Headlines vs Reality

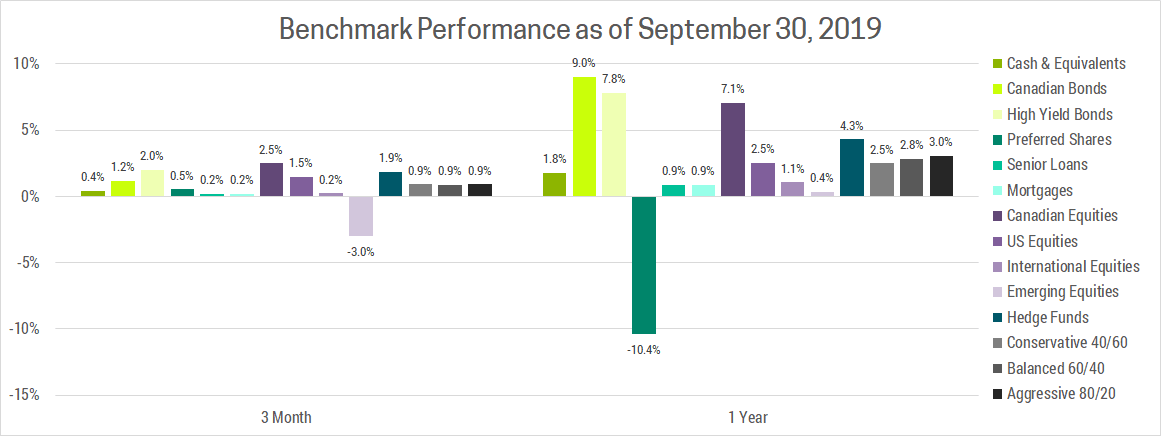

During this quarter, investors have been bombarded with negative headlines including the trade war, inverted yield curve, negative interest rates, Hong Kong protests, Brexit, Saudi oil attacks and the recent impeachment inquiry. Given all this you might be surprised to learn market performance was slightly positive across most asset classes.

IGNORE THE HEADLINES

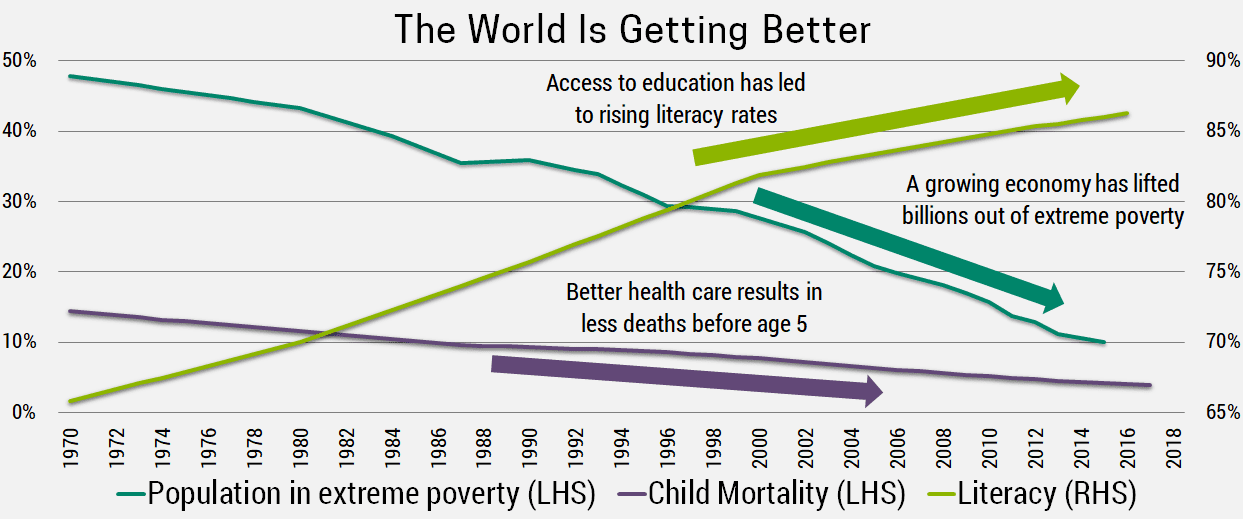

How is this possible? Remember, the news only reports on things that happen, not things that didn’t happen. You never see a news report broadcast live from a city where there were no protests, mass shootings or natural disasters. As such, news is biased towards rare, catastrophic events as opposed to the much more common, slightly positive event (the economy grew, literacy and access to education are up, meanwhile unemployment, child mortality, extreme poverty and violent crime are all down).

