Light at the End of the Tunnel

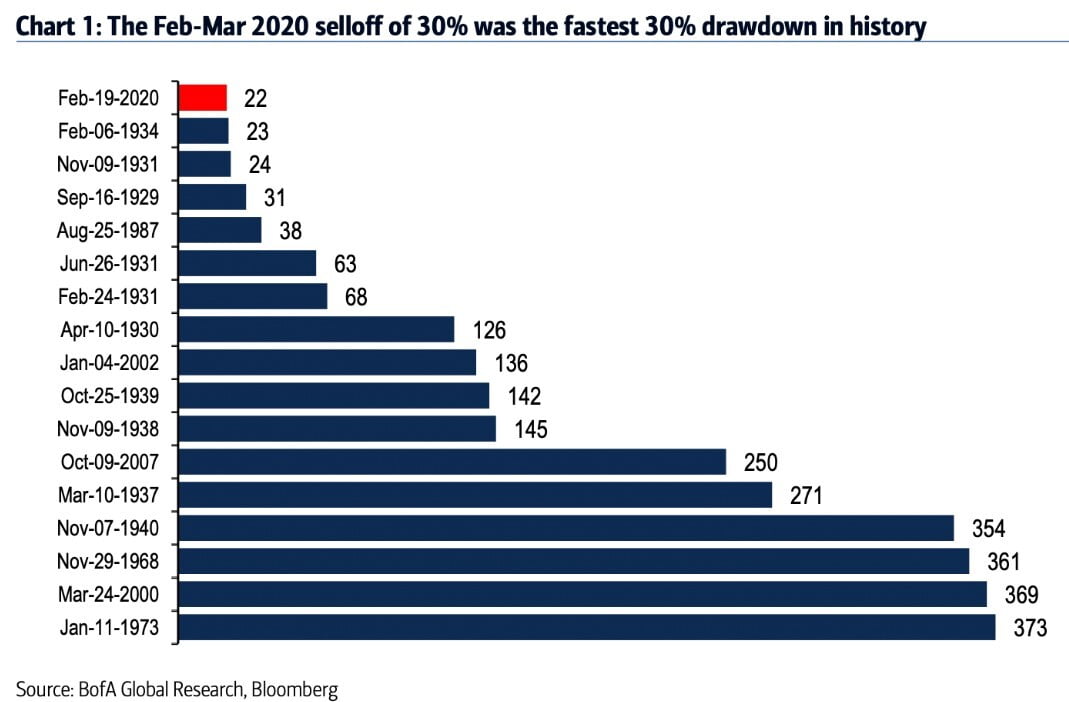

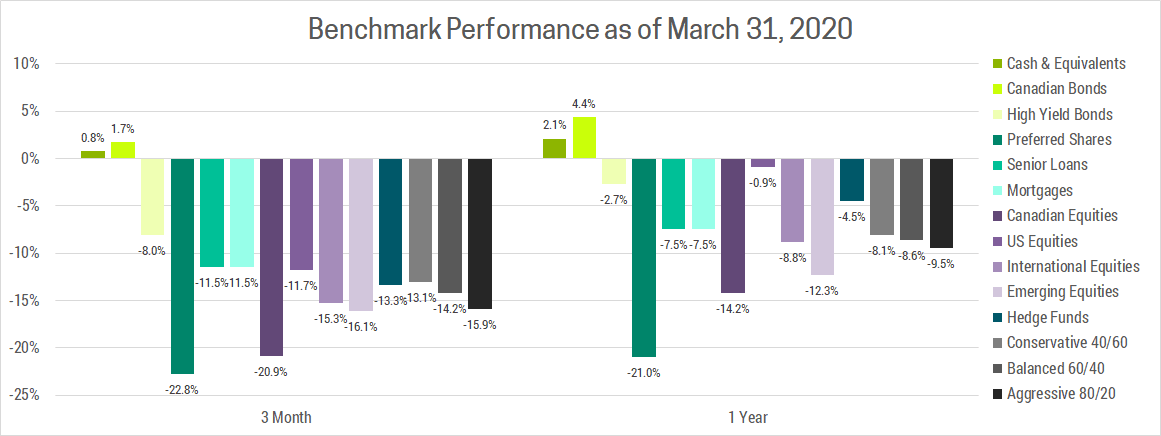

As always, I like to start off each quarterly commentary discussing how the market has performed, then we’ll talk about the outlook. Q1 2020 has been a rough ride for investors to put it mildly. We experienced the fastest bear market in history with global markets falling roughly 30% in less than 1 month.

