If you haven't already read last quarter's commentary, I suggest you do that first as we will be building on some of its topics below.

It’s hard to believe but just one quarter ago equity markets were off nearly 20% and financial pundits were predicting the end of this decade long bull market. What a difference three months can make, the recession they were predicting turned out to be nothing more than a minor slowdown. As such, markets rallied significantly which benefited the additional equity holdings we bought for clients in December. We also saw the following positive developments:

- Trade: US trade wars, particularly with China, have eased though they remain largely unresolved and we expect will continue to be a significant headwind for markets going forward. Nonetheless, an all-out trade war seems unlikely which has benefited equity markets globally.

- Interest Rates: The Federal Reserve has raised interest rates, but not to a point that it choked off growth and they have signaled the pace of future increases will be more gradual. Markets have rallied significantly on this news as it has delayed the day of reckoning for over-indebted consumers, corporations and governments.

- Oil: Crude prices have rallied and the discount on Canadian Heavy has narrowed significantly, benefiting energy producers and lifting Canadian equity markets. Our overweight Canadian equity exposure has benefited significantly from this development.

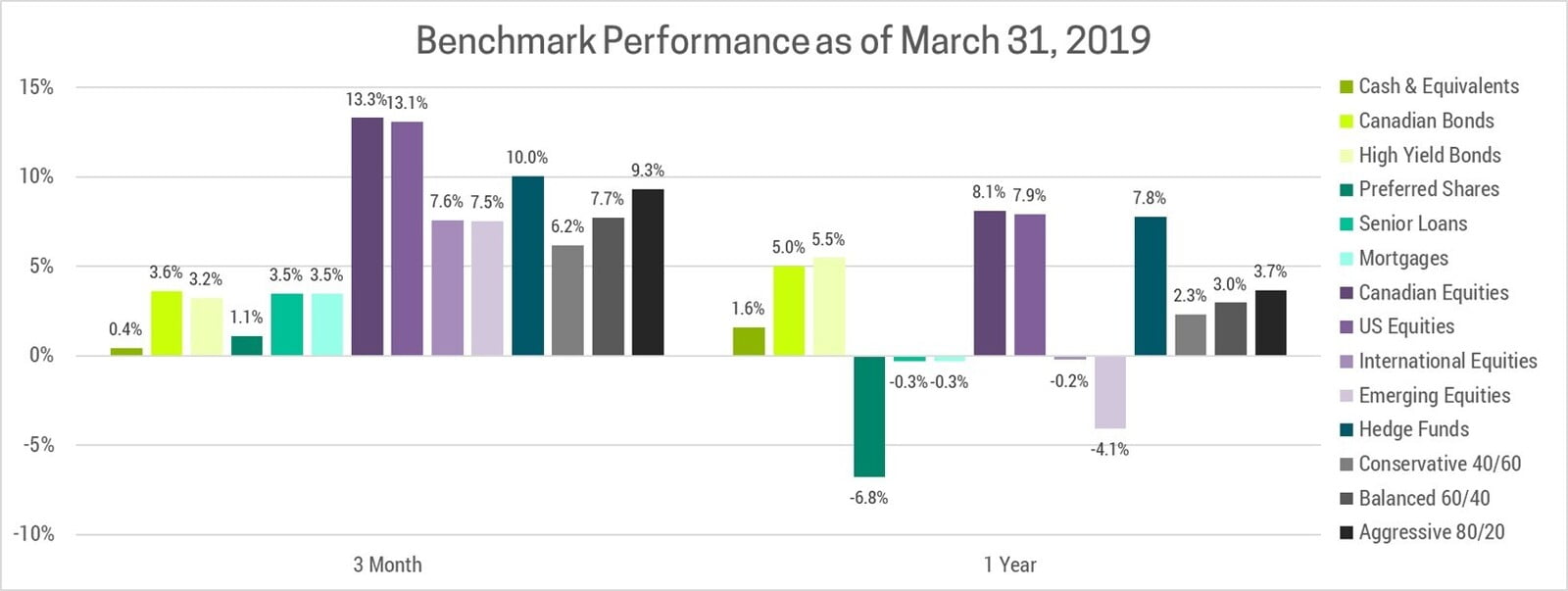

These positive developments resulted in significant gains across all major asset classes in Q1. The performance chart below shows how widespread this recovery has been.

Given the significant rebound we’ve seen, it’s prudent to ask whether markets can continue to move higher. In short, we believe the answer is yes. While the fundamentals still suggest we are in the late stages of this economic cycle, recent developments, particularly the slowing pace of central bank interest rate increases, has reduced the probability of a recession in the near future.

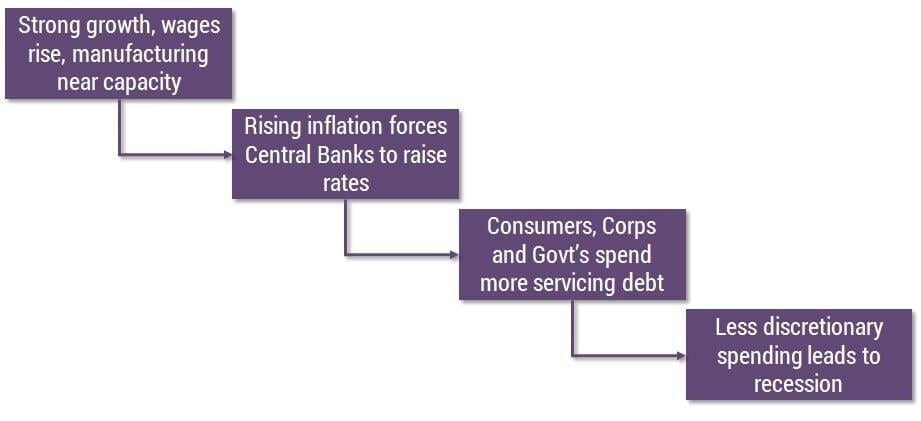

In our view, it is far more likely the economy will re-accelerate prior to the next recession, as opposed to slowly sliding into one. This is due to the impact rising interest rates will have on heavily indebted consumers, corporations and governments. Central banks are keenly aware of this issue, which is why they are unlikely to raise interest rates unless forced to do so. This push will likely come from rising inflation, which is commonly triggered by an overheating economy. This would create a waterfall effect that we've illustrated in the graphic below and is something we are monitoring closely.

Given the positive near-term impact of a re-acceleration of global growth, we are maintaining our equity exposure at this time. Once this growth shows signs of stoking inflation, we will be looking for opportunities to get more defensive.