Source: https://ourworldindata.org/

If you only read the headlines you might think the economy is on the verge of collapse, but in fact it has only slowed modestly. This has led central banks around the world to pursue stimulative policies that should lead to a re-acceleration of economic growth in 2020. As I’ve mentioned before, central banks are able to keep stimulating the economy so long as inflation remains low, a trend that continues to persist but is something we’re monitoring closely.

Those predicting a recession seem to be ignoring the fundamentals and are instead speculating that a protracted trade war or other political policy error will send the economy into a recession.

Certainly this is a possibility, but as we wrote in our last quarterly newsletter, we view this as unlikely and believe staying invested through the trade war is the best strategy, as it was during the cold war.

IS A RECESSION IMMINENT?

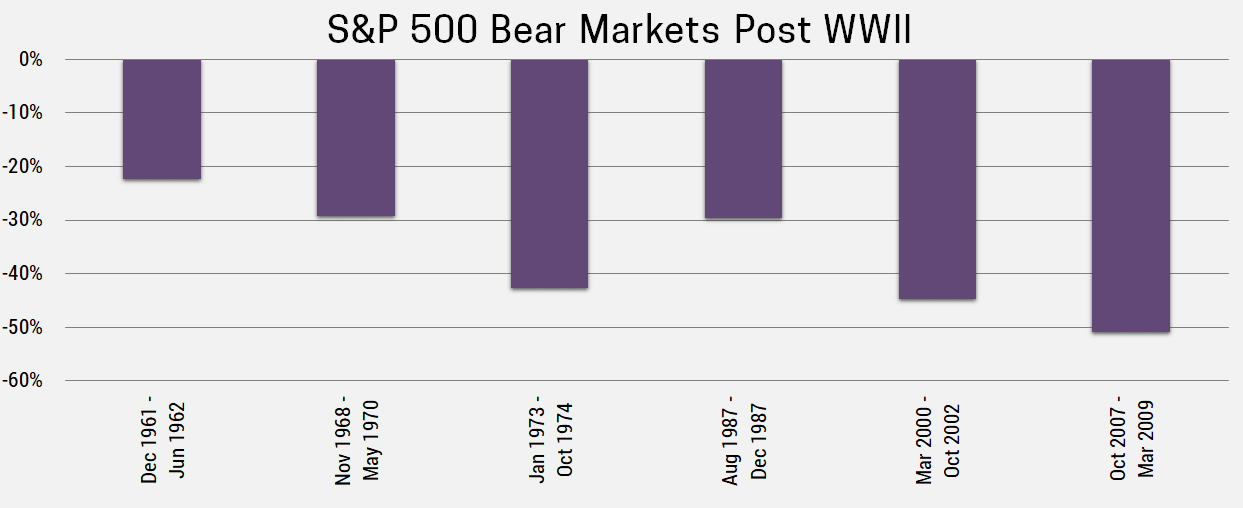

So far we’ve focused on why we believe the economy will continue to expand and that a recession is unlikely… but what if we’re wrong? Well, first of all that’s why we diversify, but secondly, it’s unlikely a recession will be as bad as most investors think. There’s a famous quote that “generals are always prepared to fight the last war” and in the case of a coming recession, investors are preparing for one similar to 2008. But 2008 saw stocks fall over 50% from their peak in what was the worst economic crisis since the great depression. In the chart below we show the peak-to-trough drawdown during each bear market (defined as a loss of 20% or more) since the end of WWII. As you can see, 2008 was the worst bear market on record and is unlikely to be a useful proxy for the next recession.

A bear market is a worst case scenario, but recessions don’t always result in a bear market. Since WWII we’ve also seen 32 corrections (defined as a loss of 10% to 20%) and they only lasted for 4 months on average. It’s certainly possible that the next recession, particularly if it’s the result of a policy error, would be mild and short lived as it could be corrected through a policy response.

