What Last Decade Teaches Us For The Coming Decade

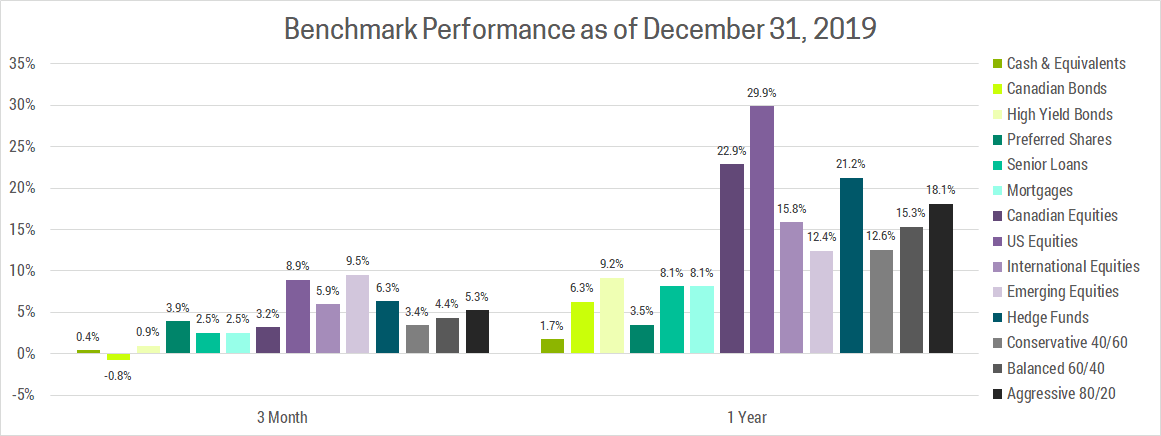

Q4 2019 brought investors more positive returns to close out an exceptional year. In fact, in 2019 every major asset class was up, giving balanced investors double digit returns for the year. This was achieved with relatively low risk, as returns were positive in 10 out of 12 months.

WHERE WE STAND TODAY

If you zoom out a bit, things are not as rosy as they appear. First, a big reason returns in 2019 were so great is because of the significant correction in Q4 2018 (we started this year at a low point). Second, despite improvements on economic, political and other fronts, many issues remain unresolved. Here’s some of the major issue’s investors faced throughout the year and where we stand today:

- Trade War: The US and China trade war is beginning to de-escalate, with phase one of the new trade deal set to be signed later this month. That said, as discussed in our Q2 newsletter, the fundamental divide between China and the US remains, and as a full deal is not yet finalized we expect the trade war is far from over.

- Economy: Fears the economic slowdown that began in Q4 2018 would turn into a full-blown recession never materialized, as growth stabilized. Furthermore, inflation remains subdued allowing central banks to continue pursuing accommodative monetary policy. For example, on January 1st China’s central bank cut their reserve requirement, a move expected to pump 800 billion yuan ($150 billion CAD) into their economy.

- Negative Yielding Debt: Globally there is ~$11 trillion in debt with a negative interest rate, meaning investors are paying banks and governments to hold their money. This clearly shows many investors remain fearful; but this number is significantly less than the peak of $17 trillion reached in August 2019.

- Brexit: A deal has finally been reached that will see the UK formally leave the EU on January 31st. However, this deal has not yet been ratified by the European Parliament and would include a transition period until December 31, 2020.

In short, we’ve made progress on many fronts but we’re not out of the woods yet. Plus, we’ve added new issues to the list with the US/Iran conflict and a 2020 US election cycle that is shaping up to be the ugliest, most polarizing political circus on record. So, what’s an investor to do?

WHAT HISTORY CAN TEACH US

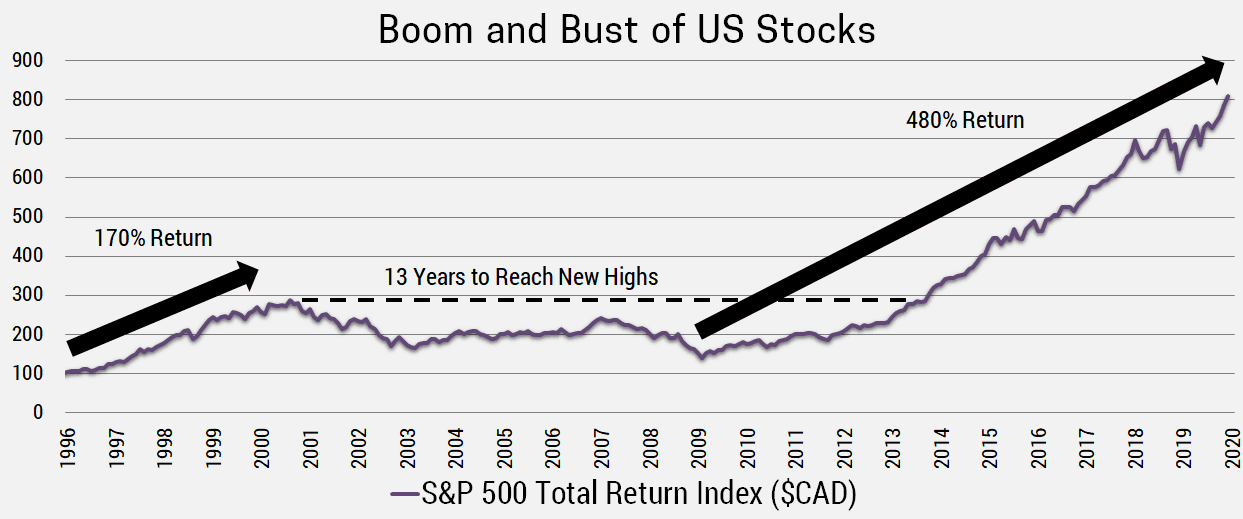

To help answer this question, it’s helpful to look back and imagine yourself as an investor in 1996. The US stock market hadn’t had a bear market (>20% decline) in 9 years and valuations were at all time highs, as measured using the Cyclically Adjusted PE Ratio (CAPE Ratio) of 24.76. Most investors gut reaction would likely be to sell.

