: Taking on debt is akin to borrowing from the future to increase consumption today. Paying it down (or saving/investing) is the opposite, you’re deferring consumption into the future. With the exception of Canada and a few other countries with housing market bubbles (see Q2 2022 newsletter), the world has been saving this past decade. The subprime crisis of 2008 caused the US housing market to burst and ever since Americans have been paying down their debt. Similarly, the Euro crisis of 2011 forced significant debt reduction in peripheral European countries. China has been saving since the pandemic began as consumers were cautious to spend in the face of relentless lockdowns. As a result, the world’s biggest consumers are able to afford higher prices and sustain inflation for longer than the market expects.

In short, the macroeconomic environment has become far more inflationary.

RHYMING WITH HISTORY

If we are indeed shifting from a deflationary to an inflationary environment, then it can be useful to see how the market has responded to similar changes historically. The current economic environment may be unique, but human emotions/biases are a driving force behind much of what happens in this world, and we have not changed much over time. This is why Mark Twain famously said, “History Doesn’t Repeat Itself, but It Often Rhymes”.

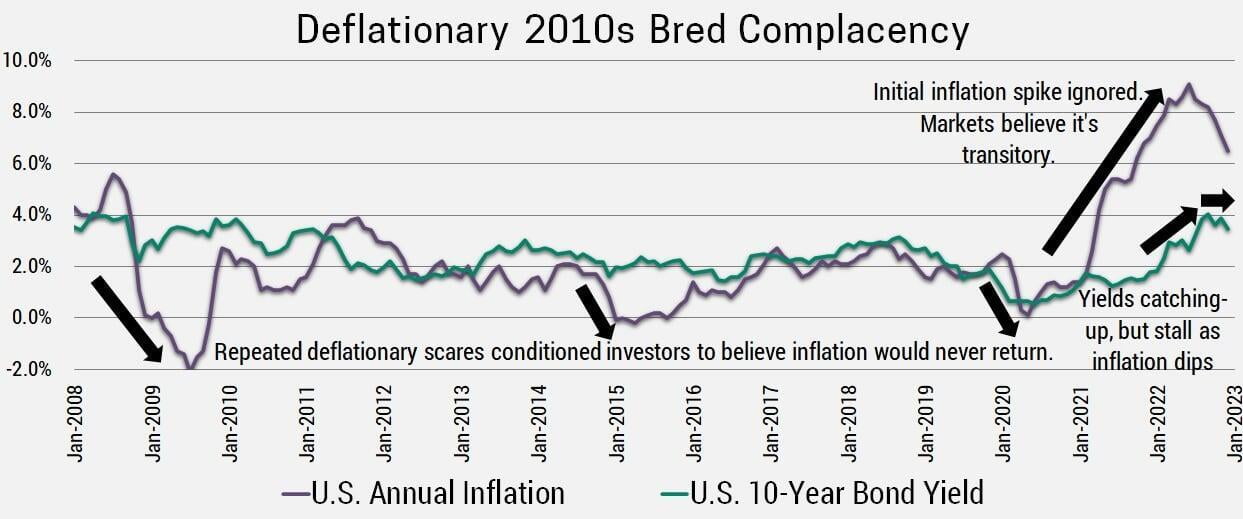

When inflation first started to spike in early 2021, it was shrugged off as “transitory”. It took a whole year of ever higher inflation data for the problem to be taken seriously, with the Fed first raising interest rates in March 2022. With inflation peaking last summer the consensus seems to believe the problem has been solved and that inflation will simply trend back down to 2%. This is rooted in the belief we will return to the deflationary environment that prevailed last decade.

Our view is that the deflationary 2010s were an outlier, not a norm that we should expect will return. Unfortunately, it’s likely the consensus will experience more pain as they fight the last war without realizing we have moved on to a new inflationary environment. This process of adapting to change, only after being caught off-guard repeatedly, mirrors what we saw in the 1980s only in reverse.

