Investors have just experienced one of the fastest bear market sell-offs in history. It seems like a distant memory, but Canadian equity markets peaked just one month ago on February 20, 2020. Since then Canadian stocks are down a third (33%), and Canadian energy is off two thirds (66%)! The speed and magnitude of this sell off is unparalleled, exacerbated by fear, as seen with the VIX index hitting an all-time high of 82.69 this Monday.

IS FEAR WARRANTED?

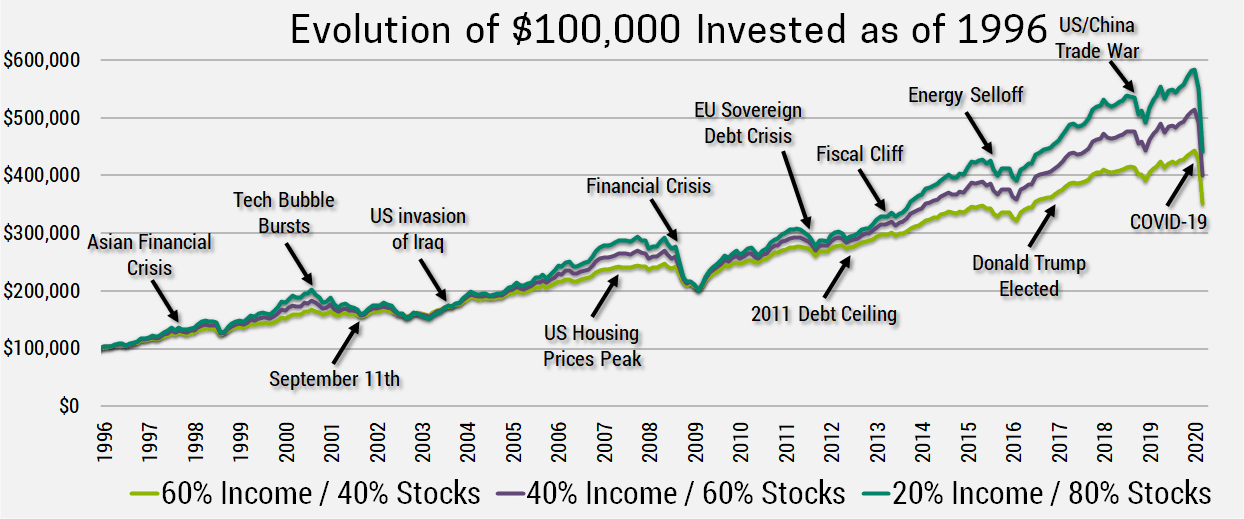

Some of this fear if warranted, after all we face a serious threat and we evolved this emotion to keep us safe. Fear can be productive by motivating us to follow health professionals guidelines around hand washing, not touching your face, social distancing, etc. Fear can also be harmful, like with investments when it makes you want to sell everything and go to cash. This is precisely the wrong thing to do for long-term investors as this may in fact be the best buying opportunity of a lifetime. You’ve already experienced the risk of stocks, why not stick around to reap the higher expected returns they now offer? In the chart below you can see how many crises we’ve been through and how the market always recovers.

COVID-19 INTERVENTIONS

How long investors need to wait to reap the rewards is primarily dependent on the spread of COVID-19. At this point, modeling the spread requires us to know which economic/personal interventions we are enacting including:

- Case Isolation: Quarantine anyone showing symptoms and their close contacts

- Travel Restrictions: Complete ban, just from certain countries, or just screen/test all travelers

- Social Distancing: Stay at least 2 meters apart

- Closing Schools: Including universities

- Restricting Businesses: Work-from-home, 50% of max occupancy, or even out-right closures

- Limiting Gathering Sizes: Different countries have different group size restrictions, whether its 50, 10, or none (shelter in place)

We would also need to understand how long these measures would be in place for. Politicians control the intensity and duration of these measures and seem to be basing their decisions on prevailing scientific research. After reviewing dozens of journal articles and models (if you’re interested, I recommend this one) I believe the most likely scenario is that these measures, in one form or another, will be with us until we have a vaccine (12-18 months).