With the benefit of hindsight, we know the dot-com bubble was just getting started, and by the turn of the century, US stocks were up an additional 170% (CAD). After sitting in cash for 4 years, watching everyone around you get richer, eventually the pressure builds and you buy back into the market, just in time for the bubble to pop. As the markets sell-off, now you’re stuck waiting for a recovery so you can at least break even.

Unfortunately, US stocks still haven’t recouped these losses by 2007, leaving you fully exposed to the 2008 financial crisis, the worst recession since the Great Depression. By March 2009, you’ve lost over 50% (CAD) over the last 9 years, and with all the headlines talking about the end of the world you cut your losses and sell. I’ll stop my analogy here, but in case you’re wondering the US market is now up 480% (CAD) since those March 2009 lows.

You might be asking yourself, is the current investment environment closer to 1996 or 2000?

The answer depends on which asset class and region we’re talking about.

I used the US equity market as an example simply because it is the largest and most well known, but these trends of boom and bust occur in all asset classes and at different times. The underlying reason is that investors drive markets and we’re all susceptible to the same psychological, social, cognitive and emotional biases. This is why the most successful investors are those who are able to remove these biases that negatively impact decision making.

PROCESS DRIVEN INVESTING

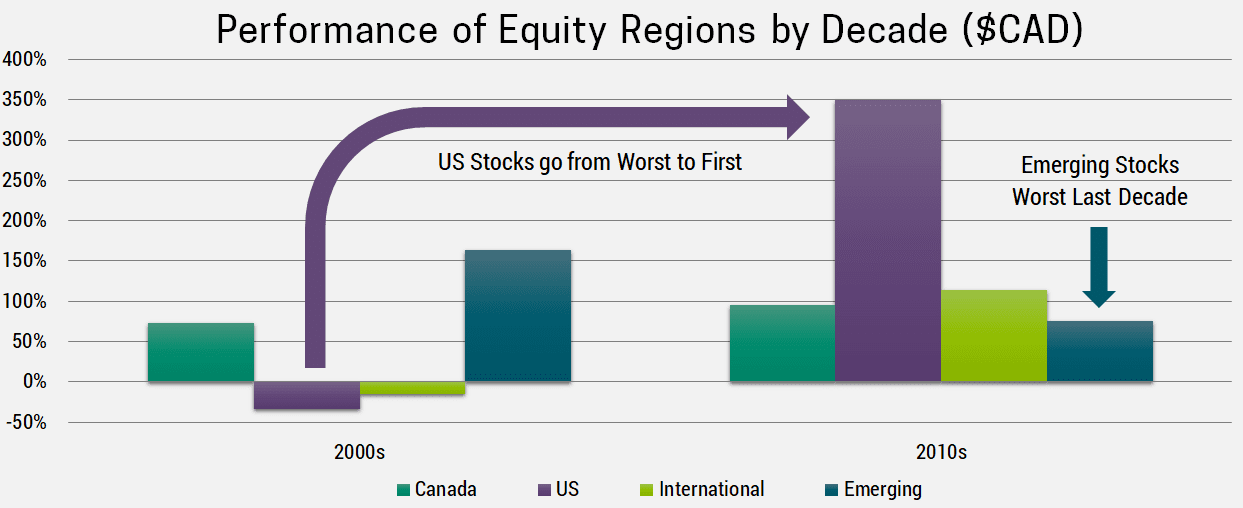

We all want to “buy low, sell high”, but as the previous example illustrates it’s much easier said than done as our emotions and biases tend to get in the way. The best way to accomplish this goal is to manage your money in a systematic fashion. This starts by diversifying your portfolio by asset class and region, which helps protect from unforeseeable market events. This diversification is formalized in a written Investment Policy Statement (IPS), which includes targets to each asset class. By rebalancing to the IPS targets we effectively sell asset classes that outperformed (like US equities did last decade) and buy asset classes that underperformed (like emerging markets).

The key is to be disciplined enough to follow the process and to set the rebalancing threshold at a point that allows momentum to carry the portfolio over the short term while rebalancing from expensive to cheap asset classes over the long-term. The benefit of this strategy can be seen by looking at stock performance by region over the past 2 decades.

It’s no coincidence that the asset classes we prefer for the coming decade (emerging markets and value stocks) are the ones that underperformed in the last decade (vice versa for US stocks and bonds). Of course, just because something has performed poorly doesn’t mean it can’t continue to do so. Cheap stocks can always get cheaper (and expensive stocks can get more expensive), at least over the short-term where emotions reign supreme.

Having a good process is like being the house at a casino. It doesn’t result in success every day, you’re simply tilting the odds in your favor which results in long-term outperformance. A bad process, like allowing emotions to cloud your judgement and ignoring the fundamentals, is the opposite. You can certainly succeed through dumb luck over short periods of time, but on average you’ll underperform.