Inflation Risks Are Rising

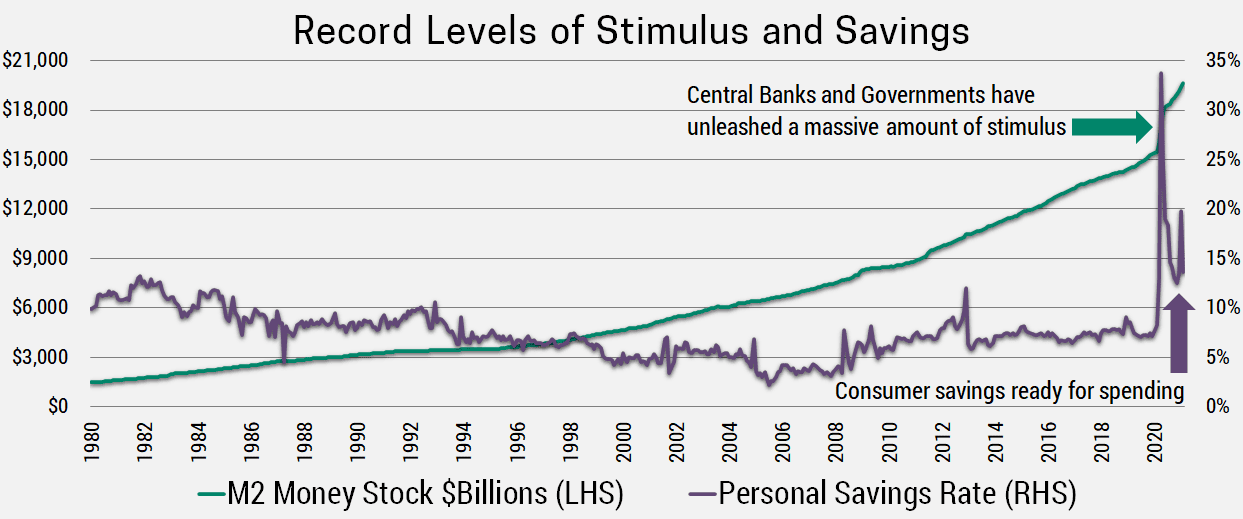

It seems the narrative we’ve had since early March has become the central thesis for investors. Stimulus from central banks and governments has helped the economy weather the pandemic storm and seems set to continue supporting the recovery. The recovery thus far has focused on technology and manufacturing, but with vaccine’s being distributed we are likely to reach herd immunity by the fall, allowing services and sectors that have struggled to catch-up. Furthermore, consumer balance sheets are in great shape as falling expenses and generous government support has boosted savings and debt repayment.

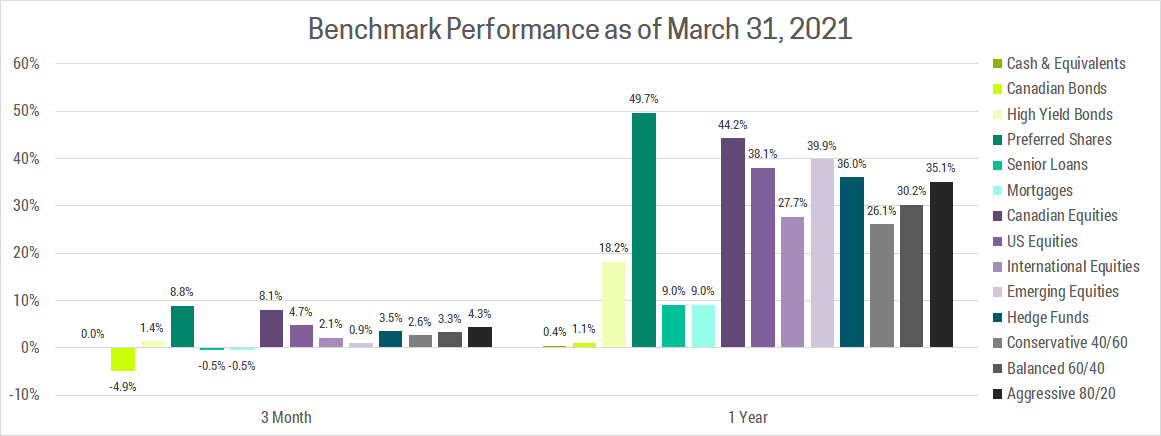

Surveys suggest there is significant pent-up demand, meaning consumers have the ability and willingness to spend which could super-charge the recovery. Unfortunately, much of this good news is now priced into the markets leaving it vulnerable to any disappointments. As seen in the performance chart below, every asset class is up substantially over the past year with the exception of low-risk investments like cash and bonds.