The speed of this selloff has made it difficult for investors to properly assess how different countries and asset classes will be affected. This may be why no asset class or region has been spared, investors have simply sold everything they can, with the exception of government bonds.

THE TREND IS ONCE AGAIN OUR FRIEND

In our last commentary on March 20th, we wrote, “Investors with more than a year to invest would be wise to put cash to work now instead of waiting for the dust to settle. If we wait to see signs we’re winning the war against COVID-19, or that an end is in sight, we may have already missed out on considerable upside.” As such, we sold safer investments to buy risk assets and were rewarded for that these past couple weeks as markets rallied substantially from their lows. Does this mean the end is in sight? Not exactly, but the trend is moving in the right direction. To help explain why, I want to start this commentary by diving into the math behind pandemics.

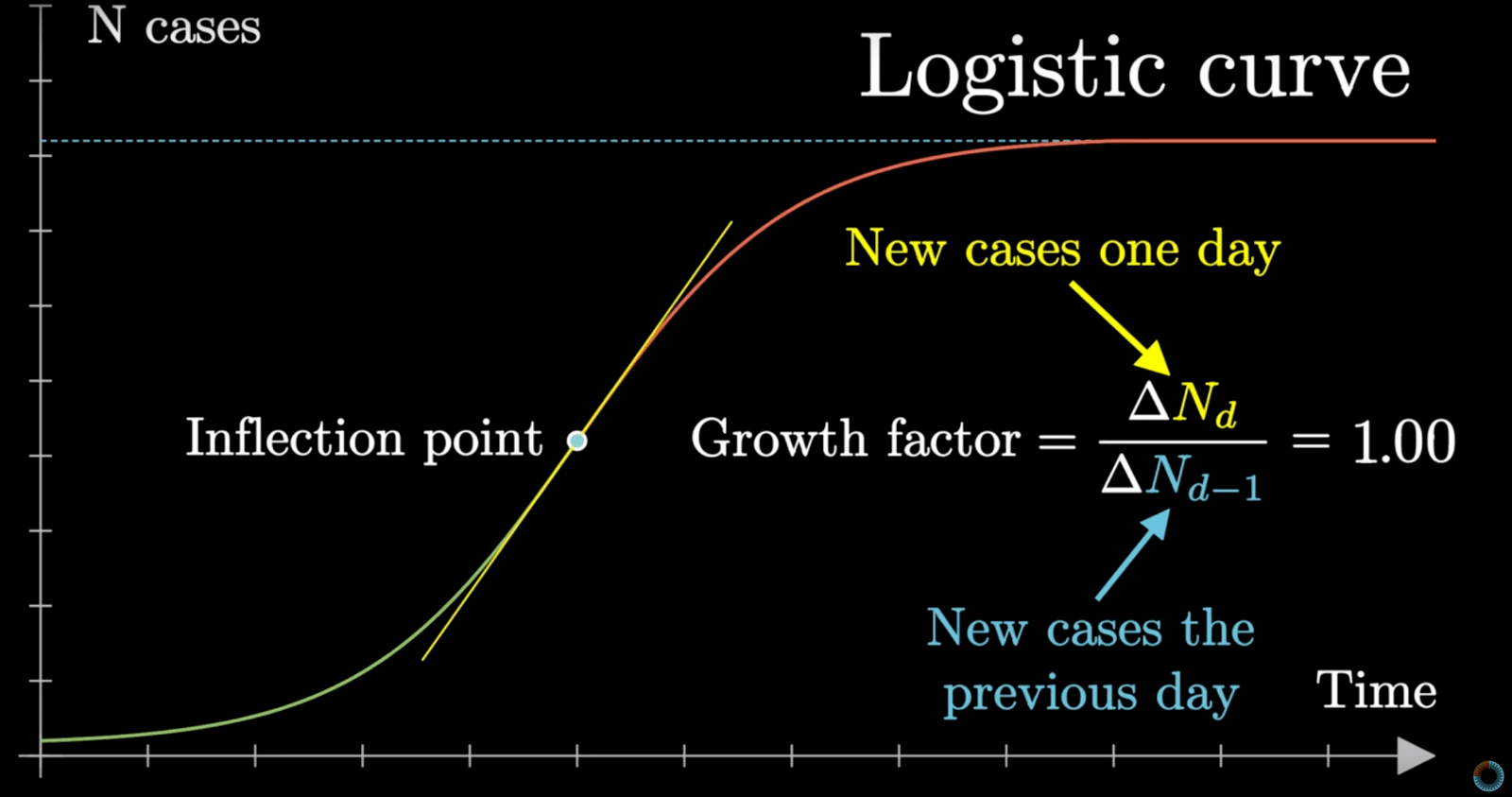

When I say the trend looks good, it might be surprising to those who view the headline case numbers as they have been skyrocketing lately. We’re now well over 1 million cases worldwide and given the lack of testing capacity in certain countries the actual number is likely much higher. But this is how pandemics always start, on an exponential curve. Exponential growth can be hard to wrap your head around because the numbers can get very large, very fast. At its core, exponential growth in pandemics involves multiplying the previous days cases by some constant (the growth factor). For COVID-19, this was between 1.15 and 1.25 in the beginning. This means 100 cases today becomes 300 in a week, and 20,000 in a month. The developed world is just over a month into this now, which is why we’ve seen case numbers in countries that started in the hundreds turn into tens or hundreds of thousands. The scary thing is that another month from now on this exponential curve turns 20,000 into 5,000,000 (or 1 million into 250 million)!

LIGHT AT THE END OF THE TUNNEL

But don’t panic, because exponential curves cannot go on forever. They eventually slow and turn into what’s called a Logistic Curve or S-Curve. By enacting suppression policies around social distancing, quarantines, travel bans, business/school closures, better hygiene, etc, we are aiming to prematurely halt the exponential part of the curve by reducing the growth factor to below 1 (the inflection point, see chart below).

