Delta Delays

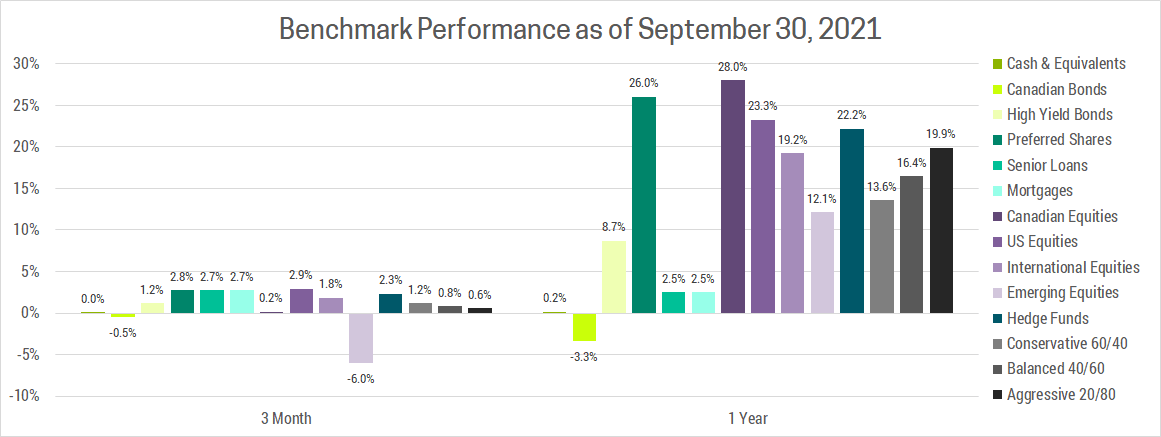

Coming into this quarter, markets had already priced in much of the good news. Support from governments and central banks, effective vaccines, economic reopening, strong consumer balance sheets and an expectation this money would unleash a wave of spending. We believe this thesis is still intact, but clearly markets had gotten a bit ahead of themselves. Instead of a nice smooth reopening and recovery, we got a delta wave, moderating growth, persistent inflation, China’s regulatory crackdown, US political bickering over the debt ceiling, and more. As a result, markets sold-off in the last couple weeks, giving up earlier gains and ending the quarter roughly flat.

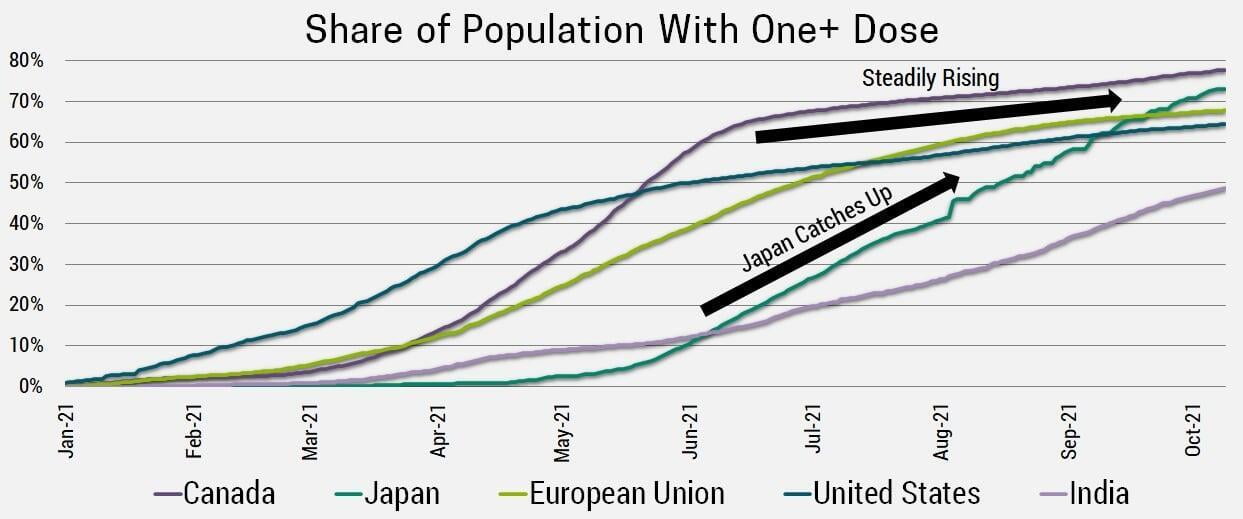

While the delta wave is dominating the news cycle, straining health care systems and peoples lives, it’s impact on the markets is much more benign. The wave has already crested in most countries and the vast majority of large publicly listed companies across the globe remained open throughout. This is largely a result of rising vaccination rates, which reduces the risk of infection, hospitalization and death. These benefits will strengthen as vaccination rates continue to climb and we are likely to see the vaccines roll-out to kids 5+ by year-end. Furthermore, promising antiviral treatments from Merck and others may cut risk of hospitalization or death from COVID-19 in half. In short, the delta wave will not derail the recovery, simply slow it.