MARKETS ARE FORWARD LOOKING

The fact that markets have performed so much better than the real economy is not a disconnect, as many market watches proclaim, but due to the fact markets are forward looking. What makes this recovery unique is how far in advance markets are looking. Typically markets lead a recovery by 6-12 months, but this time markets began pricing it in as early as late March 2020, reaching the pre-pandemic peak in July. This means pricing in the end of the pandemic and economic recovery about 12-18 months in advance.

In short, markets are looking even further into the future than they used to.

We believe this trend is here to stay as technology and past experience has allowed us to better forecast the future. This is particularly true for this recovery as the cause (pandemic) and solution (vaccine/herd immunity) are clearly understood. Therefore, our strategy going forward will involve trying to get ahead of important long-term trends like inflation, which we continue to view as the biggest risk to this recovery. Central banks will continue to support the economy through low interest rates until inflation rises to an uncomfortable level and forces them to raise rates. This would cool off the economy as more money goes towards interest payments instead of productive investments, particularly for heavily indebted governments. Furthermore, expensive assets that have been supported by low interest rates would come under pressure.

THE GOLDILOCKS SCENARIO

While investors are becoming concerned about inflation, this is not necessarily a bad outcome when considering the alternative. Over the past decade, many markets, particularly Europe and Japan have battled a deflationary environment. This means the price of goods and services have been flat or declining and interest rates have even gone negative. This is bad news because when prices are declining, consumer have an inventive to hold off on purchases since they will continue to get cheaper over time. This can lead to a deflationary spiral where lower prices reduces purchases, resulting in prices falling even further. There are parallels with the story of Goldilocks and the Three Bears, where markets experiencing high inflation are too hot, deflation is too cold, and low/moderate inflation is just right!

PREDICTING INFLATION

It’s important to note that inflation measures the cost of a basket of goods and services. Right now, many service industries are in lockdown, which is a major reason we don’t expect inflation in the near-term. That said, we are already seeing asset price inflation as money pumped into the economy currently has no other place to go. Whether it’s cryptocurrencies, residential real-estate, industrial commodities, growth stocks, SPACs, NFTs, or collectibles (the list goes on), many assets are at or near all-time highs.

Outside asset prices, the first market to experience consumer inflation will likely be the US. This is due to chronic government deficits, better underlying growth and a falling US dollar (USD). We expect the USD will continue to fall for many years to come as it is:

- Counter-cycle: Investors rush into the USD when they are scared, but are now moving away as the economy improves.

- Expensive: The USD is 20% overvalued according to purchasing power parity, which measures the cost to buy a comparable basket of goods and services in different currencies.

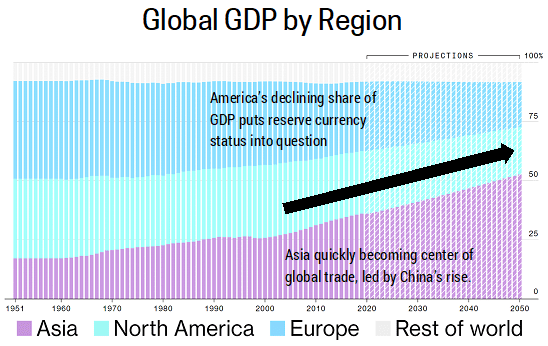

- Declining Status: The USD benefitted for decades as the global reserve currency due to its status as a safe haven at the center of global trade. After years of isolationist policies and a declining share of global GDP (primarily a result of China’s rise), investors appear to be moving towards a more diversified mix of global currencies.

Source: https://www.bloomberg.com/graphics/2020-global-economic-forecast-2050/

The result of a lower USD is rising import prices for US consumers and therefore rising inflation. As inflation rises in the US it is likely to spill over into other markets, which will help lift Europe and Japan out of deflation and into the goldilocks environment of low/moderate inflation. This will spur consumer spending while allowing interest rates to remain low and stimulative.