In Italy, which went under lockdown on March 9th, they appear to have reached the inflection point on March 22nd. Much of the developed world, is still on the exponential part of the curve as we enacted these policies over a week later, but this means we’re likely to be reaching inflection this week. If the policies continue and the math holds, we should see a dramatic slowdown of new cases. The US looks to be an exception as they delayed implementing suppression policies until much higher case numbers, have been more lax in their implementation and have been uncoordinated with many states forced to act on their own (we remain underweight US equities at this time).

Outside the US, the data shows our efforts are working at stemming the growth, but that does not mean COVID-19 will disappear. We are likely to have intervention policies in place for 2-3 more months, at which point we can adopt testing, contact tracing and quarantine measures. It is also likely we will have a resurgence of cases in the fall, leading to a partial resumption of suppression policies at that time. In short, the effect of COVID-19 on our economy and personal lives should ease over time, but last another 12-18 months. The good news is it appears we will avoid a worst-case scenario with uncontrollable spread. This better scenario is not yet consensus, so we feel the market could rally further as we begin focusing on the long-term recovery phase.

If you’re looking for more information on what the next 12-18 months will look like, I highly recommend this article.

WHAT SHOULD INVESTORS DO?

Well, from an investment standpoint it’s pretty clear, invest in risk assets. It’s possible the markets dip again and re-test mid-march lows, it’s even possible we go much lower. After all, while we seem to be getting a handle on COVID-19 this could change quickly. Meanwhile, the economic impact is still being quantified and could be worse than expected.

In markets, and in life, anything is possible. But as an investor, you want to position yourself for what’s “probable”, while ensuring your protected against what’s “possible”.

While we are overweight risk assets at this time, we’re also holding slightly more cash than usual and are diversified across multiple regions and asset classes.

FOCUS ON WHAT YOU CAN CONTROL?

Most people spend far too much time worrying about financial matters that are beyond their control. If you’ve taken the time to build a portfolio that’s suitable to your risk, then stick to the plan. Staring at the markets constantly refreshing the prices is not going to help. After all, where the markets are headed next (especially in the short-term), is beyond your control. My advice is to focus your time and attention to things you can do right now to improve your financial situation in the future. With that in mind, here’s some things you can do:

- Replace Income: Hopefully your job/income has not been impacted, but if it has make sure you’re taking advantage of government programs to replace lost income. Here’s a comprehensive list of the benefits available.