CASH ON THE SIDELINES

Another factor that supports our view that a possible upcoming recession would not be nearly as bad as 2008 is the amount of cash on the sidelines. The U.S. Federal Reserve Q2 2019 report shows a total of $2.73 trillion in overnight money market funds, $4.42 trillion in checking accounts and currency, and another $12.54 trillion in savings account and Certificates of Deposit (source: https://www.federalreserve.

HOW ARE WE INVESTED?

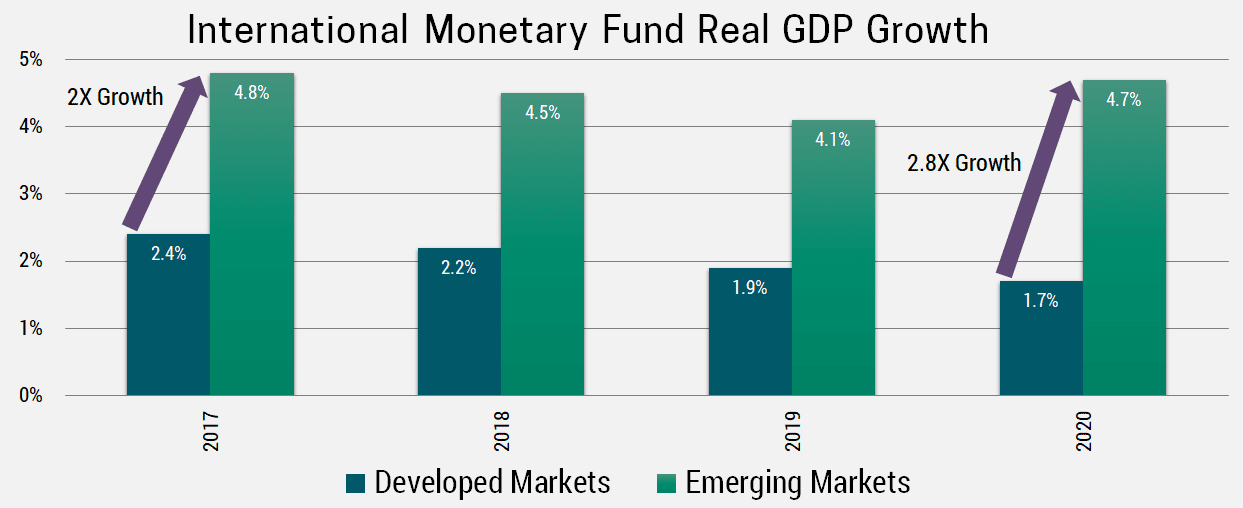

Well, within stocks we believe emerging markets offer investors the best long-term opportunity due to their low valuations and real GDP growth that continues to double that of developed markets. This trend of higher emerging market growth is likely to accelerate as it’s underpinned by strong demographic trends (younger workforce, higher birth rates) and the catch-up effect (technology implementation). In addition, developed markets have a culture of borrowing while emerging markets have a culture of saving. China and India’s household savings rate is 36% and 30.5% respectively, which is big reason they have a growing middle class (India and China will represent 2 of the top 3 largest middle class populations). This is a huge opportunity as their economies transition away from manufacturing and exports, towards technology and services. In short, emerging markets are growth stocks at value prices.

Meanwhile, growth stocks in developed markets continue to trade at over a 50% premium to their value peers. This discrepancy is largely due to our obsession with growth in our current low-growth, low-interest rate environment; but there are signs the euphoria around growth companies is beginning to abate.

A recent example is WeWork, one of the latest high-growth firms planning an Initial Public Offering (IPO). In August, they were privately valued at $47 billion, but once they filed their intention to IPO investors began scrutinizing the company’s financials. In 2016, they lost $429M on $436M of revenue. The following year they lost $890M on $886M of revenue and in 2018 lost $1.6B on $1.8B in revenue. A growth investor might look at this and say wow, they’re doubling their revenue every year. A value investor would say yikes, they’ve doubled their losses every year. Subsequently, high profile fund managers who own the stock have been fired, the company’s CEO has stepped down and the IPO was pulled, all positive signals that value investing is making a comeback.

If you found this commentary helpful, please pass it along to your friends, family, or anyone you think would benefit from it. We want to create better financial outcomes for Canadians and believe education is key. If you'd like a complimentary review of your finances please reach out to me directly.