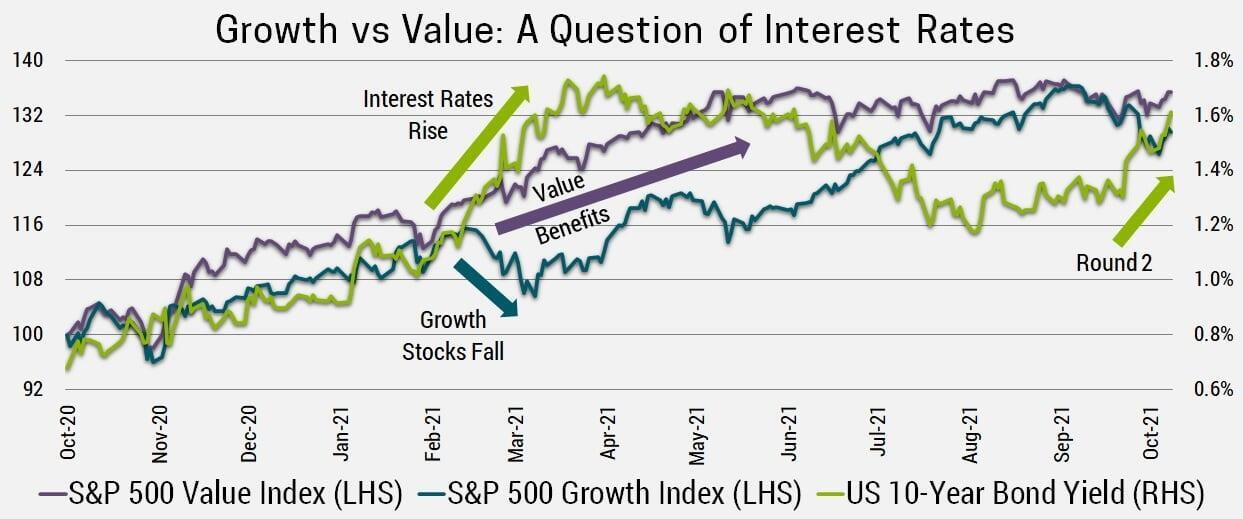

While there are many variables affecting markets right now, the most important is rising interest rates. When markets price any asset, they calculate the present value of future cash flows. After all, $100 received a decade from now is clearly worth less than $100 received today. The question is, how much less?

As interest rates rise, assets that derive more of their value from the distant future become less attractive. A classic example is Growth stocks (eg. Technology), which are priced at a premium because their earnings are expected to grow faster than average. As interest rates rise, we discount their long-term earnings more heavily, resulting in a smaller premium and lower prices. We saw this play out earlier this year and recently entered round 2.

While interest rates are rising, they are being kept artificially low by central banks, who want to support the ongoing economic recovery with cheap money. Central banks will continue doing so until they are forced to rise rates to cool an overheated economy or persistently higher inflation. This is a topic we’ve covered a lot during this recovery and will revisit again below.

Supply chain issues during the economic reopening have caused temporary price spikes in many goods/services. The semiconductor shortage sent used and new car prices up over 20%, which accounted for a ~1% increase in overall inflation. Next year these prices should come down, leading year-over-year inflation numbers drastically lower. Some market participants may view this as proof inflation was transitory, but this would be premature. There are a number of key inflation trends we addressed in our Q1 newsletter that should lead to sustainably higher long-term inflation.

Labour shortages continue to be an issue in many industries, particularly in the US. There was some speculation these issues would resolve as enhanced unemployment benefits lapse. This was proven incorrect as roughly half of US states ended these benefits early but saw no change in job growth when compared to states who kept them. This has forced companies to raise wages to fill openings, a trend we expect will continue.

The more money people make, the more they can afford to spend. This is a key reason we expect higher long-term inflation. Meanwhile, house prices have risen dramatically, up 19.2% in the US over the past 12 months. This has not significantly impacted inflation yet because CPI uses the “rental equivalent” approach and house prices tend to lead rising rent by ~18 months. The impact could be significant as shelter accounts for a third of the US inflation basket (CPI) and 40% of core CPI (volatile components like energy removed).

The question is not whether inflation continues to rise from here (it won’t), but rather where inflation will settle by 2023 and beyond. Here the central banks and consensus view is around 2%, whereas we see inflation in the 3% range. This may not seem like a big deal, but when you consider that higher inflation leads to more restrictive central bank policy and higher interest rates, the impact on markets is significant. This is especially true for long-term bonds and growth stocks that derive most of their value from the distant future.

There have been no significant changes this quarter as we were already positioned for this market environment. We continue to focus on assets that benefit from an ongoing recovery, rising inflation and interest rates. On the equity side this includes value stocks, Europe and Japan, all of which offer cheaper valuations and outperform when interest rates rise. On the income side of our portfolios, we prefer short-term and floating rate debt, while boosting yields by taking credit risk where appropriate.

If you have any questions, comments or would like to become a client please do not hesitate to reach out. You can email me or schedule a free 30 minute consultation using the link below.