- Reduce Expenses: Now is the time to review your household budget and cut out or cut back on things you don’t need.

- Review Pre-Authorized Payments: Since they automatically come out of your account, most people don't review recurring expenses like phone, internet, utilities, mortgage, etc. These expenses can really add up but are often ignored as a potential cost savings due to the perception that they are fixed. This is not the case, you can always negotiate (especially now!) or take your business elsewhere.

- Auto Insurance: Most auto insurance policies provide discounts if you drive less, which I imagine most of you are these days. So give them a call, update your estimated annual mileage and ask for a discount.

- File Your Taxes: The deadline has been extended to June 1, and you don’t need to pay any balance owing until September 1. That said, might as well file them now so you can plan for what you’ll owe or get money back now if you are entitled to a refund.

- Debt deferral: If you’ve tried all the previous ideas and are still struggling to get by, call your bank and request up to six months of mortgage deferral. They are also offering relief on lines of credit, credit cards and other loans. You will still accrue interest, but if you’re struggling to make the payments then at least these can be deferred.

INVEST YOUR EXCESS CASH

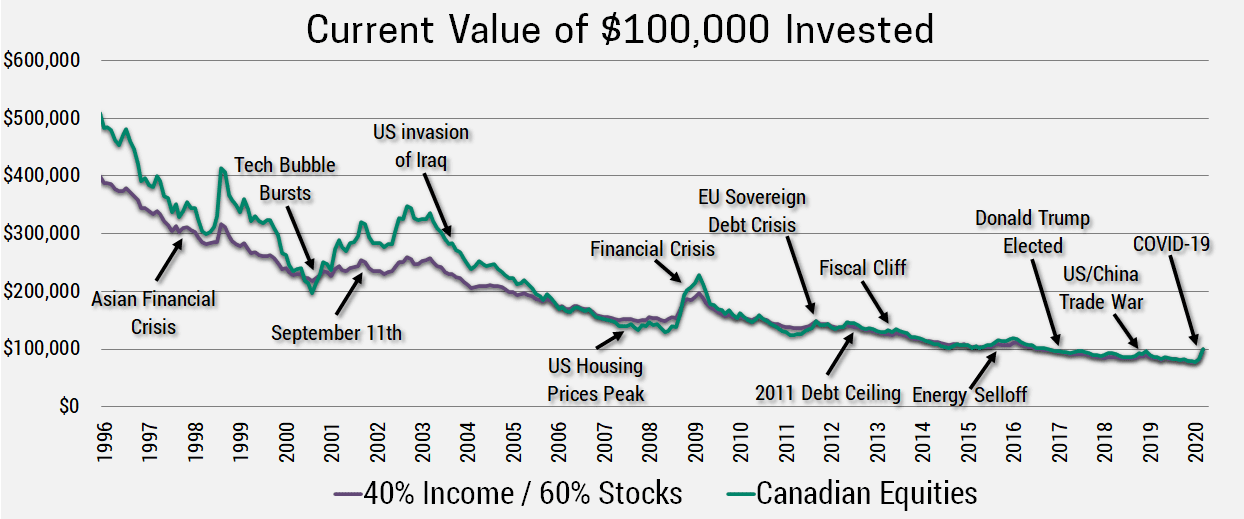

If you’ve already shored up your personal finances and you have excess cash that you don’t need in the near future, now’s the time to invest. To illustrate why, we’ve reversed our market evolution chart so you can see how $100,000 invested at different points in the past has evolved.

There’s 2 main points I draw from this chart. First, the best time to invest is always way in the past. Investments need time to compound, so get your money invested now to give it a chance to grow over time. Second, investments made during a correction will be worth more. This seems obvious but can be difficult to implement. After all, during a correction the money you put in can be worth less a week later which is very disheartening. Right now, most investments made after August 2016 are worth less than what you put in, and when you’re not seeing a benefit from an action it seems crazy to continue doing it. Investing cash always feels better when markets are rising, but you get the best bang for your buck during a crisis.