KEY TRENDS IMPACTING INFLATION

We’ve spoken of why inflation is so important, now we’ll address the major factors behind inflation forecasting:

- Central banks want inflation: The Fed is on record stating their goal to achieve above average inflation going forward to offset below average inflation over the previous decade.

- Governments want inflation: The Biden administration has also shown a bias towards stronger economic growth and inflation. This is partly due to their experience in the 2010 mid-term elections when a more mild recovery led to them losing the popular vote by 6.8% and control of the House of Representatives. Globally, markets like Europe and Japan also want more inflation given that they’ve been mired in deflation for most of this past decade.

- Central bank and Government stimulus: Talk is cheap, but central banks are putting their money where their mouth is by keeping interest rates low and buying bonds to put downward pressure on short-term interest rates. Governments have also shown a willingness to run deficits to support the economy, most notably in the US with their recent $1.9T stimulus package and proposed $3T infrastructure bill.

- Wage Growth: Rising wages is a necessary precursor to sustained increases of inflation. With unemployment rates still elevated, we don’t expect wages to rise this year, but it may not take as long as many investors expect. Currently the Fed is projecting US unemployment to reach 3.5%, it’s pre-pandemic low, in 2023 while Goldman is even more optimistic forecasting this for next year!

- Globalization: Offshoring to lower-cost jurisdictions was a major force in reducing prices (ie. Deflation) these past few decades. As emerging market wages have caught up and more manual work is automated, there is less savings available by shifting production overseas. In short, globalization was a deflationary force that has now run its course.

- Supply Chain Disruptions: Supply chains have been severely impacted by this pandemic making it more difficult to produce goods and services. When demand comes back post-vaccine its possible supply will not be there to meet it, resulting in rising inflation at least temporarily (eg. Post-vaccine many people will want to vacation, but the travel industry and airlines have had to scale back and will likely be unable to ramp-up quick enough).

- Technology: We are now able to produce more with less. Just look at this radio shack ad from 1991. That’s $3,000 of tech ($5,800 adjusted for inflation) that is now available at a lower price on a device that fits in your pocket. That said, we’ve had technological advancements for centuries and it doesn’t prevent inflation from happening.

PORTFOLIO STRATEGY

We have pre-emptively positioned client portfolios for an environment where a strong economic recovery and rising inflation pushes up interest rates. Specifically, this includes:

- Income: On the income side of our portfolios, we have focused on short-term and variable-rate debt who’s yields will move up as interest rates rise. While long-term debt offers higher current yields, they are more sensitive to rising interest rates, a trend we expect will continue. As such, we prefer taking credit risk to boost yields since an economic recovery pushes down default rates on higher risk debt. In short, we prefer credit risk over interest rate risk.

- US Growth: We are max underweight US equities as they continue to trade at a substantial (~50%) premium to nearly every other market. This is largely due to higher earnings growth expectations which we believe are too optimistic. The US has benefited from having a larger exposure to sectors that are less impacted by the pandemic (or positively impacted like Technology). Analysts have taken this growth and extrapolated, but we believe much of it was pulled forward from future years. ie. If you didn’t subscribe to Amazon Prime, Netflix, etc. during the pandemic, you’re unlikely to do it in the next couple years. As such, growth will likely come in lower than expected in these sectors, meanwhile the lagging industries that have been heavily impacted by COVID-19 disproportionately benefit from the vaccine roll-out and should catch-up.

- Europe/Japan/Value: We have a strong preference for Europe and Japan, which represent the opposite of the US. They have a larger exposure to sectors more heavily impacted by the pandemic (cyclical, value, trade and tourism), meaning they have more to gain during the recovery. Due to an older population they have been more willing to use lockdowns to control the spread, so the economic and health impacts of COVID-19 are more severe. This means they have more to gain from the vaccine rollout. Furthermore, low/moderate inflation means central banks and governments can remain stimulative while low valuations allow for significant upside.

- Emerging Markets: We remain max overweight emerging markets as they benefit from stronger growth rates, demographic trends and cheaper valuations.

If you have any questions, comments or you'd like your investments managed with the prudence and care it deserves please do not hesitate to reach out.