SUPPRESSION, NOT MITIGATION

The reason is that it has become increasingly clear that we need to pursue a “suppression” strategy, not just “mitigation” ie. We can’t just flatten the curve, we have to prevent the spread and eliminate the curve. Mitigation is better than nothing, estimates show we could cut the number of deaths in half, but this would still result in tens of millions of deaths globally which is why so many governments are now aggressively pursuing suppression tactics.

Does this mean people should prepare for 12-18 months of quarantine? No. Once we get active cases under control (likely 2-3 months) it becomes feasible to adopt intensive testing, contact tracing and quarantine measures similar to China and South Korea. Initial results of these strategies seem promising, but countries may still need to resort to broad based policies periodically if case numbers begin to rise.

Anyways, enough bad news about COVID-19. I was even debating whether it’s beneficial to share these details, but then I remembered the wise words of Carl Sagan, “knowledge is preferable to ignorance. Better by far to embrace the hard truth than a reassuring fable.” If we’re going to make it through this as a society, we need a clear understanding of the threat we face.

WE ARE AT WAR

As investors, it can be difficult to wrap our heads around the economic impact of COVID-19 as we’ve never seen anything quite like this before. That said, it has many economic parallels with war, only instead of fighting each other, we’re fighting together against a common, invisible enemy. This sentiment was echoed in a recent televised address from French President Emmanuel Macron who repeatedly said, “We are at war.” With this comparison in mind, let’s discuss some common economic impacts of war:

- Government Spending: History is clear on this one, nothing blows a hole through government budgets like wars. We’re already seen massive stimulus packages being announced, and there’s likely more to come.

- Inflation: Largely a result of government spending, inflation often follows as the only way out for massively indebted governments.

- Stocks Generally Do Well: In the six months following the onset of WWI, the Dow fell over 30% as business ground to a halt (sound familiar?). It then closed for six months (unlikely to happen today) and when it reopened went up 88% over the next year. WWII saw the Dow rise an average of 7% per year.

So how long will this war against COVID-19 last? No-one knows for sure, there’s lots of possible scenarios. Whether it’s the development of a vaccine, eventually building herd immunity, complete suppression, or something else entirely, there is no doubt we will eventually get through this. The magnitude is difficult to predict, but regardless of the path we take it seems likely this crisis will be over by the end of next years cold/flu season (April – May 2021).

LOOKING THROUGH THE FOG

Since we don’t know exactly how COVID-19 will play out, but we do know it will eventually end, the prudent thing to do as investors is position ourselves in advance for what happens following the crisis. Here’s what we recommend and what we’re doing:

- Put Cash To Work: Investors with more than a year to invest would be wise to put cash to work now instead of waiting for the dust to settle. If we wait to see signs we’re winning the war against COVID-19, or that an end is in sight, we may have already missed out on considerable upside.

- Sell Bonds: With yields so low and the term to maturity of loans getting longer, the impact of deficit induced inflation on bond markets could be severe. We’ve been calling for the bond bubble to burst for many years now, and it appears we were a bit early. That said, with yields falling even further it’s comparable to compressing a spring. When this 40 year bond bull market finally ends, the recoil could be extreme. As such, we believe it is prudent to avoid bonds at this time or for low risk investors to stick to short-term maturities.

- Buy Stocks (Canada, Emerging Markets and Value): Stocks are relatively cheap across all regions, but some countries are in a better position to weather the storm than others. We believe that Canada, with our public healthcare system, low population density, and relatively high faith in our government is in a better position to weather the storm than our American peers. Emerging markets like China have also shown impressive responses to COVID-19, scaling up testing, contact tracing and quarantine measures to halt new infections in their tracks. Finally, by focusing on regions and companies with cheaper valuations, we’re positioning ourselves to fully benefit from the long-term upside following the crisis.

While we acknowledge there are significant short-term risks in the market, we believe the potential upside more than compensates investors for the risk they are taking. We hope everyone is staying healthy, both mentally and physically during this time. Please reach out directly if you have any comments, questions or concerns.