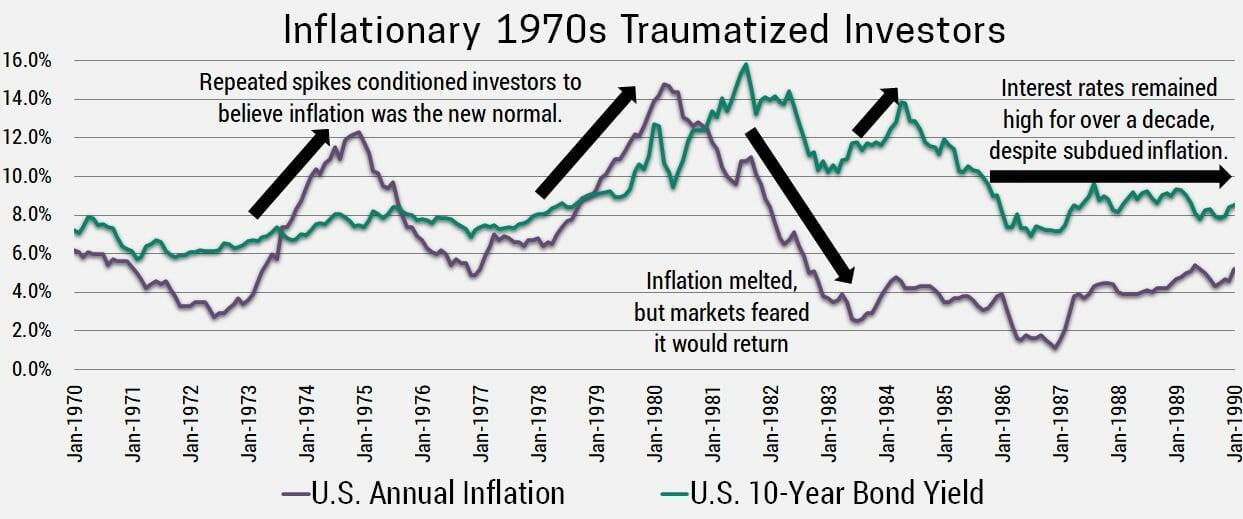

In the 1980s there was a shift from the inflationary 1970s to the disinflationary environment that would prevail all the way up until 2021. Just like today, the market was slow to adapt to this underlying shift, largely due to the lessons learned in the previous decade. The 1970s saw inflation spike repeatedly and each time the Fed hiked interest rates, inflation started to drop, only to return a few years later. By the time Paul Volker took over as Fed Char in August 1979, it was clear forceful and sustained action was necessary to end inflation. This culminated with the Fed funds rate at an unprecedented 19% by 1981, causing not one, but 2 deep recessions. By 1983, inflation collapsed to a low of 2.5% after peaking 3 years earlier at nearly 15%.

At this point, inflation was well and truly defeated, but for the remainder of that decade interest rates remained elevated at around 8%. The 1970s had instilled the belief that inflation was always right around the corner. As a result, each time inflation rose (even slightly), the market reacted and the Fed hiked interest rates. Meanwhile, the 2010s has instilled the belief that deflation is the norm. As a result, each time inflation rises we assume it’s temporary, or easily solved, or that acting too aggressively might cause deflation again. This belief is likely to prevail for a while yet, as these secular shifts can take up to a decade for investors to finally move past.

PORTFOLIO STRATEGY

Our strategy is largely unchanged at this time. We positioned for an inflationary environment shortly after the pandemic began and while inflation is finally coming down, it’s not likely to decline as much as the market expects. As such, we continue to prefer short-duration assets including floating rate debt and value stocks while avoiding interest rate sensitive assets like long-term bonds, innovation/tech/growth stocks and over-indebted economies like Canada (See Q2 2022 newsletter).

Outside of your portfolio, we have personal finance recommendations based on the current economic environment. Specifically, since interest rates are likely to remain higher for longer, personal debt reduction is now more important than ever. Here’s some general advice we hope will help:

- Prioritize paying down the highest interest rate debt first.

- If you can't make your current interest payments on the debt, you need to consider selling assets to pay it down, whether it's vehicles or downsizing your home. Don't wait/hope for lower interest rates to bail you out. While the market consensus believes interest rates have peaked, as outlined in this newsletter that’s unlikely and in-fact interest rates could rise further.

- Think of debt repayment as a form of investment. The Rate of Return (ROR) you'll earn, is the interest rate on the debt. That ROR is after-tax and risk-free, so you may even want to consider selling investments to pay it down. This will depend on each person’s specific circumstances, but as a general rule if the interest rate is 6%+ you should prioritize debt repayment over investment contributions. If the interest rate is 8%+ you should consider selling investments to pay it down.

- If you have low interest debt (eg. a fixed rate mortgage) that is coming up for renewal in the next couple years, you could invest in a TFSA or non-registered account. This way you can withdraw those investments and put a lump sum down upon renewal. If we’re correct that the economy avoids recession, then the investments should do well and interest rates would remain high, making this the ideal strategy. If we’re wrong and we enter a recession, then interest rates are likely to drop anyway. This removes the need to rapidly pay down the debt, allowing you to keep the money invested until markets recover. By staying flexible and giving yourself multiple options, you can take advantage of whichever situation may arise.

If you have any questions, comments or would like to become a client please do not hesitate to reach out. You can email us or schedule a free 30-minute consultation using the link below.