Taking Profits

RISING COVID-19 CASES STALLS RECOVERY

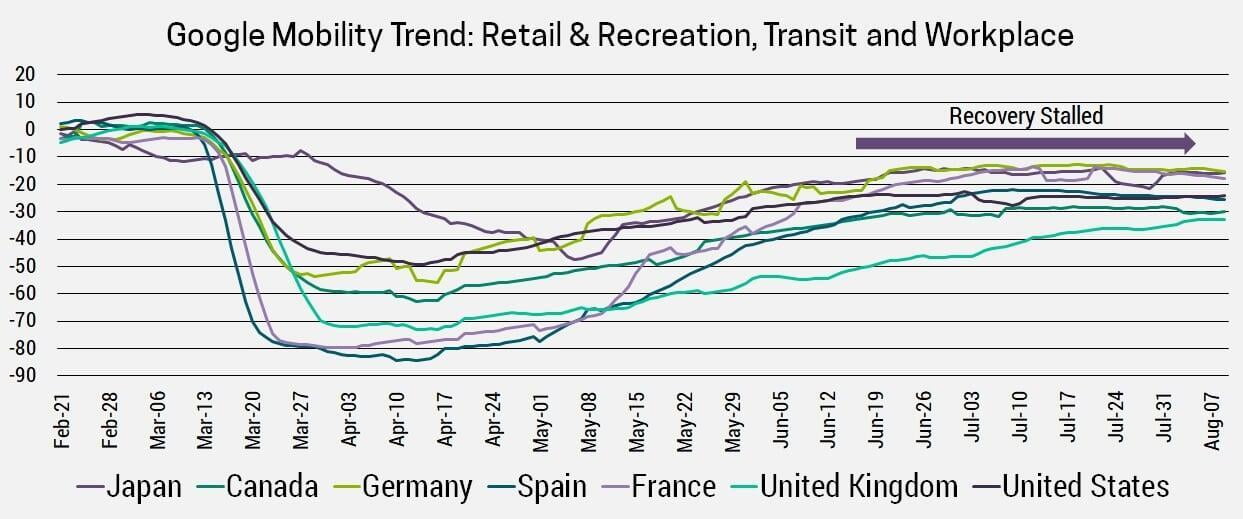

Markets have shrugged off rising cases in the US and new clusters in Spain, Hong Kong, Melbourne, and Tokyo. While the effect of rising cases has not yet appeared in economic data, due to the lag in publishing official numbers, we can see the real-time google mobility data signals the recovery has leveled off in most countries and begun to fall where case number have risen more dramatically (see chart below).

7-Day Moving Average

US CONGRESS GRIDLOCK OVER STIMULUS

Over the weekend, Trump signed four executive orders for further covid-related financial relief after talks between Democrats and Republicans stalled. This included $400/week of additional unemployment benefits, assistance for renters and homeowners and deferrals for payroll tax and student loan repayments. While this is better than nothing, it represents half of what Republicans proposed and a seventh of what Democrats want. There's also questions regarding the executive orders legality and where the money will be sourced.

We believe a relief bill will eventually be signed given the overwhelming majority (80+%) of Americans support these measures, but their inability to pass it before earlier benefits lapsed on July 31st is an additional risk to equity markets.

US-CHINA TRADE WAR BECOMING CURRENCY WAR

While the trade war has taken a back seat to COVID-19 in recent months, many of the core issues remain unresolved. For now, the dispute seems to be morphing into a currency war as both countries seem happy to devalue their currencies in an effort to make their exports more attractive.

TAKING PROFITS AND PROTECTING CAPITAL

Given these near-term headwinds we believe it is prudent to reduce the risk in our client portfolios. Yesterday we raised approximately 10% of overall portfolio's value in cash, specifically by selling value stocks. While we still favor value stocks in the long-term, they represent a higher risk investment and given the issues identified above we believe it is prudent to reduce our exposure at this time. While de-risking the portfolio typically means holding excess cash or bonds, as discussed in our last commentary these assets are handicapped by low prevailing interest rates and the risk of inflation. As such, we have instead invested this 10% portfolio weight into gold mining companies.

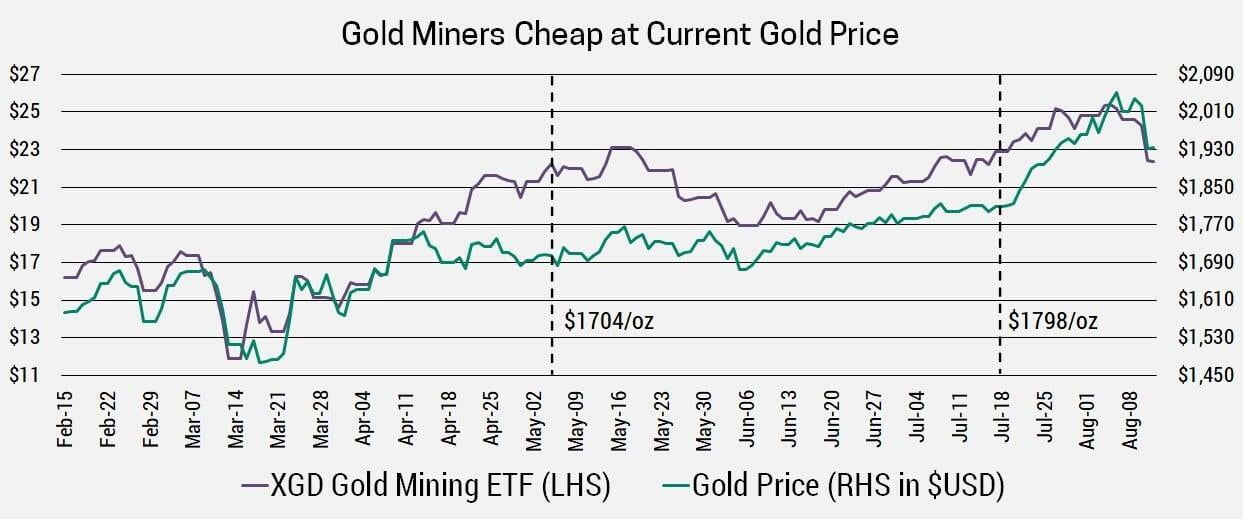

Why gold mining companies? Well, historically gold performs well during market environments similar to the one we're in. This includes currency wars, inflation, low interest rates and fear amongst investors. While we could own gold directly, gold miners valuations have lagged the recent surge in prices making them an attractive investment. In the chart below, you can see that the last time gold mining companies traded at these prices the commodity traded below $1800/oz, vs the current $1938 (at time of writing).